Solana ETF inflows hit $6.8 million last week, surpassing both $BTC and $ETH ETFs. This shows that more institutional investors are now turning their attention toward $SOL.

- What Are Solana ETFs and Why Do Inflows Matter?

- Why Are Solana ETF Inflows Outpacing Bitcoin and Ethereum?

- What Does Derivatives Data Reveal About Market Sentiment?

- How Is SOL Performing in the Spot Market?

- What Does This Mean for Investors?

- Conclusion

- Glossary

- Frequently Asked Questions About Solana ETF inflows

The demand for $SOL has been steady without sudden spikes. Traders are keeping their positions cautious rather than chasing quick profits.

What Are Solana ETFs and Why Do Inflows Matter?

Solana ETFs are investment funds that follow the performance of the $SOL token, giving investors access without needing to own the coin itself. Solana ETF inflows show how much money is moving into these funds over time. They often serve as an early sign of how confident big investors are in the project.

Many analysts believe that steady inflows usually point to lasting interest instead of short-term trading moves. The recent rise in Solana ETF inflows is important because it shows investors are beginning to look beyond $BTC and $ETH.

More people are paying attention to altcoins that seem to offer stronger growth opportunities. This change reflects growing trust in $SOL’s potential within the broader crypto market. Unlike futures trading, steady inflows into spot ETFs show a more thoughtful and balanced approach from investors.

Why Are Solana ETF Inflows Outpacing Bitcoin and Ethereum?

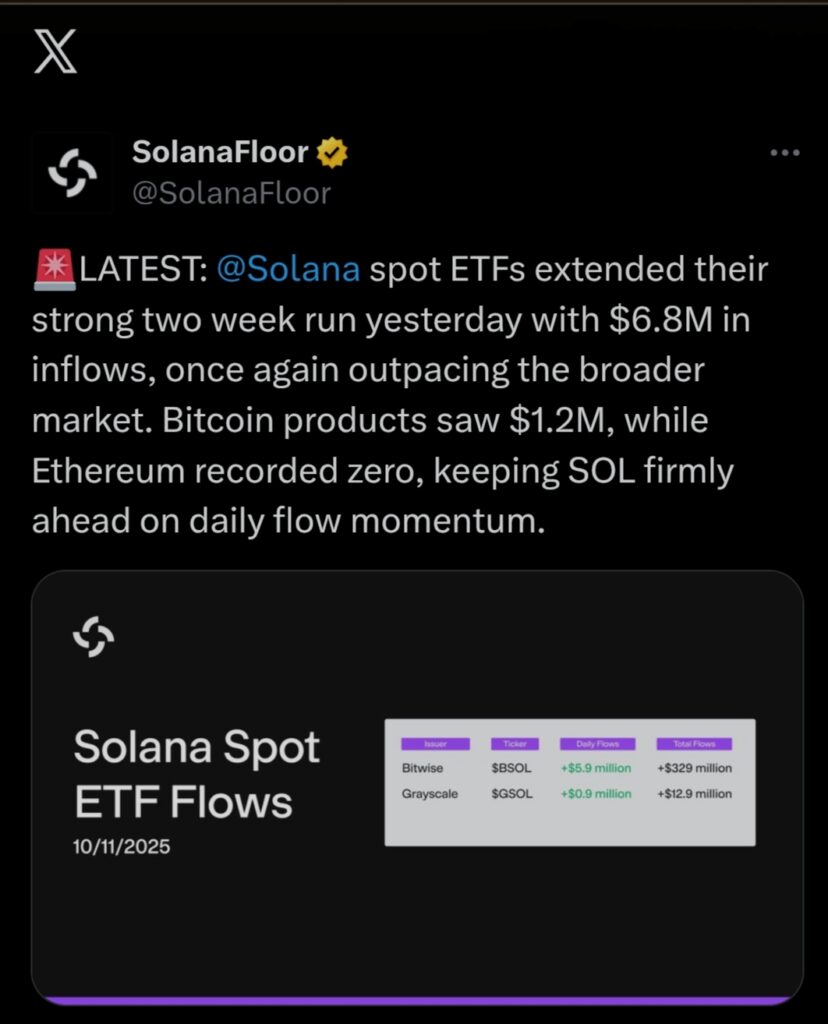

According to data, Solana’s spot ETFs brought in $6.8 million on November 10. The Bitwise Solana ETF ($BSOL) accounted for $5.9 million of that total, while the Grayscale Solana ETF ($GSOL) added another $0.9 million.

It was the second week in a row that $SOL funds recorded consistent inflows. With this momentum, Solana’s total ETF holdings have now reached $343 million since they were first launched. In comparison, $BTC and $ETH ETFs recorded very little movement during the same period.

Analysts believe Solana’s growing appeal comes from its quick transaction process and its expanding network of projects. The $SOL ecosystem now includes a wide range of decentralized finance projects and non fungible tokens. This growth has made it a more appealing option for many investors.

As more applications and developers join the network, confidence in Solana’s future continues to build. This rising trust has contributed to stronger Solana ETF inflows in recent weeks. A senior crypto analyst said that Solana is gaining attention because it offers both speed and innovation.

The expert noted that this mix helps $SOL stand out from other digital assets. Solana’s design allows it to handle more transactions efficiently while keeping performance stable. The analyst believes that Solana is far more than just another altcoin.

What Does Derivatives Data Reveal About Market Sentiment?

Despite strong ETF inflows, the derivatives market has generally maintained a steady and balanced outlook. An Open Interest value of $3.4 billion reflects consistent participation from traders without excessive leverage.

Overall activity suggests a stable setup rather than a speculative one. The funding rate of -0.0009 indicates a slightly cautious sentiment but not significant short positioning. Experts believe that the mix of strong Solana ETF inflows and steady derivatives activity shows signs of a mature market.

This balance points to careful participation rather than risky trading behavior. It also suggests that the strength of $SOL comes mainly from real investor interest. Such steady demand is often viewed as a mark of growing institutional confidence.

How Is SOL Performing in the Spot Market?

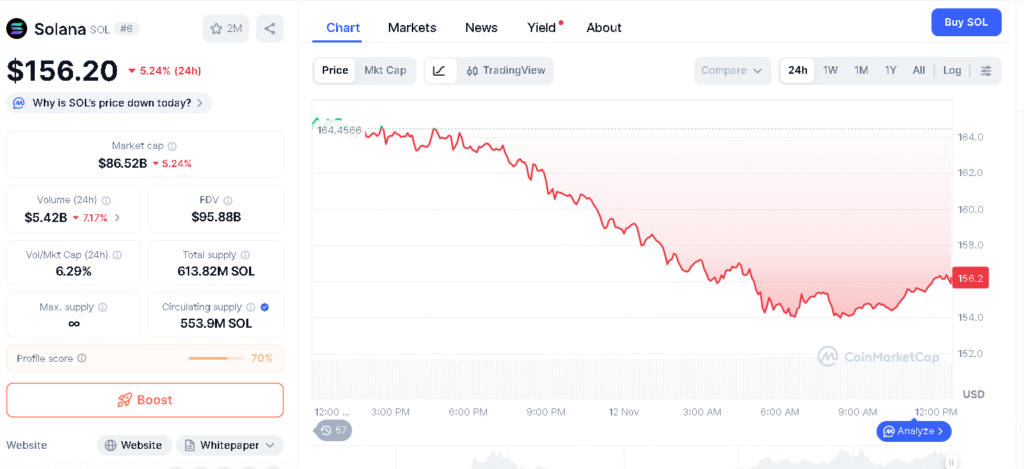

Solana price is seen near $156 with a drop of about 5.34% over the past 24 hour. The market often meets resistance close to the $170 range, where upward movement usually slows down. The Relative Strength Index has shown limited buying pressure during such phases.

A Chaikin Money Flow reading of 0.00 suggests that even with strong Solana ETF inflows, spot demand for $SOL has not shown much improvement. This short period of consolidation usually happens after several tries to move higher.

Analysts think that support for $SOL is likely to hold near $150 before any new rise begins. Such movement is often seen as a normal part of market behavior. The pattern also reflects careful but growing confidence from institutional investors.

What Does This Mean for Investors?

The recent Solana ETF inflows of $6.8 million show a possible change in how institutions are investing. Many investors are now looking beyond Bitcoin and turning toward $SOL for growth opportunities. The steady inflows point to faith in Solana’s long-term strength.

This confidence is supported by its strong network, quick transactions, and growing presence in DeFi and NFT projects. ETF inflows are often seen as a measure of how investors feel about the market.

Strong inflows into $SOL show confidence and a planned shift toward assets with higher growth potential. Ethereum’s lack of inflows may simply point to a short break in activity rather than fading interest. The slower pace of Bitcoin inflows suggests a more careful and patient attitude among investors.

Conclusion

Solana ETF inflows have climbed to $6.8 million, outpacing both Bitcoin and Ethereum funds. The rise points to a clear buildup of institutional interest in the $SOL market. The steady progress reflects growing trust and interest among larger investors. The pattern also shows a shift toward more stable and confident investment behavior.

Solana seems to be moving through a steady phase after recent market activity. The constant flow of Solana ETF inflows shows that investors are beginning to treat $SOL as a serious option for long term growth.

This growing interest points to wider acceptance of Solana among institutional players. If this momentum continues, $SOL could be stepping into a new stage of adoption that reaches beyond regular altcoin speculation.

Glossary

Bitwise Solana ETF: The Solana fund by Bitwise with the highest investor inflows.

Grayscale Solana ETF: The Solana fund by Grayscale is adding steady inflows.

Open Interest: Total value of active futures showing market activity.

Funding Rate: Fee that keeps futures prices close to real prices.

Derivatives Market: A Market where traders buy and sell contracts linked to crypto prices.

Frequently Asked Questions About Solana ETF inflows

How much did Solana ETF inflows reach last week?

Solana ETF inflows reached $6.8 million last week, beating the top crypto inflows.

Which Solana ETF recorded the highest inflows?

The Bitwise Solana ETF (BSOL) recorded the highest inflows of $5.9 million.

Which Solana ETF recorded the highest inflows?

The Bitwise Solana ETF (BSOL) recorded the highest inflows of $5.9 million.

Why are Solana ETF inflows increasing?

Solana ETF inflows are increasing because more investors trust Solana’s speed, innovation, and growing ecosystem.

What does this rise in ETF inflows mean for Solana’s future?

It means Solana is gaining strong institutional support and could enter a more mature growth phase soon.