This article was first published on Deythere.

- Solana Overtakes in Daily Perps Volume: What the Data Shows

- Open Interest and Taker Demand Pointing to Greater Market Participation

- Price Surge to $145

- Derivatives Momentum: Liquidity, ETFs, and Flows

- Conclusion

- Glossary

- Frequently Asked Questions About Solana Perps Volume

- What does Solana perps volume mean?

- Why is overtaking Ethereum noteworthy?

- What does increasing open interest mean?

- To what extent does Solana’s spot volume help move perps markets?

- References

There has been a noticeable divergence in trading activity in Solana’s derivatives market and the blockchain’s perpetual futures daily volume has surpassed Ethereum.

Over a recent 24-hour period, Solana registered $1.764 billion in perpetual futures volume, edging out Ethereum’s $1.586 billion, according to market data. This change emphasizes the growing activity of leveraged traders on Solana and how there’s an emerging market rivaling Ethereum’s derivatives ecosystem.

Solana Overtakes in Daily Perps Volume: What the Data Shows

Solana just recorded $1.764 billion in perpetual futures action on a single day, surpassing Ethereum’s $1.586 billion. Though Ethereum is still ahead in 30-day perps volume at $49.88 billion to Solana’s $32.357 billion, the recent flip suggests that short-term trader preference has changed in recent sessions.

Analysts say that the rise of Solana is due to a mixture of quicker execution time, reduced fees and increased volatility.

Structural execution and cost-based advantages continue to make Solana attractive for derivatives flows, particularly those where traders value rapid position entry and exit.

Recent data shows that Solana’s spot trading engine has helped contribute to on-chain activity, with a record $1.6 trillion in spot volumes last year, second only to Binance.

Open Interest and Taker Demand Pointing to Greater Market Participation

Open interest (OI), a measure of capital at stake in active futures contracts, also suggests more participation in Solana markets. The derivatives open interest of Solana is estimated to be $347.6 million, more than Ethereum’s $268.4 million.

That is an indication that traders aren’t just rotating through Solana contracts, but are also putting on lengthier leveraged positions.

Additional signals such as the 90-day Futures Taker Cumulative Volume Delta (CVD) are now positive. Increasing CVD bars show that taker buyer orders now outweigh taker seller lines, which means aggressive purchasing in the derivatives market.

Meanwhile, aggregate open interest in related derivatives markets has been edging towards $8 billion, higher than levels seen for most of 2025 despite a flat price. This divergence is a sign of quiet position building, and not simply reacting to violent volatility.

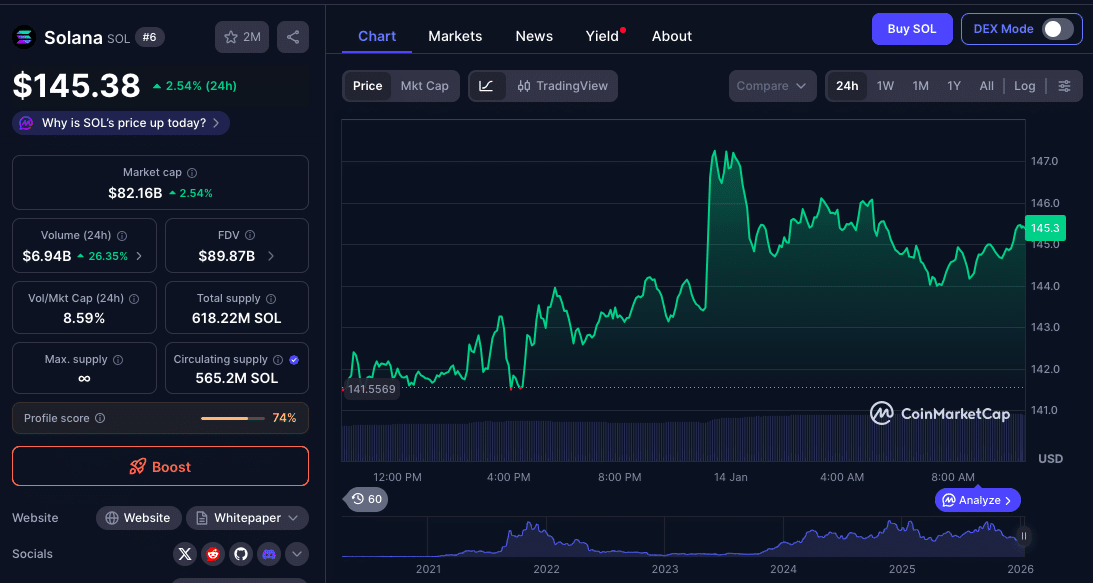

Price Surge to $145

The price of Solana had previously been consolidating under the $144 resistance level, which has been tested multiple times. Latest market data sees SOL climbing above the $145 mark; reinforcing investor confidence and improving fundamentals.

Continued volume and leveraged participation may lead to further range expansion.

The resistance at $144 is still relevant as it has time and again rejected higher appreciations, leaving behind heavier demand levels to cleanly crossover.

Beyond this level, liquidity falls off a cliff, so if perps volume and open interest continue to accrue at its current rate, perhaps prices will find some sustained support.

Derivatives Momentum: Liquidity, ETFs, and Flows

The increase in derivatives activity around Solana comes as the network sees a growing level of financialization on its platform. Solana-linked ETFs have been increasing in popularity, seeing record trading volumes and continued positive net inflow as $SOL’s price explored above and beyond $140.

These ETF flows serve to layer on top of demand for derivatives, providing regulated exposure and broadening participation beyond just spot or leveraged players.

Institutional interest has reportedly been identified as a gradual entrant in Solana markets while decentralized exchange and spot volumes have increased.

Santiment analysis has noted that high trading activities have been taking place this year for investment products with exposure to either Ethereum or Solana.

Conclusion

The Solana perps volume overtaking Ethereum in short-term perpetual futures is a meaningful market signal. While Ethereum’s derivatives dominance remains strong, the recent activity shows growing participation from leveraged traders drawn to Solana’s execution efficiency and volatility profile.

Increasing open interest, positive taker CVD flow and growing buying strength without violent price swings show a sustained engagement over fleeting speculation.

Glossary

Perpetual futures volume: The amount of notional value moved in perpetual futures contracts in a given time frame, a gauge of trading interest.

Open interest (OI) : The number of all open contracts for futures and options, showing the number of contracts involved in an active capital commitment.

Taker CVD : Cumulative volume delta for taker orders, representing net aggressive buyers from sellers.

Funding rate: Regular settlements between holders of long and short positions in perpetual futures contracts that toe prices to the spot market.

Resistance level: A price area at which selling pressure is likely to trump buying pressure, potentially capping upward movements.

Frequently Asked Questions About Solana Perps Volume

What does Solana perps volume mean?

It refers to the aggregate trading volume of Solana perpetual futures, which gives exposure to price without expiration.

Why is overtaking Ethereum noteworthy?

While it is short-term, it indicates traders’ rising interest toward Solana derivatives markets as short-term leveraged traders have been gaining interest in Solan derivatives.

What does increasing open interest mean?

Increasing open interest tends to indicate a deeper market participation, not short-lived speculative spurts.

To what extent does Solana’s spot volume help move perps markets?

Strong spot trading and on-chain volume can deepen liquidity and trader confidence, which in turn leads to derivatives participation.