This article was first published on Deythere.

- Solana Spot Trading Volume on the Rise

- Why Liquidity Is Shifting On-Chain

- Effect on Centralized Exchanges and Market Structure

- Price Action and Network Health Signals

- Conclusion

- Glossary

- Frequently Asked Questions About Solana Spot Volume

- Why did Solana’s on-chain trading volume skyrocket in 2025?

- Did Solana beat all of the big centralized exchanges in volume?

- What does the increase to on-chain volume imply for centralized exchanges?

- How does Solana price in this volume growth?

- References

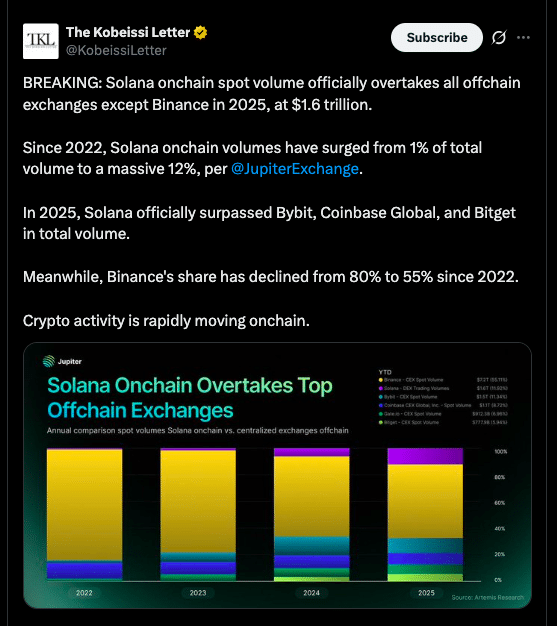

Solana saw its on-chain spot volume hit close to $1.6 trillion, surpassing nearly every centralized exchange (CEX) in annual volume except Binance.

According to the Jupiter Exchange and market analytics, Solana’s share of total spot trading has also jumped from around 1 percent in 2022 to nearly 12 percent by January 2026.

Solana Spot Trading Volume on the Rise

Based on latest reports, Solana saw an on-chain spot trading volume of $1.6 trillion in 2025, ranking only second behind Binance in annual spot activity worldwide.

This number eclipsed the aggregate volumes reported by leading centralized venues such as Coinbase, Bybit, and Bitget, according to data from Jupiter quoted in The Kobeissi Letter.

Solana’s ascent has been rapid. In 2022, on-chain activity represented only about 1 percent of total global spot trading volume. That figure had increased to about 12 percent of trades by the close of 2025, indicating that significant trading demand is moving onto on-chain execution venues where settlement transparency and finality happens directly on a blockchain rather than off-chain intermediaries.

The growth of Solana spot volume in 2025 shows both users preference as well as network potential.

Furthermore, traders have been clamoring for environments that deliver high throughput with low transactional costs and this is Solana’s proposition.

Why Liquidity Is Shifting On-Chain

One of the major catalysts behind the Solana spot volume wave was the redistribution of stablecoin liquidity toward blockchains that facilitate fast, low-cost transactions.

While Ethereum still has the largest pool of stablecoins overall, Solana’s share has expanded as traders and liquidity providers sought faster settlement layers.

Stablecoins are essential “fuel” for spot trading, providing stable assets for exchanging and arbitrage without frequent conversion into fiat.

Solana’s low fees and fast-confirmation times translated into a feedback loop; liquidity brought in volume, which strengthened the depth of liquidity.

Network innovations also helped. Solana has such a structure that is capable of processing high throughput and low latency trading that can be used in decentralized protocols like Jupiter, as well as other DEX aggregators to manage large volume and complicated trades.

This low-cost infrastructure has led traders to perform large spot trades directly on-chain, weaning them off of central intermediaries.

Effect on Centralized Exchanges and Market Structure

Solana spot volume rise has implications for centralized exchanges. Binance is still the largest venue in 2025; however, its market share of total spot volume traded has fallen off a cliff compared to where it was three years prior, when it constituted roughly 80% of global trading, decreasing to an estimated 55% by the end of 2025.

Meanwhile, Solana’s on-chain volume has surpassed other major exchanges like Bybit, Coinbase, and Bitget as it reinforces its position as the top stop for traders looking for deep liquidity and on-chain execution.

On-chain trading minimizes counterparty risk, is more transparent, and enables traders to maintain control of their funds until it gets confirmed on the blockchain. These benefits, alongside Solana’s performance numbers, contributed to moving a portion away from centralized venues over the past year.

In turn, the overall market structure is becoming increasingly fragmented and varied, with on-chain venues taking share from centralized exchanges.

Price Action and Network Health Signals

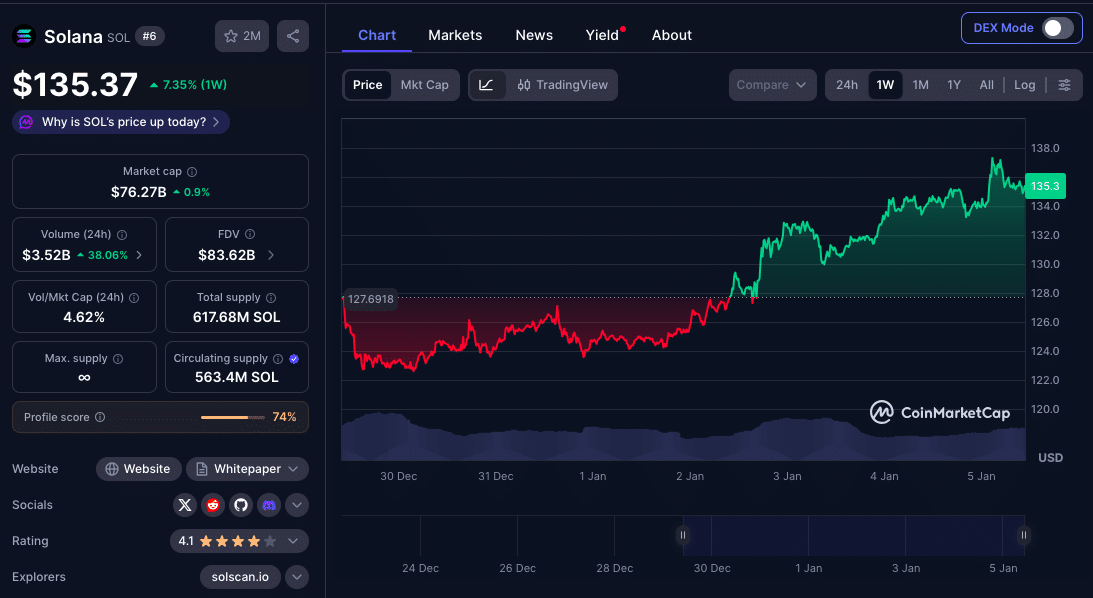

With Solana’s on-chain activity growing, the price of $SOL saw a corresponding positive reaction, settling into range above technical levels toward the end of 2025 and early 2026.

$SOL suffered from weeks of moving sideways before again rising above $130 to recover some of the losses faced towards year-end.

Technical indicators presaged accelerating momentum as the RSI was at around 58, price above the 20-day MA and the MACD signal a bullish crossover indicating more room for upward pressure.

Conclusion

With the exception of Binance, Solana has overtaken major centralized exchanges in annual spot activity to show that high-performing blockchains can compete with legacy venues on liquidity and execution.

This is a reflection of the fact that traders increasingly flock to decentralized systems that offer speed, low cost and transparent settlement.

With the continued expansion of stablecoin liquidity and on-chain settlement mechanisms, this clearly demonstrates a new reorientation in market share towards decentralized infrastructure, fundamentally changing where and how spot trading is conducted across crypto ecosystem.

Glossary

On-chain trading: Performing asset transactions on a blockchain, with decentralized protocols recording settlements in an immutable way.

Centralized Exchange (CEX): A trading platform where a third party holds and controls users’ funds which also hosts the order books.

Stablecoin: A digital token pegged to a fiat currency designed to enable trading and provide liquidity across blockchain networks.

RSI/MACD: These technical indicators are used to measure momentum and strength of a trend.

Frequently Asked Questions About Solana Spot Volume

Why did Solana’s on-chain trading volume skyrocket in 2025?

It was able to do so due to Solana’s fast transaction speeds and low costs, as well as the rise of stablecoin liquidity on the network and general market demand for decentralized execution. Solana’s spot volume reached $1.6 trillion.

Did Solana beat all of the big centralized exchanges in volume?

As of late 2025 into the new year, the on-chain spot volume of Solana was second only to Binance’s exchange and higher than that of centralized exchanges like Coinbase, Bybit or Bitget.

What does the increase to on-chain volume imply for centralized exchanges?

The sign is that traders are increasingly actualizing spot trades on decentralized infrastructure, hence less dependence on central order books and intermediaries.

How does Solana price in this volume growth?

There appears to be a price break of key technical levels earlier in 2026, supported by accelerating use and liquidity on the network.