According to latest reports, the US Securities and Exchange Commission (SEC) has extended its review of Solana exchange-traded fund (ETF) applications, pushing final decisions to mid-October 2025.

- Extensions in Detail Reveal Solana ETF Hurdles

- Public Input and Regulatory Guardrails Remain Key

- Industry Reaction: Optimism Persists Despite Delays

- Solana Price Reacts to ETF News

- Conclusion

- FAQs

- Why is Solana ETF approval delayed again?

- Which firms are affected?

- What’s the new deadline?

- Is there hope for approval?

- Glossary

Filings from major issuers, including Bitwise, 21Shares, Canary Funds, and Marinade Finance, are now under extended review as regulators need “more time to consider” the implications of the first-ever spot Solana ETFs. Amidst this Solana ETF approval delay, industry insiders are still hopeful that it will come in Q4.

Extensions in Detail Reveal Solana ETF Hurdles

In regulatory filings, the SEC used its full 60-day extension authority, setting a new deadline of October 16, 2025 for filings by Bitwise and 21Shares seeking to list under Cboe BZX’s Commodity-Based Trust Shares rules. The filings say “full review” is needed.

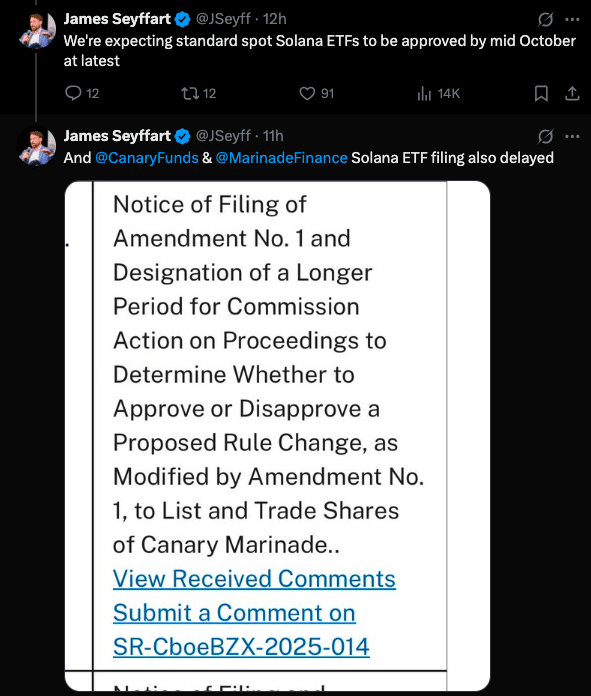

Analysts like Bloomberg’s James Seyffart noted the delay, saying after this pause, the SEC will wrap up its decision and Solana ETF approval will likely come in mid-October.

The delays aren’t isolated. Proposals from Canary Funds and Marinade Finance were also included in the extension, insinuating that the agency might be systematically reviewing altcoin fund applications.

Public Input and Regulatory Guardrails Remain Key

Beyond timing delays, the SEC has opened public comment periods for the Solana ETF proposals. This allows stakeholders to weigh in on issues like investor protection, market manipulation safeguards and custody frameworks.

This process follows a slow and steady ETF vetting route. As other altcoin ETFs, including XRP, Polkadot, and Dogecoin, are moving through the SEC pipeline, scrutiny remains high.

Industry Reaction: Optimism Persists Despite Delays

Despite the delays, market sentiment is still positive. Nate Geraci of The ETF Store thinks broad altcoin ETF adoption is imminent, driven by recent inflows into Bitcoin and Ethereum products that are building momentum across the crypto ETF space.

Some analysts warn that not all Solana ETF approvals will come through, calling altcoin-based products still experimental in institutional eyes.

Solana Price Reacts to ETF News

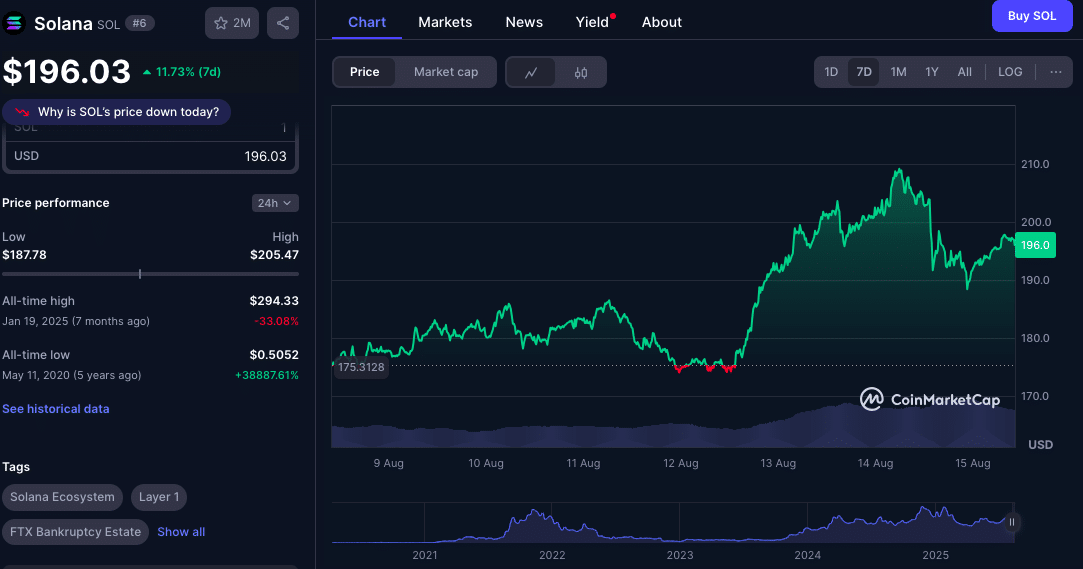

Following the latest Solana ETF news, Solana price briefly popped above $209 based on ETF hopes. The 24-hour range was between $195-$209. As at the time of this writing, however, $SOL trades at $196.

CoinGlass shows derivatives activity is high with open interest at $12 billion, not far from recent highs, indicating that traders are still betting on Solana to continue to go up regardless of the ETF.

Conclusion

Based on the latest research, the long road to Solana ETF approval shows the SEC is taking its time with crypto fund regulation. The October 16, 2025 extensions show there are still questions around market infrastructure, compliance models and investor protection.

However, momentum is in the industry and a Q4 decision of a possible Solana ETF approval is still expected. For now, the market waits as Solana goes from DeFi standout to a mainstream investment candidate.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

The SEC has delayed decisions on Solana ETF approvals for big players like Bitwise, 21Shares, Canary Funds and Marinade Finance until October 16, 2025. While delays are frustrating, public comment periods and market activity suggest Solana ETF approval may still happen in Q4.

FAQs

Why is Solana ETF approval delayed again?

The SEC is taking full review extensions; citing need for more time to evaluate investor protections, fee structures, staking behavior and market stability before approving or denying spot Solana ETFs.

Which firms are affected?

Proposals from Bitwise, 21Shares, Canary Funds and Marinade Finance have all been delayed until mid-October.

What’s the new deadline?

The final decision date is now October 16, 2025.

Is there hope for approval?

Nate Geraci and James Seyffart expect regulatory clarity to come, and altcoin ETFs to launch around mid-October.

Glossary

Solana ETF Approval – The SEC’s process of approving a fund that offers exposure to the price of SOL.

Spot ETF – A fund that tracks the current (spot) price of an asset, settles via direct ownership not derivatives.

Open Interest – The total number of outstanding derivatives contracts—used here to show Solana market activity.