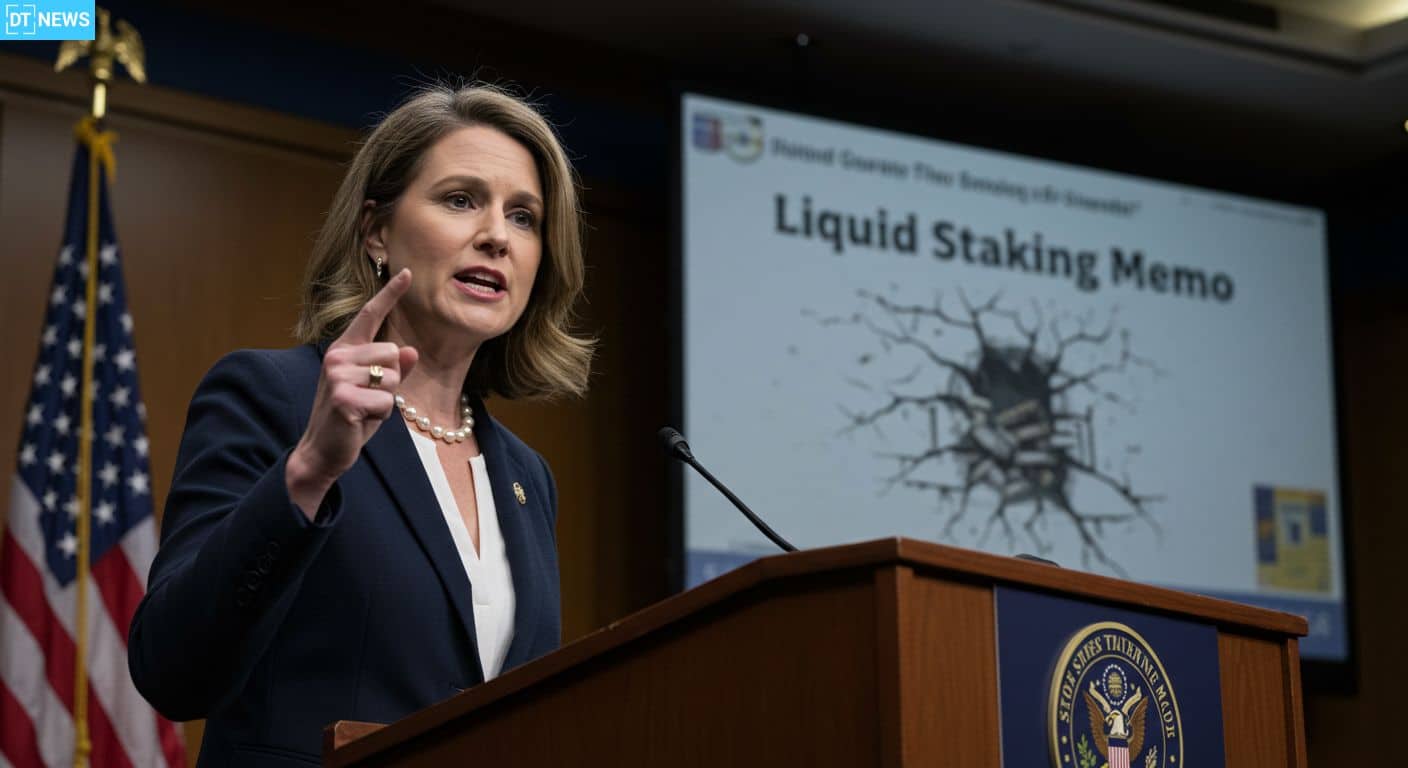

The SEC seems to be at odds with itself for the first time under its new crypto-friendly leadership. SEC Commissioner Crenshaw Caroline has issued a scathing rebuke to the Division of Corporation Finance’s liquid staking guidance, saying it’s not grounded in reality and shouldn’t be taken as official Commission policy.

- Crenshaw: A “House of Cards” Without Industry Foundation

- Staff Guidance vs Courts: Divergence with Precedent

- Atkins and “Project Crypto”: Framing Staff Guidance as Progress

- The Crypto Industry’s Problem

- Conclusion

- FAQs

- What is SEC Commissioner Crenshaw’s main criticism?

- What does the staff guidance say?

- Why does Atkins support the guidance?

- What did SEC Commissioner Crenshaw say could go wrong with poorly defined guidance?

- Glossary

Chairman Paul Atkins on the other hand, praised the guidance as a big step forward under his “Project Crypto” initiative.

Crenshaw: A “House of Cards” Without Industry Foundation

SEC Commissioner Crenshaw did not mince words. In her statement, she described the division’s liquid staking guidance as;

“The Liquid Staking Statement stacks factual assumption on top of factual assumption on top of factual assumption, resulting in a wobbly wall of facts without an anchor in industry reality.

She says it should give no comfort to liquid staking providers as it is just staff views and not Commission-backed.

“Given its unsupported factual assumptions and circumscribed legal analysis, the Liquid Staking Statement should provide little comfort to entities engaged in liquid staking; especially since, as the statement rightly notes, it only ‘represents the views of the staff of the Division of Corporation Finance,’ not the views of this or any future Commission.”

Staff Guidance vs Courts: Divergence with Precedent

In her May 29 dissent, SEC Commissioner Crenshaw already challenged staff’s assertion that “protocol staking” is not a security. She said it is directly contrary to previous enforcement actions and court findings that have deemed some staking programs to be investment contracts under the Howey test.

Her objection is that ignoring established legal frameworks creates more ambiguity, not clarity.

Atkins and “Project Crypto”: Framing Staff Guidance as Progress

Meanwhile, SEC Chairman Paul Atkins is framing the liquid staking guidance as progress under his leadership. He said it’s “a big step forward in clarifying the staff’s view about crypto asset activities that don’t fall within the SEC’s jurisdiction,” and that’s already delivering results through his Project Crypto initiative.

Project Crypto, launched in July, is to modernize U.S. securities rules for blockchain asset distribution, custody, and trading. Atkins has repeatedly said, “most crypto assets are not securities,” and is moving towards open frameworks and tailored exemptions.

The Crypto Industry’s Problem

Liquid staking is a multi-billion-dollar industry, allowing users to earn staking rewards while maintaining liquidity through derivative tokens like stETH or rETH. Clear guidance from regulators could lead to more innovation, like stakeholder-enabled ETFs.

However, SEC Commissioner Crenshaw says poorly grounded guidance could lead businesses to non-compliance based on assumptions that won’t hold up in real-world operations, especially when features like pooling, staking-as-a-service, or slashing protections are different from staff views.

Conclusion

Based on the latest research, SEC Commissioner Crenshaw shows the SEC’s internal struggle with crypto policy. While Chairman Atkins is moving forward with bold regulatory modernization, Crenshaw’s dissent stresses that clarity must be rooted in enforceable law, not aspirational policy.

Crenshaw warns stakeholders not to rely on a non-binding staff-level interpretation. As the SEC continues to push forward with crypto regulation, this exchange reveals the complexity of balancing innovation with real world legal grounding in the digital asset space.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

SEC Commissioner Caroline Crenshaw has ripped apart the new staff statement on liquid staking, calling it built on shaky ground and lacking legal basis. Her dissent contrasts with Chairman Paul Atkins’s praise for the statement as a regulatory milestone under Project Crypto.

FAQs

What is SEC Commissioner Crenshaw’s main criticism?

She argues that the liquid staking guidance is based on assumptions that don’t reflect real world and doesn’t align with existing legal precedent.

What does the staff guidance say?

That certain liquid staking arrangements don’t qualify as securities under specific conditions, trying to clarify compliance.

Why does Atkins support the guidance?

He sees it as a tangible step in regulatory modernization under Project Crypto, clarity on crypto jurisdiction.

What did SEC Commissioner Crenshaw say could go wrong with poorly defined guidance?

Firms may act outside the law and get enforcement if staff or courts interpret differently in the future.

Glossary

Project Crypto – SEC Chair Paul Atkins’s initiative to modernize digital asset regulation in the US.

Howey test – The legal test to determine if a transaction is a securities offering.

Protocol staking – Locking up crypto in a network to earn rewards, separate from liquid staking derivatives.

Staff statement – Guidance from the SEC staff, not Commission policy.