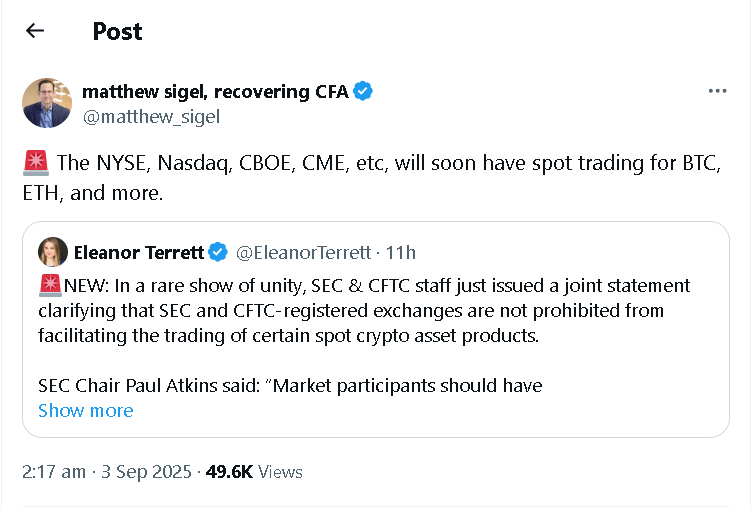

According to the Securities and Exchange Commission (SEC), the long-awaited US spot crypto trading approval has been explained in a joint statement with the Commodity Futures Trading Commission (CFTC).

The statement confirms that U.S.-registered exchanges can offer spot crypto products if they follow the rules. This is a big change from earlier confusion. It gives exchanges like NYSE, Nasdaq and CME a chance to grow into digital assets.

Why is the joint statement significant?

The joint statement is more than a regulatory clarification as it shows cooperation between two of the country’s most powerful financial watchdogs. The SEC and CFTC said that current laws allow their registered platforms to offer spot crypto services.

This is an important step for traders and institutions to use crypto in regular finance. It shows that U.S. markets are open to regulated crypto trading. This gives more clarity and confidence to investors and exchanges.

Analysts believe the US spot crypto trading approval is an important step for wider adoption. One market strategist said that for years, investors waited for regulators to clear this path, and now U.S. exchanges can compete equally with global platforms.

Also read: New CFTC Framework Aims to Launch Spot Crypto Trading in the U.S.

How does it impact U.S. exchanges?

The immediate effect is more confidence for national securities exchanges and designated contract markets. They now have clear guidance that they can list spot crypto products without breaking existing rules.

This allows major U.S. venues to start trading assets like $BTC and $ETH in a regulated environment. Industry experts say the US spot crypto trading approval will also help clearinghouses and custodians manage digital assets more clearly.

Institutional investors are expected to use these protections. This creates a safer and more organized environment for large-scale crypto trading.

| Metric | Value / Description |

| Date of Approval | September 2, 2025 |

| Regulators Involved | SEC and CFTC |

| Approved Activity | Spot crypto trading on registered US exchanges |

| Key Cryptocurrencies Approved | Bitcoin (BTC), Ethereum (ETH) |

| Registered Exchanges | NYSE, Nasdaq, CME, Cboe |

| Regulatory Focus | Margin, clearing, settlement, trade transparency, surveillance |

| Expected Outcomes | New ETFs, higher liquidity, wider adoption |

| Regulatory Initiatives | SEC’s Project Crypto, CFTC’s Crypto Sprint, PWG coordination |

| Investor Protections | Clear rules on trading, custody, clearing |

What role does transparency play?

Transparency and sharing of data are the main points of the new rules. Regulators said exchanges must watch markets carefully, share trade details, and keep prices fair. These actions protect investors and help keep the market steady.

CFTC Acting Chair Caroline Pham said the approval is only the start of creating a stronger framework. She added that aligning rules between the agencies will help make the U.S. a leading hub for blockchain innovation.

How are experts reacting?

Reactions from the financial sector have been mostly positive. Matthew Sigel of VanEck said that NYSE, Nasdaq, and CME are now ready to expand into crypto spot trading, which could improve liquidity.

Similarly, Nate Geraci said the US spot crypto trading approval could allow digital assets to reach every major brokerage, speeding up mainstream adoption. Journalists on X said this decision proves regulators want the U.S. to stay strong in the global crypto market.

Also read: How CFTC Restores U.S. Trader Access to Offshore Crypto Exchanges

What comes next for the U.S. market?

With regulatory uncertainty cleared, exchanges are likely to submit new proposals to list spot crypto products. The SEC and CFTC said their staff are ready to review these applications quickly.

This makes it possible to see spot crypto offerings on some of the largest trading venues in the world within months. The US spot crypto trading approval also creates pressure on Congress to finalize a complete crypto framework.

At the same time, the SEC and CFTC working together give a clear way forward. Experts think this teamwork can help investors trust the market again after years of uncertainty.

Conclusion

Based on the latest research, the US spot crypto trading approval marks an important turning point for digital assets in America. It brings clear rules and improves transparency.

It also opens doors for institutions that were previously limited. With the SEC and CFTC working together, exchanges, investors, and policymakers now have a clearer path to include crypto in the wider financial system.

Summary

The US spot crypto trading approval from the SEC and CFTC allows regulated exchanges to trade $BTC and $ETH safely. This move gives clear rules so investors and institutions can trade more easily.

It makes the market more transparent and keeps investors safe. More people can now use digital assets with confidence. Experts say it will help the U.S. compete in the global crypto market and make trading simpler and safer.

Stay updated on the latest crypto trading and ETF-focused news only on our platform.

Glossary

Spot Crypto Trading – Trade crypto and get it settled right away.

Registered Exchanges – Approved U.S. platforms like NYSE, Nasdaq, and CME.

Custodians – Trusted firms that keep crypto safe for investors.

Clearinghouses – Middlemen that finish trades and cut down risk

Transparency Rules – Exchanges must share data and keep prices fair.

FAQs for US Spot Crypto Trading

1. Who approved US spot crypto trading?

In a joint release, the SEC and CFTC granted approval.

2. Which cryptocurrencies are approved?

Bitcoin and Ethereum are included.

3. Which U.S. exchanges can offer spot crypto trading?

Major exchanges like NYSE, Nasdaq, and CME can offer it.

4. What protections do investors get?

There are clear rules for trading, safe holding, and smooth clearing of crypto.

5. Could this lead to crypto ETFs?

Yes, this step could bring new crypto ETFs in the future.