This article was first published on Deythere.

SEC crypto regulation takes a sharp turn as the United States adopts a more transparent structure for digital asset oversight. The update aims to reduce prolonged confusion and provide the market with a consistent rulebook for token classification.

According to the source, the shift follows long debates over the status of digital assets and the limits of the current legal system. The new move signals a fresh stage for projects, exchanges, and institutional traders.

SEC Sets New Ground Rules For Digital Assets

The SEC built the update around the long-standing Howey Test, which decides whether an asset functions as a security. The Commission kept the original standard but added limits that reflect decentralization and token maturity. This marks the first major reset of digital asset guidance in several years.

The SEC Chair outlined the change in recent remarks shared in an event transcript published by the Federal Reserve Bank of Philadelphia. The Chair said that markets grow when rules help participants understand the road ahead. The statement showed a move toward clarity rather than constant enforcement.

The update also introduces the token taxonomy framework, which helps classify assets as they shift from early development to decentralized systems. The SEC’s crypto regulation blueprint aligns with this structure to reduce uncertainty for exchanges and market participants.

Bitcoin Gains A Stronger Position

Bitcoin received direct support from the updated structure. The Commission repeated that Bitcoin operates as a decentralized digital commodity. This removes a long-standing risk for pension funds, asset managers, and other firms that require firm regulatory guidance.

A market note from a leading analytics group stated that clear rules can encourage steady capital flow. The report, shared in a research update referenced here, said that confidence grows when legal questions fade. This aligns with rising institutional demand across 2024 and 2025.

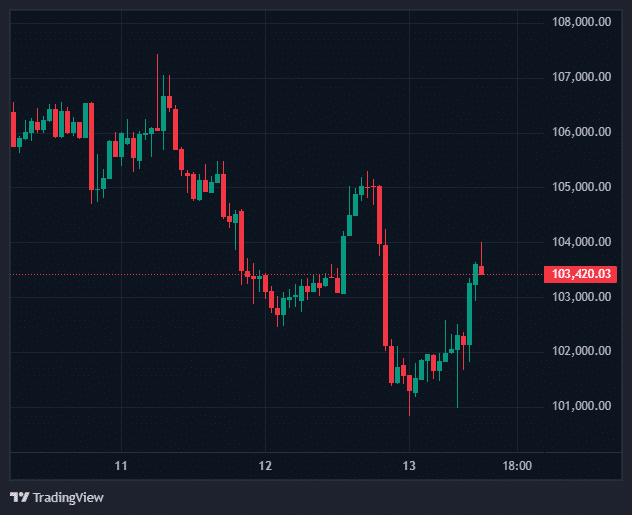

The current Bitcoin price is 103,420 dollars, down 1.5 percent over the past 24 hours and 1.9 percent over the past week.

Below is a quick price table for reference.

| Metric | Value |

|---|---|

| Bitcoin Price | 103,420 USD |

| 24H Change | 1.5 percent down |

| 7D Change | 1.9 percent down |

| Outlook | Steady rise if SEC crypto regulation improves clarity |

The token taxonomy framework connects directly with this classification. It gives a clear path for tokens that begin as securities but later reach decentralization. This helps investors understand where a project sits at any stage of its life cycle.

Impact Across The Wider Market

Market analysts expect a near-term adjustment of 10 to 20 percent as traders respond to more precise guidance. Some long-term projections place Bitcoin near 150,000 dollars by mid-2026 if other regulators adopt similar approaches. Updated SEC crypto regulation also supports smoother compliance planning for exchanges and custodians.

Supporters believe the token taxonomy framework will help limit disputes and allow digital assets to grow within a stable structure. The broader market may benefit as institutions evaluate risk with more confidence.

Conclusion

The SEC crypto regulation shift marks a critical moment for the digital asset sector in the United States. More explicit rules help users, developers, and institutions understand each stage of token evolution. With the token taxonomy framework in place, the market gains direction and a more stable foundation for long-term growth.

Glossary of Key Terms

- Howey Test: A legal method used to decide if an asset is a security.

- Digital Commodity: An asset treated as a tradable good.

- Token Taxonomy Framework: A structure for classifying tokens across different stages.

- Decentralization: A system without central authority.

FAQs About SEC Crypto Regulation

What changed in the SEC update?

The SEC introduced more explicit rules defining when a token constitutes a security or a commodity.

Does Bitcoin remain a commodity?

Yes. The update confirms Bitcoin’s status as a decentralized digital commodity.

How does the token taxonomy framework help?

It explains how assets shift from early development to decentralization.

Will institutions enter the market now?

More explicit rules can encourage larger firms to increase exposure.