This article was first published on Deythere.

Solana ETFs have reached a milestone that signals a clear shift in institutional behavior. More than one billion dollars is now parked in regulated exchange-traded funds linked to the Solana ecosystem. This development highlights how quickly structured crypto products are gaining ground beyond Bitcoin and Ethereum.

The timing stands out. Markets remain cautious, yet capital continues to flow into Solana-based funds. According to verified data, combined assets under management across Solana ETFs have now surpassed the one-billion-dollar mark, accounting for roughly 1.4 percent of Solana’s total market capitalization.

One Fund Dominates the Landscape

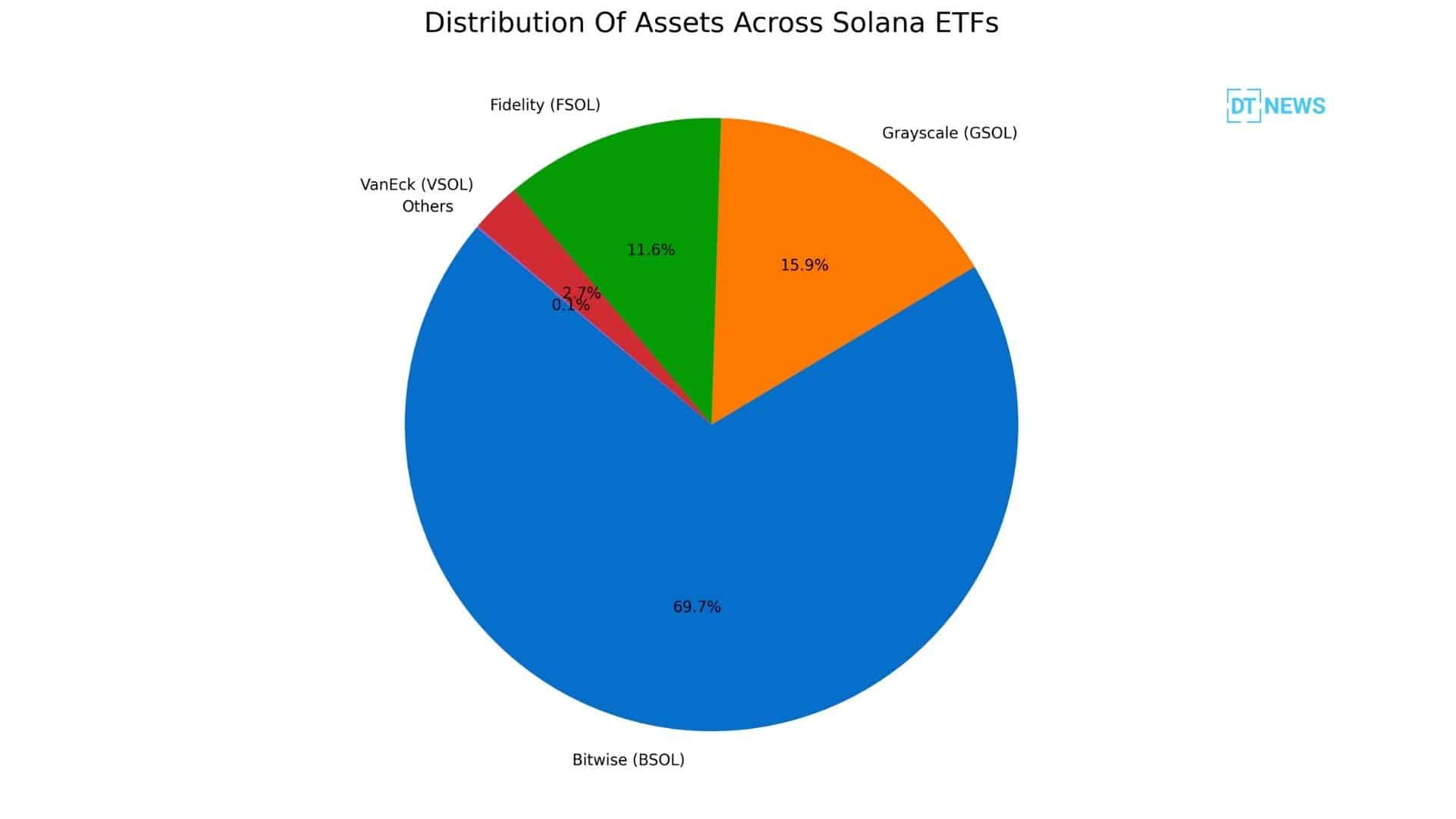

At the center of this growth is Bitwise, whose Solana staking ETF has emerged as the clear leader. The fund manages approximately $732 million in assets, making it the dominant Solana ETF.

The appeal lies in structure. Unlike standard spot products, this fund tracks Solana’s price while also earning staking rewards. Assets are staked internally, allowing investors to gain yield alongside price exposure. This design mirrors how long-term Solana holders participate in the network, while operating within a regulatory framework that institutions prefer.

This approach has proven attractive to investors seeking returns beyond simple price movement. Yield, operational clarity, and compliance have become central to allocation decisions.

Other Issuers Continue to Build Positions

While one fund leads, others are steadily gaining ground. Beyond Bitwise’s BSOL, funds from Grayscale, Fidelity, and VanEck now collectively hold over $300 million in assets. Grayscale’s GSOL accounts for roughly $167 million, followed by Fidelity’s FSOL at around $122 million, while VanEck’s VSOL continues to attract steady inflows with approximately $28 million under management.

Recent trading data support this trend. Solana ETF products recorded about $16 million in daily net inflows, with roughly $43 million in total value traded across funds. Cumulative inflows are now approaching $800 million, pointing to sustained engagement rather than short-term speculation.

Research on ETF adoption patterns suggests that once funds reach this scale, they often transition into long-term portfolio holdings. That shift can influence liquidity, reduce turnover, and shape price behavior over time.

Impact on Solana’s Market Structure

Solana ETFs now hold a growing share of circulating supply. ETF-held assets tend to remain locked for more extended periods, reducing short-term selling pressure. Staking-enabled products further limit liquid supply by actively participating in network security.

Solana’s technical strengths support this trend. Fast transaction speeds and low fees make large-scale staking practical. That efficiency strengthens the case for institutional products tied to real network activity rather than passive exposure alone.

For blockchain developers, rising institutional interest raises the importance of network stability. For financial students, it offers a clear example of how regulation shapes adoption. For analysts, ETF inflows provide a new data point alongside on-chain metrics.

A Quiet Signal With Long-Term Meaning

The rise of Solana ETFs may lack dramatic headlines, but its implications run deep. Institutions are expanding their crypto exposure through regulated channels that offer yield, transparency, and liquidity.

As long as these conditions remain in place, demand is unlikely to fade. This milestone does not mark an endpoint. It signals the beginning of a broader institutional phase for Solana within global financial markets.

Conclusion

Solana ETFs crossing the one billion dollar mark is a turning point, not a peak. Institutional capital chooses structure, yield, and long-term exposure over speculation. This shift places Solana firmly on the radar as serious financial infrastructure, not just a fast blockchain.

Glossary of Key Terms

Solana ETFs: Regulated funds providing exposure to Solana-based assets.

Assets Under Management: Total value of assets held within an investment fund.

Staking Rewards: Earnings generated by helping secure a blockchain network.

Net Inflows: New capital entering a fund after withdrawals.

FAQs About Solana ETFs

What are Solana ETFs?

They allow regulated exposure to Solana without holding the token directly.

Why is staking important in these funds?

Staking adds yield, improving total return potential.

Are institutions driving ETF inflows?

Yes, most inflows come from institutional investors.

Could more Solana ETFs launch?

Growing demand increases the likelihood of new products.