According to sources, Solana DeFi TVL is near an all-time high at $11.7 billion, even as daily fees remain under $2 million. This shows that a lot of money is flowing into Solana, and liquidity is strong.

But the network is not earning much from it. Experts say this gap could bring both chances and risks for traders watching $SOL, as low fee revenue may reduce validator incentives and slow ecosystem growth.

Why is Solana attracting record capital inflows?

Over the last month, trading on Solana has attracted billions of dollars in capital. Its daily DEX volume reached $4.6 billion. This volume shows strong liquidity and ongoing user engagement.

Perpetuals added another $2.1 billion. The growing stablecoin supply is giving Solana a strong liquidity base for its DeFi ecosystem. The rise shows that investors trust Solana’s speed and infrastructure.

But most of the capital is flowing in without equal growth in fees. This creates a gap between activity on the network and the actual returns.

Also read: Coinbase Launches XRP and Solana Perpetual Futures for U.S. Traders

What explains the gap between TVL and revenue?

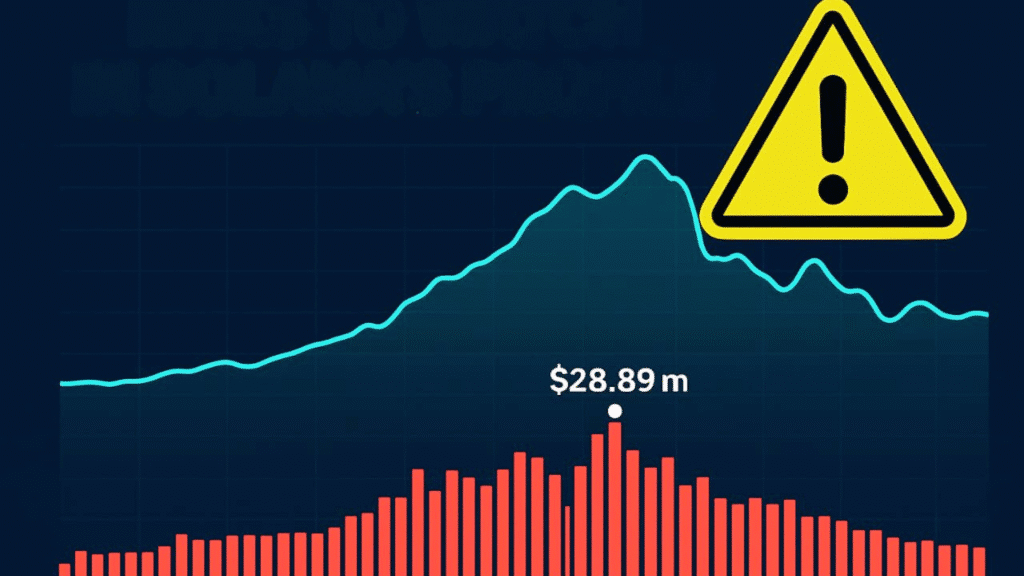

While Solana DeFi TVL near all-time high, daily chain fees stay around $1.6 million, the blockchain processes close to 65 million transactions every day.

This shows that transaction capacity is high, but fee revenue remains low. Messari’s Q2 report highlights that spot DEX volumes fell by 45% compared to the previous quarter.

At the same time, liquidity continued to grow. This means users trade efficiently on Solana, but validators and apps earn relatively low fees.

| Metrics | Key Value |

| Total Value Locked (TVL) | $11.7 billion |

| Daily Fees | Under $2 million |

| Daily Transactions | ~65 million |

| Daily DEX Volume | $4.6 billion (spot) |

| Daily Perpetuals Volume | $2.1 billion |

| Stablecoin Supply | ~$12 billion |

| Institutional Staking | $1.72 billion |

| Percentage of Total SOL Staked | 1.44% (institutional) |

| Peak Daily Fees | $28.89 million |

| Key Partnerships | Stripe, BlackRock |

| Network Upgrade | Alpenglow |

How are institutions shaping Solana’s growth?

Institutional staking is now a major growth factor. Corporations have staked $1.72 billion worth of $SOL, which is more than 1.44% of the total supply.

Partnerships with companies like Stripe and BlackRock strengthen Solana’s role as a bridge between traditional finance and DeFi. Analysts believe these capital inflows set up a lasting cycle of growth.

They explain that when institutions join, it builds credibility and attracts more developers and users. This cycle helps Solana gain more participants and investment over time.

Does high liquidity make Solana more resilient?

Yes. With Solana DeFi TVL near all-time high, liquidity providers enjoy tight spreads and minimal slippage. Large stablecoin balances help keep settlements smooth.

This works even when market conditions are volatile. CoinGlass data shows that perpetual markets are busy, but funding rates are stable.

This stability lowers the risk of forced liquidations. It also helps keep the market depth healthy for traders and investors.

Also read: Will Solana Hit $360 in 2025? All Eyes on $189 Breakout Zone

What are the risks to watch in Solana’s profile?

The main challenge is stagnant fees. Even though Solana DeFi TVL is near an all-time high, daily revenue is much lower than the $28.89 million peak earlier in 2025.

If most activity stays in low-cost transfers and efficient DEX routing, validators and apps may find it hard to earn more. However, if users start using higher-fee protocols, revenue could increase quickly.

Experts say upgrades like Alpenglow keep fees low while improving infrastructure. These changes may bring in more retail and institutional users.

Conclusion

Based on the latest research, Solana DeFi TVL near all-time high, shows that the blockchain handles liquidity well but earns low fees. Analysts note that increasing institutional participation is making the network stronger.

Strong stablecoin use also supports its ecosystem. High trading activity on DEXs suggests Solana is establishing a robust network base. For now, Solana attracts liquidity more than revenue.

If the fee system improves to match capital inflows, the gap between activity and earnings could shrink, making Solana DeFi TVL near all-time high more than just a number and marking a key moment in the network’s growth.

Summary

Solana’s DeFi now holds $11.7 billion in value, reflecting strong liquidity and investor confidence in the network. It also shows growing investor trust. Daily fees are still under $2 million, so the network earns less than expected. Companies staking $SOL and partnerships with firms like Stripe and BlackRock are helping Solana grow.

Transaction volume and DEX activity are high, but fees remain low. Experts say future upgrades and higher-fee activity could increase earnings, making Solana DeFi TVL near all-time high an important milestone.

Follow the latest Solana DeFi trends and price forecasts to stay alert on market shifts, only on our platform.

Glossary

Daily Fees: Revenue earned by Solana from user transactions.

DEX Volume: Trading activity happening on Solana’s decentralized exchanges.

Perpetuals: Derivative contracts traded on Solana without expiry dates.

Stablecoin Supply: A Pool of stable digital assets that provide liquidity on Solana.

Validator Earnings: Rewards earned by Solana validators for securing the network.

Alpenglow Upgrade: A Solana update designed to cut costs and boost performance.

FAQs For Solana DeFi TVL Near All-Time High

1. What is Solana’s current DeFi TVL?

It recorded around $11.7 billion.

2. Which big companies are linked with Solana?

Big companies include Stripe and BlackRock.

3. What is the main risk for Solana DeFi right now?

The main risk includes low fee revenue despite high liquidity.

4. What supports Solana’s market stability?

Strong stablecoin balances and healthy liquidity depth.

5. How much comes from perpetual trading?

Roughly $2.1 billion daily comes from perpetuals trading