A Market Tug-of-War

Solana and Binance Coin are competing for dominance in the global cryptocurrency market. Solana has gained significant traction in the United States, thanks to institutional inflows and Wall Street-style treasury strategies.

In contrast, Binance Coin continues to rely on strong Asian support, which is based in its huge network. This dispute has fueled investor speculation about Solana price prediction and if regional capital disparities would decide the next major winner in cryptocurrency marketplaces.

Institutional backing gives Solana an edge

Solana’s success stems from its increased acceptance by US corporations using institutional treasury strategies. According to reports, businesses have bought millions of SOL through private placements and long-term holdings, decreasing the accessible supply on exchanges. This not only reduces short-term volatility, but also boosts trust among investors looking for transparency.

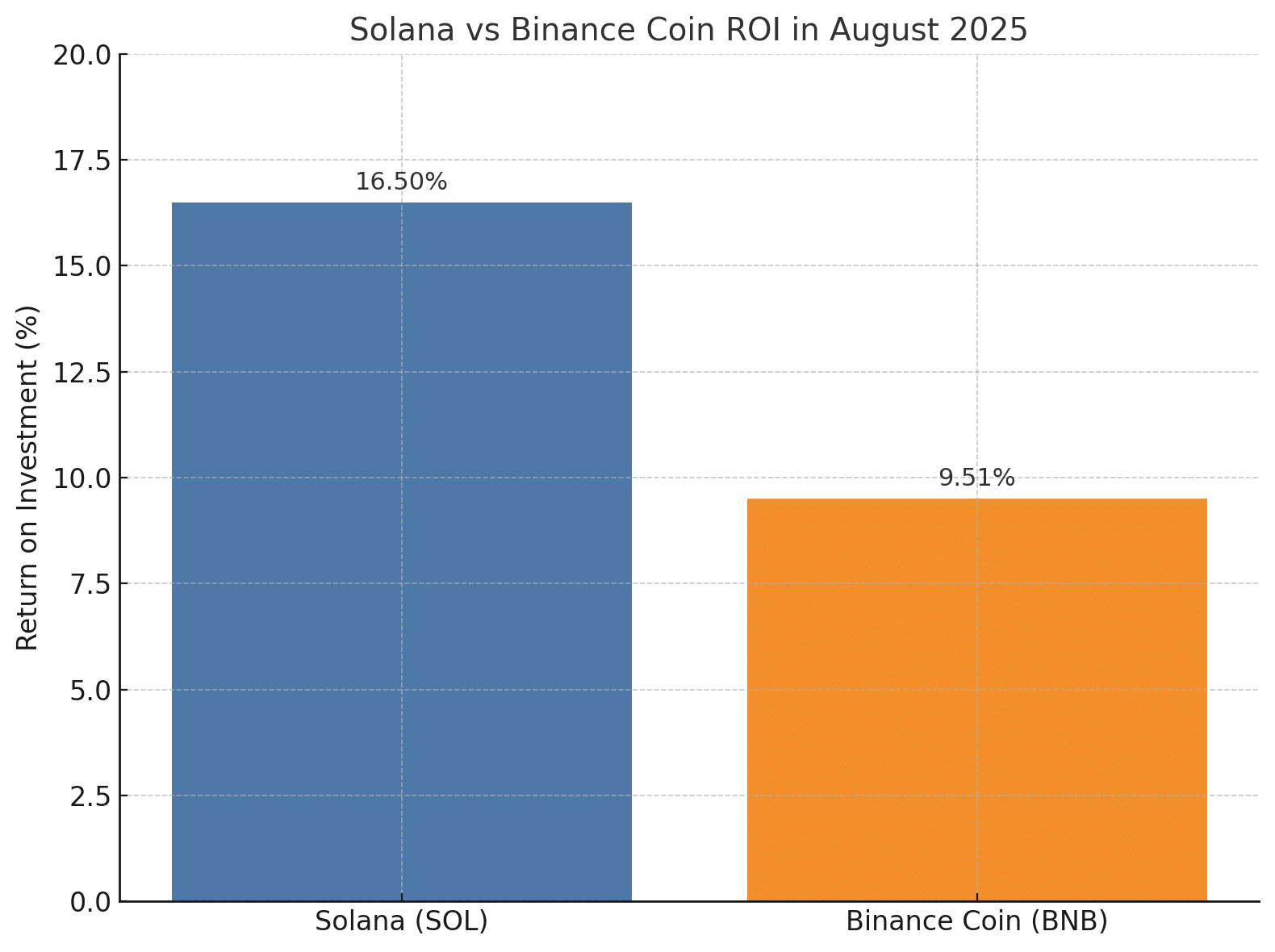

Solana returned 16.5% on investment in August, outperforming Binance Coin’s 9.51% ROI. The Solana-to-BNB ratio has risen 5.17% in one week, bringing it closer to the important 0.24 threshold.

Which might seal Solana’s ascension to the top five cryptocurrencies by market capitalization. This performance reinforces the case for a positive Solana price prediction, but uncertainties remain linked to U.S. economic developments.

Binance Coin is anchored in the Asian ecosystem

While Solana relies on Wall Street-style inflows, Binance Coin survives due of its significant Asian presence. Binance remains the dominant exchange in terms of liquidity, volume, and token usefulness inside its ecosystem. Corporate buyers have also stepped in, with one business apparently purchasing around 400,000 BNB, accumulating up to 1% of total supply.

This amount of involvement demonstrates how Asian capital values ecosystem-based growth. Binance Coin’s dependence on community engagement and exchange dominance provides resilience, but it also exposes the asset to regulatory pressures from many jurisdictions. Compared to Solana, BNB’s future is more dependent on the continuous health of its parent exchange.

Technical Analysis: Resistance and Momentum

From a chart viewpoint, Solana confronts strong resistance at $210. Technical indications indicate that a breakout might take SOL to $220-$225, which aligns with optimistic sentiments in crypto groups. Social media experts usually stress the importance of trade volume and whale accumulation.

On-chain data reveals Solana’s whales increasing their holdings during declines, supporting the optimistic Solana price prediction. However, macroeconomic uncertainties related to Federal Reserve interest rate decisions may impact on US-linked capital flows, generating vulnerability notwithstanding recent gains.

Binance Coin’s technical picture remains solid, but less explosive. BNB trades in a consolidation zone, with resistance above $900 and support near $820. Analysts believe that BNB’s trajectory will be determined more by ecosystem utility than speculative whale activity.

Market Sentiment and Whale Activity

Crypto traders continue to be vociferous on social media sites like as X, emphasizing the symbolic importance of the Solana vs Binance story. One analyst recently stated, “Solana’s institutional playbook is rewriting the rules for altcoins, but macro risks remain a wild card.” Someone else responded: “BNB’s strength lies in its unmatched exchange dominance, which no U.S. capital inflow can replicate.”

The division is reflected in whale activity. Large sums of money have been invested in Solana, about $200, indicating a long-term commitment. Meanwhile, Binance Coin whales are intent on maintaining supremacy, frequently engaging in staking and ecosystem governance to gain influence. Both sides emphasize the strategic depth that drives cryptocurrency competitiveness.

Solana Price prediction and Future Outlook

Solana’s near-term bullish thesis is dependent on sustained volume over $210. If accomplished, prices may reach $225 before consolidating. If US capital inflows slow, SOL might go back to $180.

Binance Coin’s value might remain in the $820-$900 range if the ecosystem continues to expand. Without additional catalysts, it may hard to exceed Solana in percentage returns. This disparity supports the assumption that Solana price prediction models are now more positive than those for BNB.

Conclusion: A Definitive Rivalry

The conflict between Solana and Binance Coin underscores more than just market trends; it represents a fight between US institutional capital and Asian ecosystem-driven growth. Solana gains from credibility and inflows, but it remains vulnerable to macroeconomic shocks. Binance Coin is successful in its own right, but its reliance on exchange-driven activity poses additional problems.

The future may not award a single champion, but for the time being, Solana has a little advantage. As long as institutional money continues to support its climb, the positive Solana price forecast story may stay popular in the coming months.

Glossary

ROI: Return on Investment, a measure of profitability.

Resistance: A price level where upward movement often slows.

Whales: Large crypto holders who influence markets.

Treasury Strategy: Institutional practice of holding tokens for balance sheet strength.

On-chain Data: Blockchain information about wallet activity and transactions.

Liquidity: How easily an asset can be bought or sold without major price changes.

FAQs for Solana price prediction

1. Why is Solana outperforming Binance Coin?

Institutional inflows in the U.S. and treasury accumulation strategies are fueling Solana’s stronger momentum.

2. What resistance levels matter most for Solana?

The $210 mark is key. A breakout could lead to a move toward $225.

3. Is Binance Coin still competitive?

Yes. BNB’s ecosystem dominance in Asia keeps it relevant, though performance lags Solana’s recent ROI.

4. Could macro risks hurt Solana’s rise?

Yes. U.S. capital inflows make Solana vulnerable to Federal Reserve policy changes.

5. Is this article financial advice?

No. This article is for informational purposes only and does not constitute financial advice.