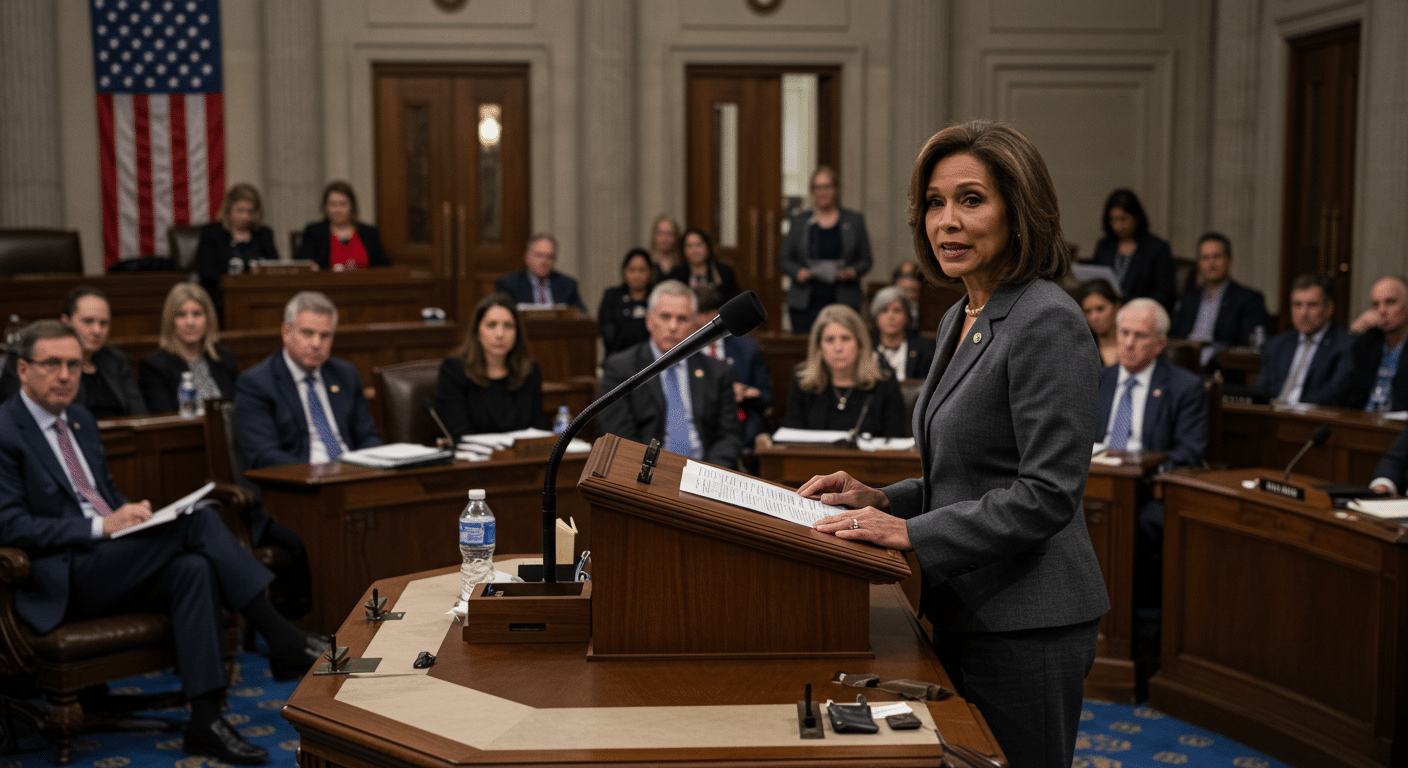

Senator Cynthia Lummis introduced a crypto-focused tax bill aimed at modernizing current digital asset regulations. The proposed legislation seeks to reduce tax burdens on everyday crypto use and staking activities. It marks a direct response to rising demands for clarity in how digital assets are taxed across the U.S.

Senator Cynthia Lummis Proposes New Crypto Tax Bill

Senator Cynthia Lummis submitted the standalone proposal just days after Congress passed a federal budget excluding any crypto provisions. Her bill includes a de minimis exception to taxation of crypto gains below $300 in a single transaction and a total of $5,000 per annum. It also defers taxation on mining and staking rewards until the subsequent sale of those assets.

The act does not tax crypto loans and crypto donations of digital assets, which is an indication that more lenient taxation will follow. Senator Cynthia Lummis emphasized practicality, stating, “We cannot allow our archaic tax policies to stifle American innovation.” Advocates of the same assert that it mimics the workings of digital assets in the real world.

This step is to be taken at the height of increasing frustration among digital asset users and developers who are subject to ambiguous taxation. Senator Cynthia Lummis has been vocal about the need to streamline digital asset taxation. Her new measure is meant to rid the sweeping interpretations in favor of specific regulatory language.

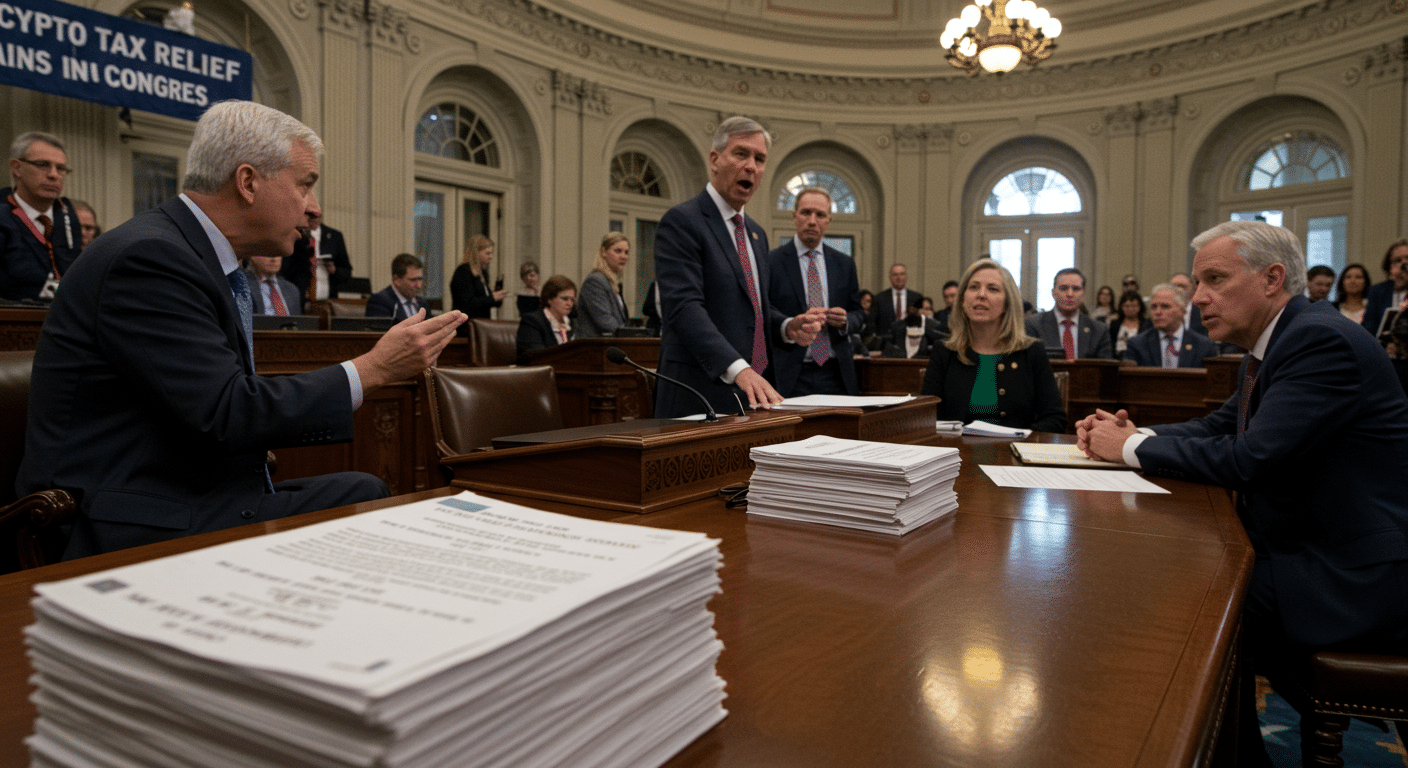

Crypto Tax Relief Gains Support in Congress

Crypto supporters have made it their mission to revile the U.S. tax code; a system that punishes everyday electronic transactions. In its current standard, the IRS is seeing the use of crypto to purchase small items, such as a cup of coffee, as a taxable occurrence. Such an approach has reduced mainstream adoption and has both baffled individual consumers and businesses.

With Senator Cynthia Lummis’ proposed $300-per-transaction exemption, users can finally conduct low-value crypto payments without tax penalties. The $5,000 per year limit further clarifies this, leaving some room to innovate and grow the economy. The proposal she presented concerns issues long held between the blockchain and fintech communities.

Legislative Timing and Crypto’s Regulatory Future

Senator Cynthia Lummis introduced the bill during a critical policy moment following the passage of a federal spending package without crypto measures. Lawmakers are reportedly considering last-minute digital asset additions before the budget reaches President Donald Trump. However, the standalone nature of this bill positions it as a strategic alternative.

The bill arrives shortly after the House voted to repeal IRS rules requiring crypto platforms, including decentralized finance (DeFi) entities to report detailed user data. That rule faced backlash from both the public and lawmakers who claimed it imposed excessive compliance costs. Senator Cynthia Lummis now presents her legislation as the most straightforward route to defining fair crypto taxation.

Texas Democrat Lloyd Doggett opposed that IRS repeal, warning of possible revenue losses and illegal financial activity. He argued that strong rules are necessary to prevent tax avoidance and protect national revenue. Yet Senator Cynthia Lummis believes practical and precise definitions will ensure compliance without blocking growth.

Summary

Senator Cynthia Lummis has introduced a new bill to clearly define crypto tax rules, offering key exemptions for micro-payments and validation rewards. The bill provides a $300 transaction exemption and defers taxation on mining and staking until assets are sold. It also excludes crypto lending and charitable donations from taxation. With crypto regulation in flux, the bill offers precise, actionable changes.

FAQs

What is Senator Cynthia Lummis proposing?

She is proposing a standalone bill to modernize tax rules for digital assets, including small transaction exemptions and deferred taxation on staking.

What is the de minimis exemption in the bill?

It allows crypto users to avoid paying taxes on transactions under $300, with a cap of $5,000 per year.

How are mining and staking rewards treated?

The bill defers taxes on these rewards until the assets are sold, rather than when they are earned.

Does the bill affect crypto donations?

Yes, it exempts charitable donations made in digital assets from taxation.

Why is this bill significant?

It provides legal clarity, supports innovation, and removes small, burdensome tax obligations that limit crypto adoption.

Glossary of Key Terms

De minimis exemption – A small amount of income or gain that is not subject to tax under specific thresholds.

Staking – The process of participating in a blockchain by locking up tokens to support network operations.

Mining – The act of validating blockchain transactions in exchange for newly created digital assets.

Digital assets – Cryptographic tokens or currencies that exist on blockchain platforms and are used for transactions or utility.

Decentralized Finance (DeFi) – Financial services built on blockchain technology that operate without central intermediaries.

References: