As the crypto market enters mid-2025, Solana (SOL) remains a standout among Layer-1 blockchain projects. Known for its high-speed, low-cost infrastructure, Solana has captured the attention of both retail and institutional investors. June 2025 presents a key inflection point, as the network consolidates gains from the recent DeFi resurgence and NFT revival.

- Solana’s Market Position in Early June 2025

- Solana Technical Analysis: Support, Resistance, and Momentum

- Ecosystem Growth and Fundamental Catalysts

- Firedancer Upgrade and Network Scaling

- Liquidity Expansion via SecondSwap

- Institutional and DeFi Growth

- Recent News Influencing Solana in June 2025

- Solana Price Forecast Table: June 2025

- Analyst Sentiment and Long-Term Projections

- Key Catalysts for June and Beyond

- Risks and Considerations

- Conclusion: A Crucial Month for Solana’s Next Move

- Frequently Asked Questions (FAQs)

- What is Solana’s price forecast for June 2025?

- Is Solana a good investment for long-term holding?

- What could push SOL above $170?

- Glossary of Terms

This long-term Solana price analysis explores Solana’s current technical setup, recent developments, and forecasted trajectory throughout June 2025 — alongside expert insights and market sentiment.

Solana’s Market Position in Early June 2025

As of early June 2025, Solana trades near a crucial support range just under the $150 mark. The asset experienced a mild intraday decline of 0.05%, ranging between $148.80 and $157.65. Despite short-term volatility, SOL maintains its position as one of the top 10 cryptocurrencies by market capitalization.

SOL has shown signs of stabilization within a broader market that has experienced both bullish reversals and macro-driven dips. Trading volumes remain healthy, and open interest in Solana-related DeFi and staking products continues to rise.

Solana Technical Analysis: Support, Resistance, and Momentum

Key Levels to Watch

Solana’s primary resistance lies between $160 and $165, a zone historically triggering profit-taking and liquidity fades. Meanwhile, support around $145 to $150 has proven resilient, with multiple rebounds seen over the past few weeks.

A breakout above the $165 zone could trigger renewed momentum toward the $180 level, while a failure to hold $145 may open room for a temporary pullback to $135–$140.

Indicators

Relative Strength Index (RSI): Hovering around 53, indicating neutral momentum.

50-day Moving Average: Rising steadily, supporting a medium-term bullish bias.

MACD: Showing signs of a potential bullish crossover by mid-June.

Technical indicators suggest consolidation, but momentum may tilt in favor of bulls if volume increases during breakout attempts.

Ecosystem Growth and Fundamental Catalysts

Firedancer Upgrade and Network Scaling

A major tailwind for Solana’s long-term potential is the upcoming Firedancer upgrade, developed by Jump Crypto. This new validator client is expected to significantly boost Solana’s throughput and reduce latency, reinforcing its position as a leading high-performance blockchain.

Liquidity Expansion via SecondSwap

The SecondSwap protocol has introduced an innovative marketplace for trading locked Solana-based assets. This mechanism has improved overall liquidity and enabled more efficient use of vested tokens across the ecosystem.

Institutional and DeFi Growth

Solana’s ecosystem continues to attract institutional interest. Funds with Solana exposure are seeing inflows, and platforms like Orca, Jupiter, and MarginFi are gaining traction in DeFi volume metrics. The Solana Foundation will also increase its grant distribution to emerging dApps in 2025, further bolstering on-chain activity.

Recent News Influencing Solana in June 2025

Delayed approval of Solana ETF proposals by the U.S. Securities and Exchange Commission (SEC) has introduced temporary uncertainty but is not expected to hinder long-term growth prospects.

DEX volumes on Solana surpass $4.8 billion weekly, signaling strong retail engagement and protocol adoption.

Bonk, Jupiter, and WEN tokens maintain high community engagement, strengthening Solana’s meme and cultural layer.

These developments suggest that Solana continues to grow in both utility and community strength — two factors often correlated with sustainable price appreciation.

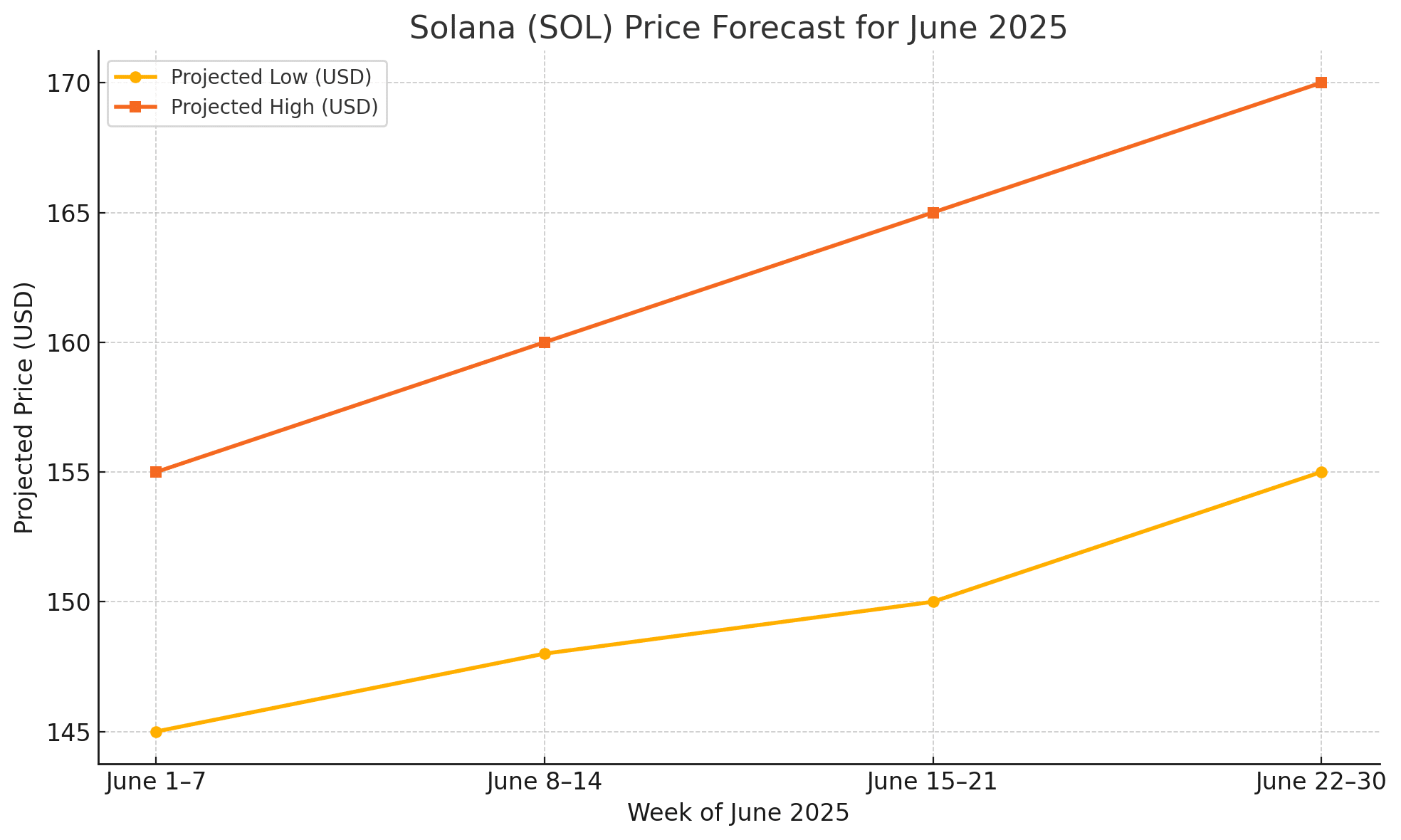

Solana Price Forecast Table: June 2025

| Week | Projected Low (USD) | Projected High (USD) |

|---|---|---|

| June 1–7 | $145 | $155 |

| June 8–14 | $148 | $160 |

| June 15–21 | $150 | $165 |

| June 22–30 | $155 | $170 |

Analysts forecast a cautiously bullish trajectory throughout June, with the potential for a technical breakout by month-end if buying pressure increases across Solana’s DeFi and NFT markets.

Analyst Sentiment and Long-Term Projections

Bullish Outlook

Analysts at CoinPedia maintain a bullish stance, suggesting Solana could reach as high as $400 by year-end 2025 if its scaling upgrades and DeFi integrations proceed as planned.

InvestingHaven’s technical team supports this view, noting a cup-and-handle formation on Solana’s multi-year chart that could push prices toward the $495 level over the long term.

Moderate-to-Conservative Forecasts

CoinCodex projects more tempered gains, with Solana potentially trading around $200 through 2026, reflecting a steady but not explosive trajectory.

These varied predictions highlight the importance of network usage, community engagement, and macroeconomic conditions in shaping Solana’s price path.

Key Catalysts for June and Beyond

Firedancer launch and improved validator performance.

ETF approval speculation and institutional onboarding.

Sustained DeFi growth on platforms like MarginFi and Kamino.

Meme coin integration across Solana-based wallets and exchanges.

Any combination of these catalysts could support price expansion beyond $170 during or after June 2025.

Risks and Considerations

Regulatory uncertainty, especially regarding U.S.-based ETFs.

Dependence on Solana infrastructure performance amid increased traffic.

Competition from other L1 and L2 chains, such as Ethereum, Avalanche, and Sui.

Market-wide corrections, which may delay breakout attempts even with strong fundamentals.

Conclusion: A Crucial Month for Solana’s Next Move

June 2025 appears to be a pivotal month for Solana, as the network builds momentum around scaling upgrades, community growth, and product expansion. While short-term price action suggests consolidation, long-term fundamentals remain compelling.

If Solana breaks above $165 with volume confirmation, the asset could begin a broader leg up heading into Q3. Whether or not a major breakout occurs this month, Solana remains positioned as one of the most technically advanced and community-aligned ecosystems in crypto — with meaningful upside still on the table.

Frequently Asked Questions (FAQs)

What is Solana’s price forecast for June 2025?

Analysts project a range between $145 and $170 depending on market sentiment and technical breakout success.

Is Solana a good investment for long-term holding?

Solana is considered a strong Layer-1 contender with growing utility in DeFi, NFTs, and enterprise integrations.

What could push SOL above $170?

Key drivers include the Firedancer upgrade, DEX volume growth, and positive regulatory signals.

Glossary of Terms

Firedancer – A high-performance Solana validator client built by Jump Crypto to scale network throughput.

SecondSwap – A marketplace for trading vested or locked tokens in the Solana ecosystem.

DEX (Decentralized Exchange) – A platform allowing peer-to-peer crypto trading without intermediaries.

TVL (Total Value Locked) – A metric that measures the value of assets deposited in DeFi protocols.

MACD (Moving Average Convergence Divergence) – A technical indicator used to signal trend changes and momentum.

Sources and References

https://www.coingecko.com/en/coins/solana

https://coinmarketcap.com/currencies/solana/

secondswap.xyz/ (protocol homepage)