The crypto landscape rarely stands still. This week, Solana overtakes Ethereum in decentralized exchange (DEX) trading volume, sparking fresh debate about which network truly defines DeFi’s next chapter. For years, Ethereum has ruled decentralized finance. But Solana’s latest performance shows that speed, low fees, and real user engagement are starting to bend the market narrative.

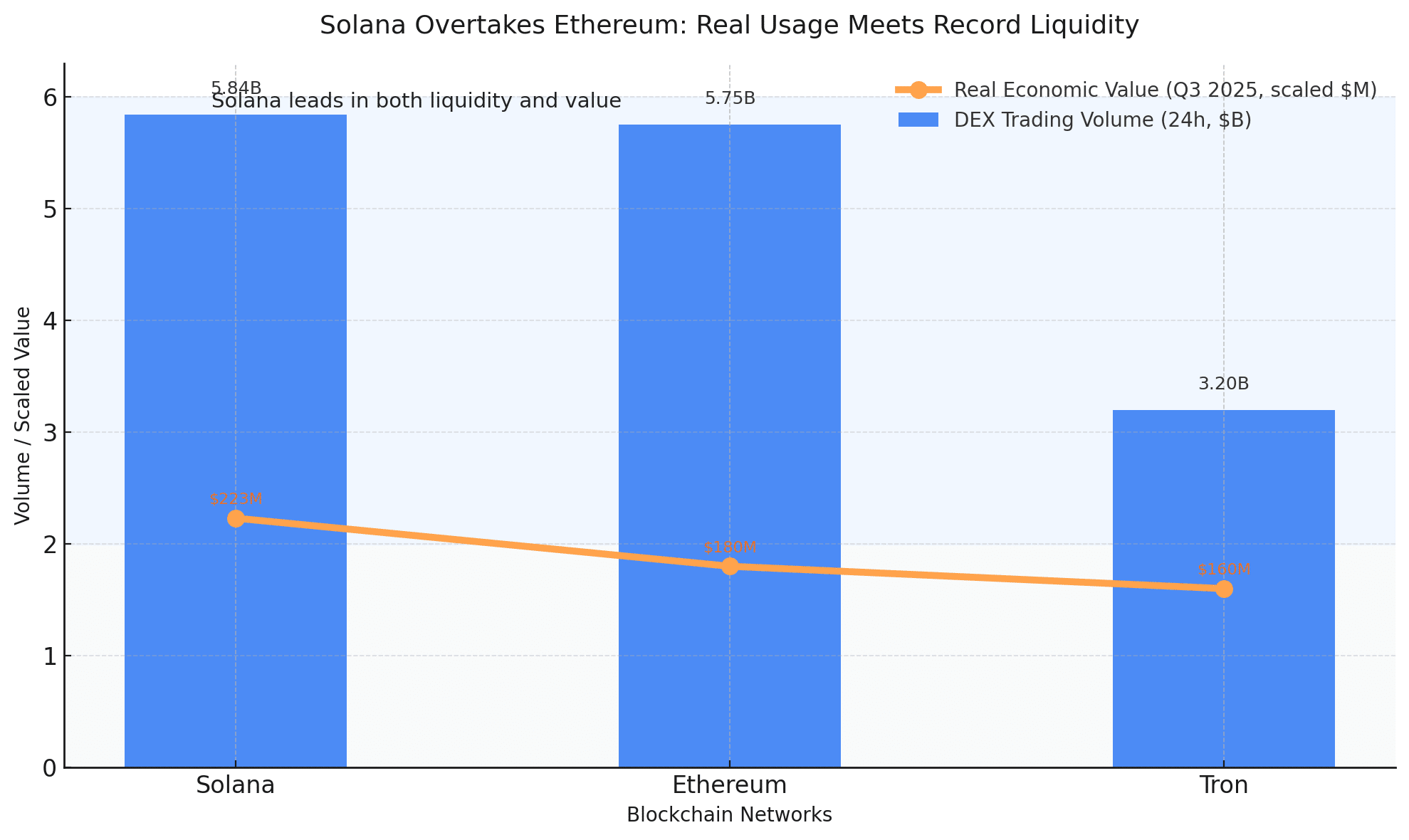

Solana’s trading activity did not just tick higher, it surged. In the last 24 hours, its DEX volume hit nearly $5.84 billion, slightly ahead of Ethereum’s $5.75 billion. That might sound like a narrow win, but in a sector driven by perception and momentum, small margins can reshape sentiment fast.

When Solana Overtakes Ethereum, Liquidity Tells the Story

Behind this sudden surge lies something bigger than a trading spike. Solana’s stablecoin liquidity has reached record levels, hovering around $17.5 billion. These inflows have deepened liquidity across popular Solana DEX platforms like Jupiter, Raydium, and Phoenix, enabling faster trades with less slippage.

In practical terms, it means traders can move capital more efficiently than before. Every major DEX now has an order book that feels thicker and more reliable, and that is pulling more volume into Solana’s orbit. As one market analyst on X recently put it, “Liquidity is oxygen for DeFi, and Solana is breathing easy right now.”

The market is responding accordingly. Solana overtakes Ethereum not just in raw transaction count but in trader preference. Where Ethereum once enjoyed a monopoly on serious DeFi volume, Solana is slowly cracking that dominance through accessibility and speed.

Real Economic Value: Measuring Genuine Usage

Volume alone can mislead. The truer test of blockchain activity is how much real value users actually generate. In Q3 2025, Solana’s Real Economic Value, fees and real transaction payments, stripped of token rewards, stood at roughly $223 million, topping Tron’s $160 million and comfortably ahead of most other chains.

This data reflects genuine economic participation. It is not inflated by staking rewards or artificial volume farming. Real users are paying real fees to use Solana’s infrastructure. That distinction matters because it means Solana overtakes Ethereum in meaningful network demand, not just temporary hype.

Ecosystem activity from DeFi protocols like Jupiter, marginfi, and Marinade has amplified that momentum. The NFT sector, long a side story to Solana’s narrative, continues to add depth with platforms like Magic Eden attracting fresh liquidity.

Price, and Momentum

Naturally, price followed the buzz. After falling from around $221 to $177 earlier this month, SOL rebounded by roughly 5.8%, now trading near $208. The market’s short-term technicals show balance: the Relative Strength Index sits close to 47, signaling neutrality.

Analysts see key resistance around $220 and support near $190, levels that traders are watching closely. A break above $220 could open the door to new highs, while slipping below $190 might cool the enthusiasm. But even here, sentiment remains upbeat. The DEX dominance story has given SOL a tailwind that might sustain longer than expected if capital continues flowing in.

Challenges Beneath the Surface

Still, not everything is set in stone. Much of Solana’s recent activity stems from meme tokens and short-term speculative assets. That can boost metrics but not necessarily stability. Liquidity depth also remains a challenge; while DEX volumes are large, total locked value is still lower than Ethereum’s sprawling DeFi ecosystem.

Regulatory pressure and risk appetite shifts could also test Solana’s newfound momentum. As one trader wrote on X, “Flipping Ethereum for a day is exciting, but keeping it flipped is the hard part.”

A Shift That Feels Structural

Even with caveats, Solana overtakes Ethereum in DEX volume represents more than a flash in the pan. It speaks to a growing appetite for faster, cheaper alternatives and a user base less willing to tolerate high fees. The next question is not whether Solana can flip Ethereum again, but how often, and how sustainably, it can do it.

In a space defined by cycles, the networks that attract real users and genuine liquidity usually win in the long run. If Solana continues to post strong Real Economic Value and maintain robust trading depth, it could become the first credible parallel to Ethereum’s DeFi dominance since the movement began.

Frequently Asked Questions

What does it mean that Solana overtakes Ethereum?

It means Solana’s decentralized exchanges processed more 24-hour trading volume than Ethereum’s, indicating growing user and liquidity activity.

Is this a permanent change in DeFi leadership?

Not yet. Solana’s rise is impressive but must prove sustainable over multiple weeks to confirm a long-term leadership shift.

Why is Real Economic Value important?

It filters out inflated metrics by counting only genuine usage, actual fees paid by users, not subsidized activity or rewards.

What could slow Solana’s growth?

Regulatory hurdles, liquidity depth issues, and speculative excess in its ecosystem could make sustained leadership difficult.

Glossary of Long Key Terms

Real Economic Value (REV): A metric showing genuine blockchain usage, measuring actual fees and payments rather than incentivized transactions.

Decentralized Exchange (DEX): A blockchain-based trading platform allowing peer-to-peer swaps without centralized intermediaries.

Stablecoin Liquidity: The total value of stablecoins like USDC circulating within a blockchain, reflecting market confidence and available capital.

Relative Strength Index (RSI): A technical indicator used to gauge momentum and identify potential overbought or oversold conditions.

Liquidity Depth: The amount of capital available in a trading pool. Deeper liquidity usually means less price slippage during large trades.