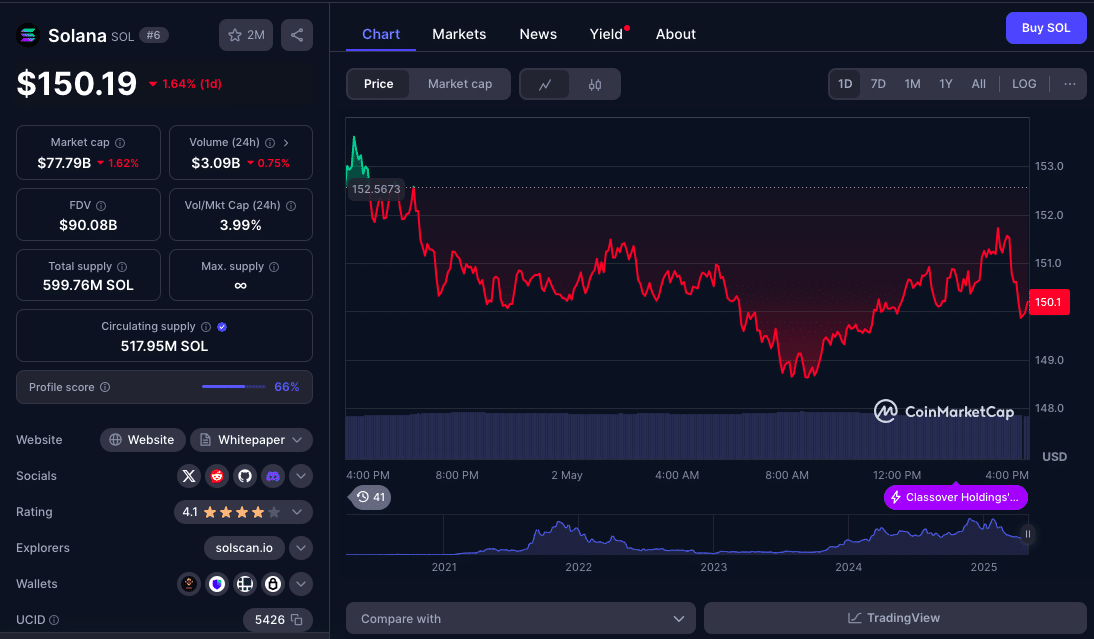

As we head into May 2025, the crypto market is looking strong, and Solana (SOL) is seemingly back in the game. After a rough start to the year, SOL has bounced back and is now trading at $150.19 at press time. With growing whale activity, institutional interest and good technicals, analysts are wondering if Solana can break through key resistance and hit new monthly highs.

Whale Activity and On-Chain Accumulation

Solana’s current price action is a reflection of the broader bullish sentiment that’s returned to the altcoin space. Last week of April, Solana price went up from $138 to over $150, driven by strong buying volume and on-chain activity. One of the best indicators of market conviction is the increasing number of whales buying and holding SOL. According to on-chain data from Santiment and Lookonchain, several wallets holding over 100,000 SOL have had huge inflows over the last 10 days, with total whale purchases over $80 million.

Whale activity has been a leading indicator for Solana’s price movements. During previous bull runs, such as Q4 2021 and late 2023, accumulation by large holders preceded the breakouts. This is happening again. Current data shows whales are reducing exchange balances and moving funds into cold storage and DeFi staking protocols, a sign of long-term conviction.

Technical Indicators Support Bullish Momentum

Along with whale accumulation, technicals also support the bullish case. RSI is below 70, currently at 61 on the daily chart. There’s still room for upside before a correction. MACD is above the signal line, bullish momentum is building. 50-day and 200-day moving averages are in a golden cross, a classic bullish signal for medium-term price appreciation.

Fundamental Growth in the Solana Ecosystem

Solana also has fundamental growth. The network is still fast and scalable and developer activity is strong. Recent updates to Solana Saga mobile ecosystem, Solana Pay integrations and growth of decentralized applications (dApps) and NFTs on the network are driving user adoption and total value locked (TVL). According to DefiLlama, Solana’s TVL grew 11.8% in April, above $3.5 billion.

Retail sentiment is also coming back. Google Trends shows 19% increase in searches for “Solana price prediction” in the last month. Derivatives data shows a spike in open interest on Solana perpetual futures across major exchanges like Binance and OKX. This increased leverage means traders are positioning for an upside breakout.

Current Market Reaction: Solana Price Movement in Early May 2025

As of May 2, 2025, Solana (SOL) is trading at $150.19, up 7% in the last week. This upmove is supported by moderate volume, buyers are back. Technicals are bullish: RSI is at 58.78 and rising, MACD is above the signal line, confirming the price action.

Solana is consolidating below a key resistance at $157. If this level is broken with volume, SOL could go to $180 or even $205 in the month. Crowd sentiment data shows strong retail appetite for SOL, 1.81 on sentiment indices, while institutional sentiment is lagging, 0.88. This means retail traders are more bullish, institutions are cautious.

Overall, Solana’s early May is looking good. With technicals aligned and sentiment positive, the market reaction so far supports the broader bullish case for May 2025.

Factors Affecting Solana Price Prediction in May 2025

Solana is one of the most watched cryptocurrencies, attracting both retail and institutional attention. As we head into May 2025, several factors will shape its price. From network upgrades and ecosystem growth to broader market sentiment and regulatory developments, understanding these drivers is key for anyone looking at Solana. Several factors that could impact Solana’s price this month.

Bitcoin’s performance will impact capital flow into altcoins like SOL as it is currently hovering around $97,000, thus good for Solana.

Global interest rate policies, inflation trends and risk appetite in traditional markets will impact investor sentiment towards crypto. Clear or positive regulatory guidance in key markets like US and EU will drive institutional entry.

Continued dApps, DeFi integrations and user experience upgrades will increase demand for SOL. Outages or exploits will dampen sentiment, while improvements to uptime and speed will reinforce bullish trends.

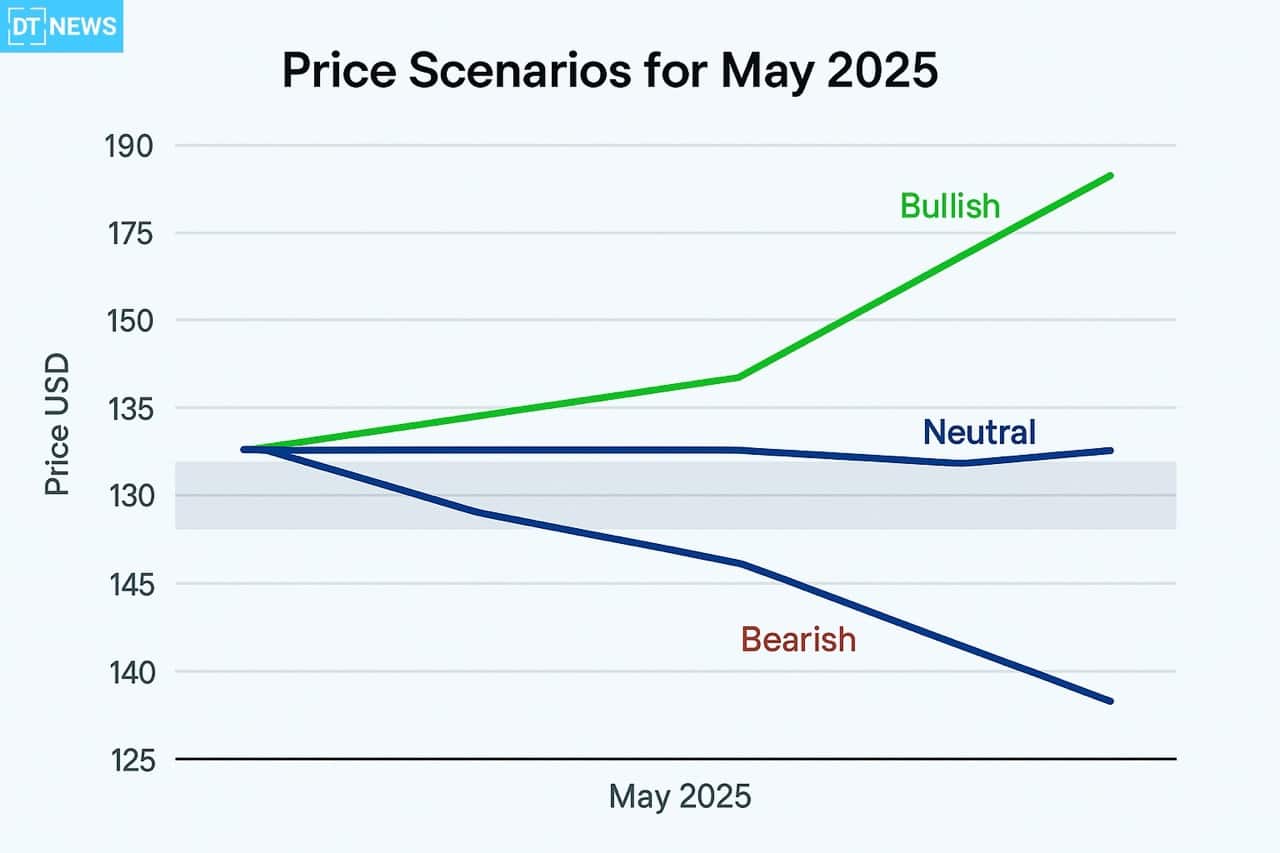

Three Price Scenarios for May 2025

Based on all these metrics, analysts have outlined three price scenarios for Solana in May 2025.

In the bull case, if Solana breaks above $155 with volume, it could go to $175 and potentially $190 by end of month. This is in line with past bullish patterns where similar setups have led to 20-30% moves in weeks. Analysts from CoinEdition and Changelly say if Bitcoin holds above $97,000, it will create the macro environment for SOL to accelerate.

In the neutral scenario, Solana will consolidate between $140 and $155 if market momentum stalls or BTC fails to hold support. This will be healthy market digestion and allow for stronger accumulation zones before another breakout attempt. Sideways movement is common after a strong monthly close, especially in early Q2.

If Solana can’t hold above $145 and Bitcoin is under pressure, the bearish scenario could play out and SOL could retrace to the $132-$126 support zone. But most indicators are showing limited downside unless macro or security issues kick in.

Overall the May 2025 outlook for Solana is cautiously optimistic. Whale activity, technicals, ecosystem growth and retail interest are all pointing to a breakout. But as always in crypto, volatility is inescapable and risk management is key.

Glossary

Whale: A wallet or individual holding large amounts of a particular cryptocurrency.

Golden Cross: A bullish technical signal when a short-term moving average ‘crosses above a long-term moving average.

MACD: A momentum indicator showing ‘the relationship between two moving averages.

TVL (Total Value Locked): The total amount of assets locked in ‘DeFi protocols on a given blockchain.

Perpetual Futures: Derivative contracts with no expiry, used for trading crypto price speculation.

FAQs

What is Solana’s current price?

As at the time ‘of this publication, Solana (SOL) is trading at $150.19.

Can Solana reach $175 in May 2025?

If it breaks $155 with volume, Solana could ‘go to $175 or higher this month.

What indicators are bullish for SOL?

Whale accumulation, RSI’ and MACD trends and a golden cross on daily charts.

What’s the main risk to Solana’s price?

A drop in Bitcoin’s price or macro uncertainty could stop SOL from moving higher.