This article was first published on Deythere.

Solana price has accelerated its hike, forming a resistance area at $145. Price movement structure seems to have changed after escaping a descending channel of long duration to indicate a possible end to the correction and maybe even push higher.

However, core usage metrics are giving off mixed signals. While technical signs and trader positioning favor the bulls, on-chain growth remains weakened.

Technical Breakout Reframes Solana Price Structure

Solana has shown a clear change of structure in its recent price action. After months of corrective price action, $SOL broke out from a descending channel that had been limiting gains since the end of 2025.

This moved the market structure from a consolidation to a possible trend renewal. This has been accompanied by a bullish MACD and rising momentum showing that buyers might be starting to gain near-term control of price action.

Technical analysis concurs that going after this resistance has now become the focus. Chart coverage indicates that sustained trade above $145, with daily closes well above it at the end of each session, would confirm corrective behavior has ended.

A breakout is largely believed to be necessary for an extension towards higher levels like $150 and above.

Exchange Flows and Positioning Support the Rally

Backing the challenge of resistance at $145 is market flows. Spot market figures from the past week show sustained net negative exchange flows, with the rate at which $SOL tokens are withdrawn from exchange inventories exceeding that of their deposit.

This effectively removes the direct sell pressures on exchanges, therefore constraining liquidity on centralized channels. And although outflows are on a scale that is not extreme with consistent rather than aggressive accumulation, it still forms structural support under prices.

At the same time, futures market is telling a consistent bullish story. Data from exchanges on liquidations showed a huge pressure on short positions. On 12 January short liquidations outpaced long positions by over $7.24 million, while about $3.75 million of long positions were liquidated, suggestive that bearish bets trying to fade the rally are being swept as Solana nears key resistance.

Funding rates also flipped bullish, indicating traders are paying to keep longs open not a form of uncertainty but rather conviction. However, analysts warn the spike in funding may start to pose a risk if momentum falters as it approaches resistance.

On-Chain Expansion has Slowed, Generating Tension

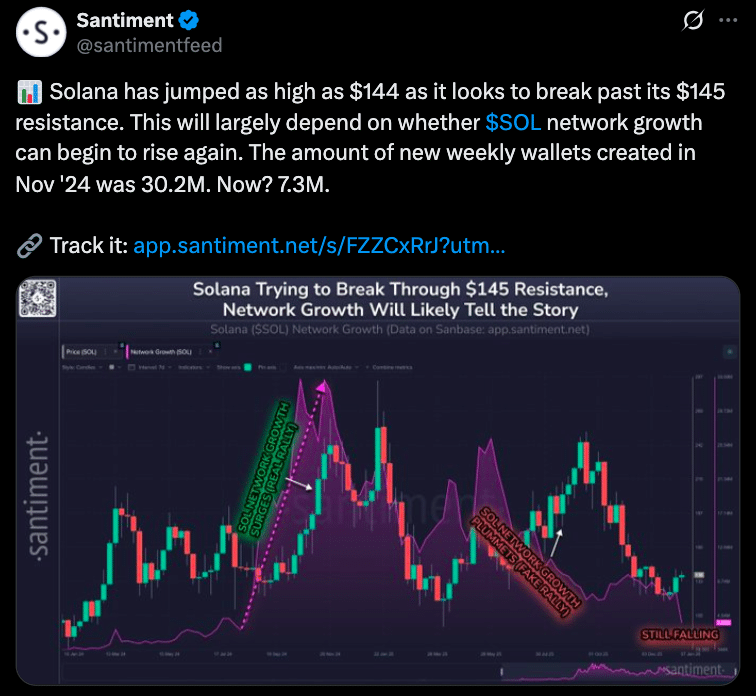

Opposing those bullish technicals is a slowing on-chain network growth. New weekly wallets have fallen precipitously from about 30.2 million in late 2024 to around 7.3 million currently, on-chain metrics indicate.

A decline in new wallet creation (which indicates fresh network participation), also suggests that price action at the moment is more about positioning and trader activity than it is about widespread adoption.

The disconnect between the price strength and network participation is a consideration for analysts, who argue that long-term sustained uptrends generally need expanding user engagement, not just speculative flows or derivatives positioning.

Solana Price Outlook: What the Current Setup Suggests

Based on current market structure and positioning, Solana’s near-term price direction depends largely on how it behaves around the $145 resistance. The breakout from a multi-month descending channel, combined with sustained exchange outflows and short liquidations, shows that buyers currently control momentum.

If $SOL maintains pressure above the $140 zone and clears $145 with follow-through, price action could naturally extend toward higher psychological levels of $150 and above as momentum trading continues to support the move.

In the short term, Solana’s strength is driven more by trader positioning than network expansion. This means price can still push higher even as on-chain growth lags, but durability depends on participation eventually catching up.

If resistance holds and momentum fades, consolidation just below $145 would remain a likely outcome rather than an immediate breakdown, given reduced sell-side pressure.

Looking further ahead, Solana price trajectory appears constructive as long as supply remains constrained on exchanges and leverage stays controlled.

Sustained upside over time will require renewed growth in wallets and activity to support higher price levels, but structurally, $SOL has already shifted away from its prior corrective phase. That change alone places Solana in a stronger position than it held throughout much of the previous consolidation period.

Conclusion

Solana price action right now is actually indicating a real push to the $145 resistance, with a breakout from a multi-month descending channel, bullish positioning data, and exchange outflows.

The downside is that the momentum is held in check by a distinct slowing down of the network growth, notably new wallet creation, suggesting that usage dynamics have not been able to keep up with price dynamics.

The question remains for Solana as to whether it can make a strong move through $145 or not with buyer control still held and traction continuing to build on the participation front, which will naturally invite volume.

A successful break would then signal a trend continuation, but a rejection at this level could bring consolidation or ranging. .

Glossary

Descending Channel Breakout: a technical system that involves a movement of price out of a descending channel and appears to signal a reversal to the upside.

Exchange Netflows: track the net flow of assets on or off centralized exchanges; negative flows can diminish sell pressure.

Liquidations: take place when leveraged positions are forcefully closed as a result of price action transcending maintenance margin.

Funding rates: periodic payments between longs and shorts crypto futures traders; positive indicates a bias towards bullish sentiment.

On-chain wallet growth: measures the speed at which wallet addresses are being generated on a blockchain network.

Frequently Asked Questions About Solana Price Resistance

What is Solana’s $145 resistance?

The price barrier is at $145, a level that $SOL has repeatedly tested but not managed to break.

Why does breaking $145 matter?

A break at $145 would indicate a possible change in correction mode toward trend continuation thus allowing for higher resistance.

What’s driving the recent momentum?

The breakout from a descending channel, outflows on exchanges, and bullish derivatives positioning are the primary catalysts of this momentum move.

Is a network expansion fueling the rally?

On-chain metrics suggest that new wallet growth is slowing, suggesting the rally is more momentum-driven rather than adoption driven.