This article was first published on Deythere.

Solana is once again under intense market scrutiny as a renewed memecoin wave drives unusually high on-chain activity. While speculation dominates headlines, the deeper story is technical. The network is undergoing a real-time stress test that measures scalability, execution strength, and fee dynamics under live demand.

According to the source, recent on-chain analysis confirms transaction rates are shooting up, yet this uptick does not drag performance down. Instead of impending congestion or calamity, the network plodded along with operations continuing to be processed at scale providing a rare understanding of how a high-throughput blockchain behaves under practical, real-life conditions.

Sustained Throughput Signals Production-Grade Execution

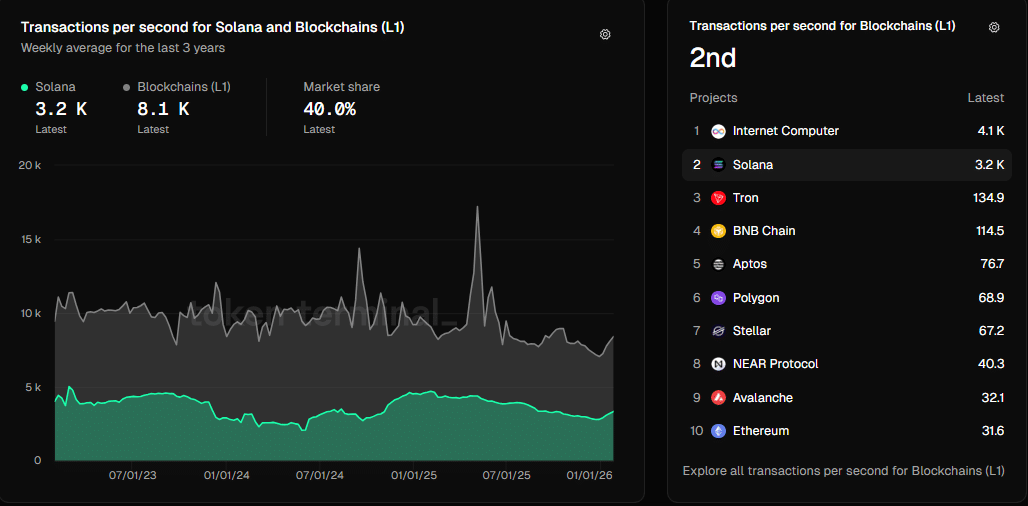

Solana has consistently processed between 2,000 and 5,000 transactions per second since 2023, regardless of speculative surges. Record readings are presently around 3,200 TPS from active memecoin launches.Why it all matters is that High burst is not what defines scalability, but something sustained.

Speculation spikes did not lead to a performance collapse of any duration. Throughput recovered quickly after every spike, proving that enduring under true demand rather than only when conditions are perfect was Solana’s strength.

Performance recovered after slumping near 2,000 TPS in mid-2024, and through 2025 it steadily extended upwards. This rebound did not follow any single stress event, but was instead an indicator of ecosystem growth as seen through a widely trusted on-chain performance dashboard.

Solana’s weekly averages now show it handling about 40% of total Layer-1 transaction throughput. The Internet Computer represents the only network that posts higher raw figures than the rest. TRON, BNB Chain, and Ethereum show their monthly averages which stay below 150 TPS. The existing gaps between the two systems demonstrate their architectural differences, which extend beyond their basic operational capabilities.

The edge comes from parallelized execution, optimized networking, and low fees. Transactions run in parallel rather than waiting in sequence. As explained in a recent public blockchain performance analysis, this design allows activity to remain additive rather than destabilizing, confirming production readiness in live environments.

Memecoin Comeback Pushes Real Demand

Memecoin activity on Solana has accelerated again. Daily token deployments recently exceeded 40,000, marking an eleven-month high. This surge aligned with sustained throughput of 3,000-5,000 TPS, even during peak launch windows.

High-volume token creation did not degrade network performance. Instead, consistent TPS enabled rapid launches, frequent trading, and continuous experimentation. Deployment counts trended higher alongside stable execution, confirming scalability under genuine demand rather than simulated tests.

Launchpad activity also broadened. Participation expanded rather than focusing on a few platforms. Analysts reviewing public deployment data noted that high TPS reduced friction, attracted speculative builders, and reinforced Solana as the preferred execution layer for memecoin cycles.

When Speculation Converts Into Revenue

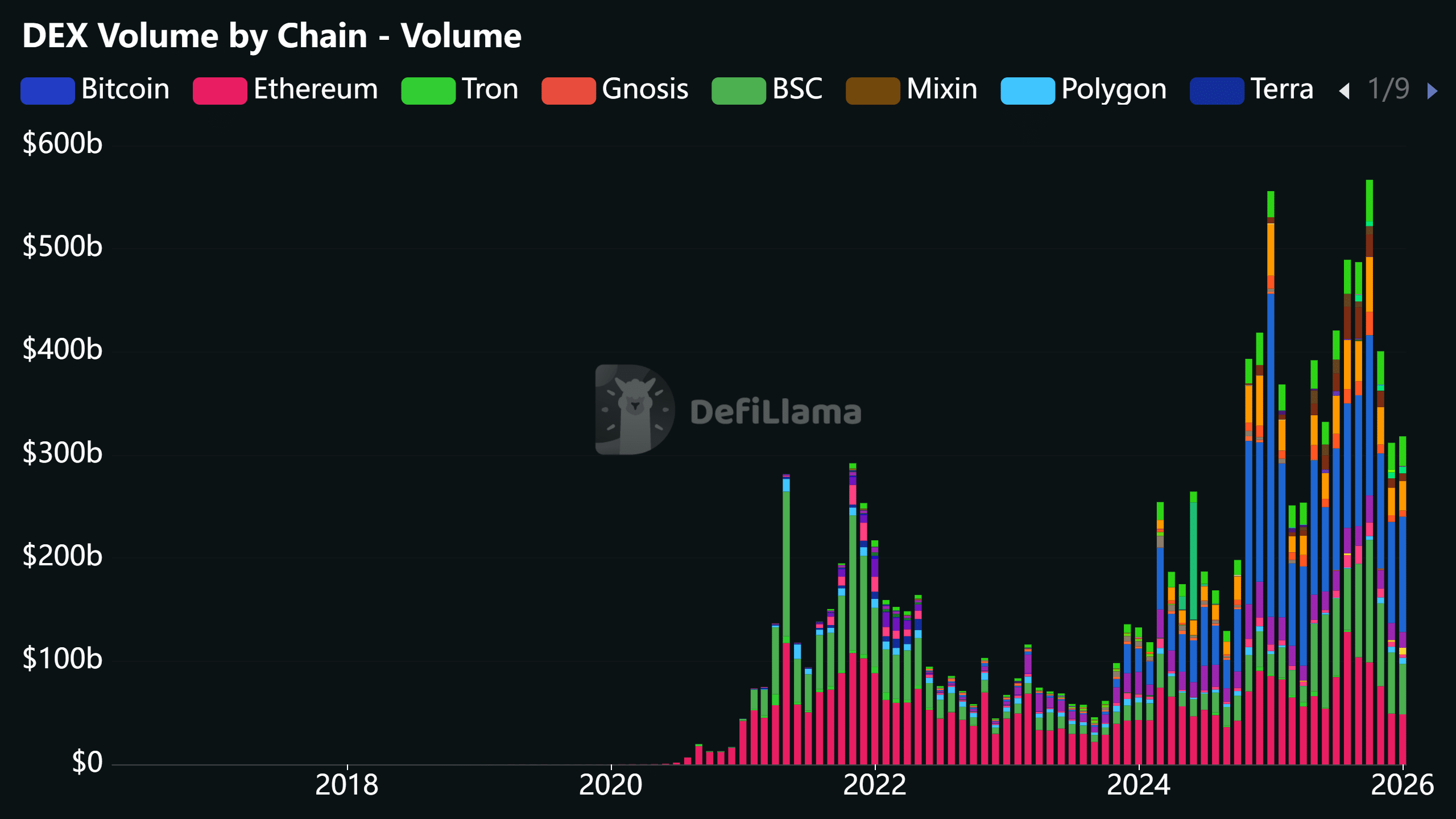

Solana’s speculative activities have resulted in real economic benefits. In the last 30 days, decentralized exchange volume has exceeded $110 billion, above even the level of activity registered on Ethereum during this period. This data, delivered by open DeFi analytics platforms, signifies prolonged trading intensity rather than flash floods.

Application revenue followed. Roughly $145 million flowed to apps and protocols during the same window. This revenue emerged during a memecoin-driven phase, not a lull. Meanwhile, other high-profile platforms with strong niches trailed meaningfully.

As activity scales, base and priority fees are compounded alongside MEV extraction. This reinforced validator incentives and monetization without eroding user participation. Research shared by DeFi economists shows that when throughput supports revenue capture, usage becomes durable rather than hollow.

Conclusion

The memecoin surge has evolved beyond mere speculation. It has become a live stress test that Solana passed without material degradation. High throughput held, execution remained stable, and activity converted into revenue.

That outcome signals production-grade scalability, not laboratory performance. As future cycles arrive, the data from this period will shape how scalability claims are judged.

Glossary of Key Terms

Throughput: The number of transactions processed per second.

TPS: Transactions per second, a performance metric.

MEV: Value extracted from transaction ordering.

Layer-1: A base blockchain network.

FAQs About Solana

Why is Solana attracting memecoin activity?

Low fees and high throughput support rapid launches.

Did performance decline during peak demand?

No lasting degradation appeared in recent data.

How does Solana compare with Ethereum?

Solana processes far more transactions per second.

Does speculation benefit the network?

When usage generates revenue, it supports sustainability.