The US Securities and Exchange Commission (SEC) has put Solana in the spotlight, asking several asset managers to submit updated S-1 filings for spot Solana ETFs by mid-June. According to a Blockworks report citing sources, the SEC will provide feedback within 30 days. This means a potential decision as early as mid-July should be expected.

- What the SEC Is Asking for and What It Means

- July Approval in Sight? Timelines and Expectations

- 90% Approval Odds for Solana and Litecoin

- Who’s Filing for Solana ETFs?

- International Momentum: Brazil’s Solana ETF Paves the Way

- SOL Price Holds Steady Amid ETF Buzz

- Conclusion: Solana ETF May Lead Altcoin Era

- FAQ

- What is an S-1 filing and why is the SEC asking for it now?

- What are the chances of a Solana ETF in 2025?

- What’s the role of staking in this ETF?

- How will a Solana ETF impact SOL’s price?

- Who is applying to launch Solana ETFs?

- Glossary

While no official approval date has been announced, Bloomberg ETF analyst James Seyffart expects Solana ETF decisions to come in early Q4 2025. But the SEC’s urgency in asking for filing updates, especially with staking, suggests it could happen sooner. Approval odds are now at 90%, putting Solana in the lead among altcoins vying for institutional investment channels.

What the SEC Is Asking for and What It Means

Sources say the agency is asking for updates that clarify in-kind redemption mechanisms, a process where ETF shares can be exchanged for the underlying Solana tokens instead of cash. This improves tax efficiency and liquidity of ETFs, an important feature for spot crypto ETFs that will attract both institutional and retail flows.

The SEC is also open to staking as part of the fund structure. If approved, this would allow Solana ETF investors to earn staking rewards within the ETF, something that was off the table for Ethereum ETFs just weeks ago. The inclusion of staking shows a more mature dialogue between issuers and the regulator, acknowledging the functional reality of proof-of-stake networks like Solana.

This focus on redemption and staking mechanisms means the SEC is getting more flexible, and more comfortable with blockchain infrastructure, and may set a precedent for other altcoin ETFs.

July Approval in Sight? Timelines and Expectations

With a mid-June deadline for updated filings and a 30-day review window, the SEC could decide as early as mid-July 2025. Seyffart says delays are expected but the fast-tracked process suggests an earlier approval is possible.

“If we see early approvals from the SEC on any of these assets, I wouldn’t expect to see them until late June or early July at the earliest,” Seyffart said on X.

This is in line with the Ethereum ETF precedent where S-1 revisions were important steps before approval. It should be noted that this 30-day comment period is separate from the 19b-4 process where regulators review proposed rule changes to allow exchanges to list new ETFs. But active feedback on S-1s is a good sign of regulatory intent.

90% Approval Odds for Solana and Litecoin

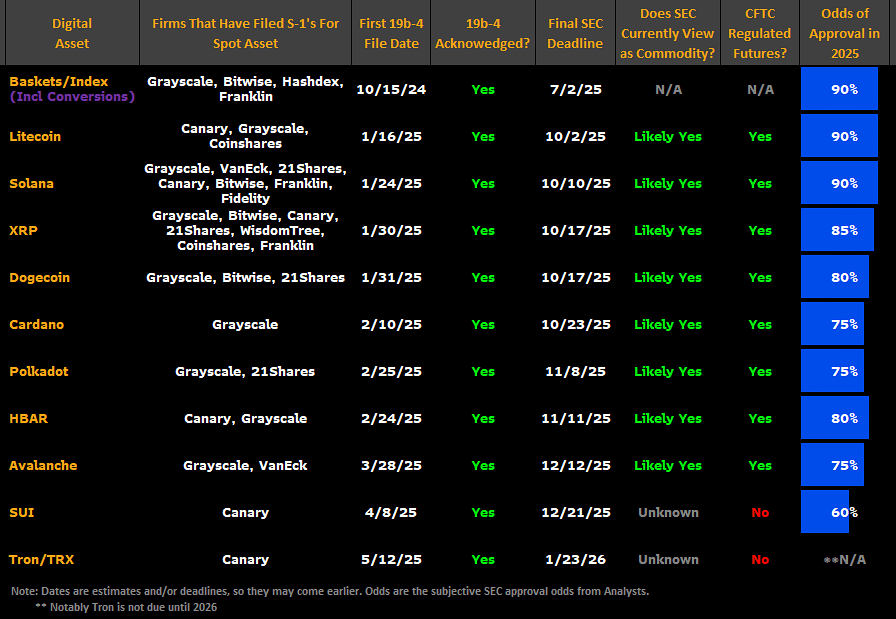

According to Bloomberg Intelligence, the odds of Solana getting an ETF in 2025 are 90% tied with Litecoin. XRP is at 85% and Dogecoin and Hedera Hashgraph (HBAR) are at 80%.

These numbers are based on multiple factors: the SEC treating these tokens as commodities, not securities, robust futures markets, and increasing regulatory clarity around staking.

Seyffart said these altcoins are “viewed more as commodities” by the agency which lowers the legal barrier for ETF approval. Commodity classification simplifies the approval process under the SEC and aligns the tokens with the frameworks used for Bitcoin and Ethereum spot ETFs.

Who’s Filing for Solana ETFs?

Several big asset managers are in line to offer Solana spot ETFs including Grayscale, VanEck, Bitwise, 21Shares, Franklin Templeton, Canary Capital and Fidelity. Grayscale plans to convert its existing Solana Trust into a spot ETF using the same model as its Bitcoin and Ethereum trusts.

The SEC reportedly acknowledged Grayscale’s Solana ETF proposal in February but delayed a decision in May, citing more time to analyze legal, technical, and investor protection issues. Bitwise and 21Shares faced similar delays.

Despite the slow pace, experts believe the pipeline is robust and the number of issuers shows growing institutional interest in Solana.

International Momentum: Brazil’s Solana ETF Paves the Way

While the US waits for clarity, the rest of the world is moving faster. In August 2024, Brazil’s CVM approved the first spot Solana ETF by Hashdex. A second Solana ETF followed shortly after. The launch has been successful in South America and is attracting institutional flows and validating Solana as a global investable asset.

This international precedent puts pressure on US regulators to keep up with global innovation or risk driving crypto asset managers offshore.

SOL Price Holds Steady Amid ETF Buzz

After the SEC filing news, SOL rose 4% intraday and briefly touched $165 and the 50-day SMA. Technicals show resistance at $167-$170 and a break above could take it to $183.

RSI and MACD are showing bullish momentum but price action is tied to ETF news and a delay or negative news could bring selling pressure. A close above $170 would strengthen the case for more upside as institutions start to buy.

Conclusion: Solana ETF May Lead Altcoin Era

The SEC’s request for updated S-1 filings and its reported openness to staking is a welcome approach to crypto ETFs. Unlike previous cycles of rejection or delay, the agency is now working with issuers to resolve procedural and structural issues.

With a July decision window and 90% approval odds, Solana is poised to be the first altcoin ETF to market beyond Ethereum. If approved, the fund will open up to institutional and retail investors and be a model for future ETFs on other Layer 1 networks.

Timelines can change and regulatory surprises are possible but the path to a Solana ETF looks better than ever.

FAQ

What is an S-1 filing and why is the SEC asking for it now?

An S-1 filing is a registration document required to launch a new publicly traded ETF. The SEC is asking issuers to update it with clearer disclosure on redemption mechanisms and staking, so they’re taking this seriously.

What are the chances of a Solana ETF in 2025?

According to Bloomberg ETF analysts, Solana has a 90% chance of getting approved this year, making it one of the most likely altcoins to become an ETF.

What’s the role of staking in this ETF?

Staking would allow ETF holders to earn passive rewards by helping secure the Solana network. The SEC is reportedly open to including this, which would make the ETF more attractive and aligned with Solana’s tech.

How will a Solana ETF impact SOL’s price?

Approval will boost investor confidence and bring institutional capital into SOL, potentially big time. Delays will stall short term momentum.

Who is applying to launch Solana ETFs?

Applicants include Grayscale, VanEck, Bitwise, 21Shares, Canary Capital, Franklin Templeton, and Fidelity, with Grayscale looking to convert its SOL Trust into a spot ETF.

Glossary

Spot ETF – An ETF that holds the actual cryptocurrency rather than derivatives like futures.

S-1 Filing – A registration document filed with the SEC that contains key information about a new security offering, including risks, fund structure and management.

Staking – A blockchain mechanism where users lock up tokens to help validate transactions and secure the network and get rewarded.

In-kind Redemption – Exchanging ETF shares for the underlying asset instead of cash, for tax efficiency.

Commodity Classification – Classifying a crypto asset as a commodity under US law so it can be regulated by the CFTC and make ETF approval easier.