The U.S. Securities and Exchange Commission (SEC) has brought a broad enforcement action against crypto project Unicoin and three of its former top executives, alleging a scheme that raised over $100 million from more than 5,000 investors.

- Inflated Promises and Fabricated Numbers

- Aggressive Promotion, Misleading Messaging

- Legal Violations and SEC Enforcement Actions

- Legal Counsel Named in Complaint

- Unicoin CEO Responds: Denies Wrongdoing, Blames Regulators

- Conclusion: A Case That Could Change Crypto Enforcement

- FAQs

- What did Unicoin do according to the SEC?

- Who is charged in the case?

- How did Unicoin promote its offerings?

- How is this different from previous SEC crypto cases?

- What is the SEC seeking?

- Glossary

In a complaint filed yesterday, the SEC sues Unicoin, saying the company misled investors with fake sales numbers, misrepresented regulatory compliance, and false claims about asset backing that never materialized.

According to the SEC, Unicoin sold “rights certificates” and common stock under the promise of high returns and regulatory legitimacy. These offerings were marketed as safe and compliant next-gen crypto assets. But investigators say the whole thing was propped up by deliberate misstatements and an aggressive media blitz that reached from airport terminals to social media feeds.

“Unicoin told investors it had sold over $3 billion in certificates. In reality it was over $110 million,” the SEC said in the complaint. “The company falsely claimed these assets were backed by billions in real estate holdings.”

Inflated Promises and Fabricated Numbers

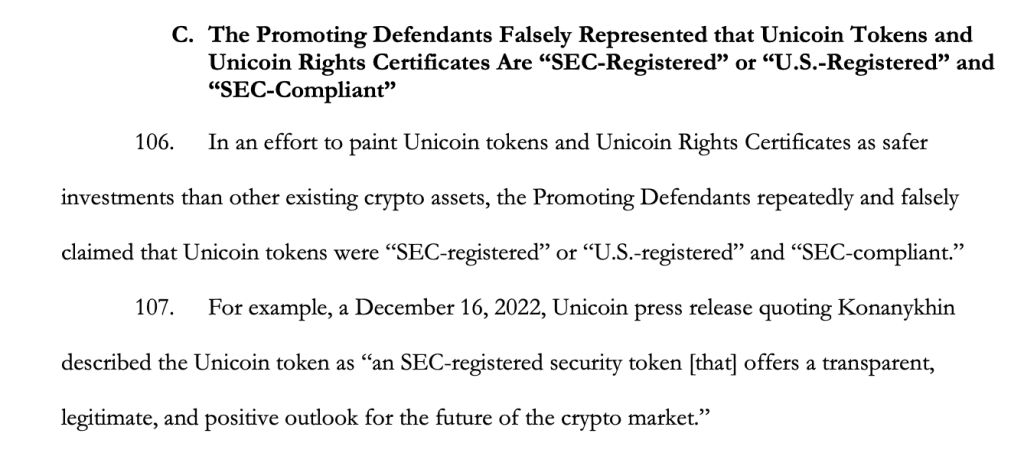

Reports dated February 2022 onwards claim Unicoin executives lied to the public about the value and regulatory status of their offerings. The main product – Unicoin’s so-called “asset-backed” rights certificates was marketed as a new standard in crypto investing. The project promised a token that would be backed by real-world assets, mainly real estate, worth billions.

However, the SEC says these asset valuations were grossly exaggerated. In reality the total value of the real estate holdings was a fraction of what was advertised. No documentation was ever provided to back up the claims of billions in assets. The complaint says Unicoin’s leadership knew about this discrepancy and continued to promote the illusion through multi-platform campaigns.

Alex Konanykhin, Unicoin’s CEO and chairman, was singled out for allegedly orchestrating much of the misdirection. Along with Silvina Moschini, former president and chairwoman of the board, and ex-Chief Investment Officer Alex Dominguez, Konanykhin is accused of making repeated false statements across marketing materials, investor pitches and online broadcasts.

The SEC complaint describes a “pattern of exaggeration” used to convince investors that Unicoin was not only compliant with US securities laws but was also offering a rare opportunity to invest in a token backed by tangible value. These tactics, the regulators say, were the backbone of the fraud.

Aggressive Promotion, Misleading Messaging

To keep the momentum and interest going, Unicoin launched a multi-platform promotional campaign. Ads were placed in airports, New York City taxis, TV channels, and social media feeds.

The message was the same: Unicoin rights certificates were a safe, next-gen asset class, already getting billions of investor interest and fully compliant with SEC regulations. But as the SEC now says, these were lies and material misrepresentations.

The promotional campaign generated over 5,000 investors who bought certificates under the impression that the offering was secure and regulated. The agency claims these buyers were misled into thinking they were participating in a new and compliant crypto project backed by real assets.

Legal Violations and SEC Enforcement Actions

The charges go beyond misrepresentation. The SEC sues Unicoin, alleging that they violated multiple federal securities laws including the unregistered sale of securities and offering fraudulent investments.

One of the more egregious allegations is that Konanykhin sold nearly 38 million of his personal certificates at discounted prices to investors who had previously been excluded to maintain the company’s registration exemption, a move that directly contradicts federal securities laws.

In its complaint, the SEC is seeking: permanent injunctions to prevent future violations, disgorgement of ill-gotten gains with interest, civil penalties and director-and-officer bars for all named individuals.

“Through this enforcement we are holding Unicoin and its executives accountable for deceiving the public and manipulating the crypto market,” the SEC said in its press release.

Legal Counsel Named in Complaint

Unicoin’s general counsel, Richard Devlin, has also been charged. The SEC alleges he negligently approved misleading statements in private placement materials sent to investors. Although he has not admitted to wrongdoing, Devlin has agreed to a final judgment that includes permanent injunctive relief and a $37,500 civil penalty.

Legal experts say that when general counsel participates in or fails to stop misleading activities, it raises questions about the company’s governance.

What sets the Unicoin case apart is the structure of the alleged fraud. Unlike previous high-profile SEC cases against Telegram and Kik, which focused on token registration violations, the Unicoin enforcement targets a hybrid scheme involving “rights certificates” marketed as asset-backed.

Unicoin CEO Responds: Denies Wrongdoing, Blames Regulators

In a statement to CoinDesk, Konanykhin denied the SEC’s allegations and called the investigation “destructive and unfair”. He said the probe had caused “multi-billion dollar damage” to the project and its investors.

Konanykhin also accused the SEC of refusing to settle despite Unicoin’s attempts to negotiate in good faith.

“We followed U.S. laws to the letter,” Konanykhin said. “The SEC is targeting us because we made the world pay attention to a new financial model.”

Conclusion: A Case That Could Change Crypto Enforcement

As the SEC sues Unicoin, it’s a sign of how regulators go after misconduct in the digital asset space. With billions of dollars at stake and thousands of investors affected, the case shows the growing consequences of mixing promotional hype with regulatory misrepresentation.

Whether the case settles or goes to trial, it will set new standards on what constitutes investor fraud in an industry still largely undefined. For now, Unicoin is a stark reminder that regulatory boundaries are still very much in place, no matter how cool the project may be.

FAQs

What did Unicoin do according to the SEC?

Unicoin raised over $100 million through fraudulent sales of rights certificates and common stock. The SEC sues Unicoin, saying the company inflated sales figures, misrepresented SEC registration, and said its tokens were backed by billions in real estate.

Who is charged in the case?

The SEC’s complaint names CEO Alex Konanykhin, former president Silvina Moschini, former CIO Alex Dominguez, and general counsel Richard Devlin.

How did Unicoin promote its offerings?

The company ran big promotional campaigns in airports, taxis, TV, and social media, saying its offerings were SEC-compliant and backed by real assets.

How is this different from previous SEC crypto cases?

Unlike previous cases involving unregistered token offerings, this case is about misleading sales of “rights certificates” presented as asset-backed investments.

What is the SEC seeking?

Permanent injunctions, civil penalties, return of funds with interest and bars from serving as an officer or director of any public company.

Glossary

SEC (Securities and Exchange Commission): The US federal agency that regulates securities and investors.

Rights Certificates: Financial instruments that give future rights, often to buy equity or other assets.

Disgorgement: The requirement to return profits made through illegal activity.

Injunctive Relief: A court order to stop doing something or to do something.

Real Estate Backing: Using property assets to make a financial product look good or valuable.