Top U.S. regulators are preparing for the first joint SEC and CFTC roundtable, bringing together government officials, crypto executives, and policy leaders.

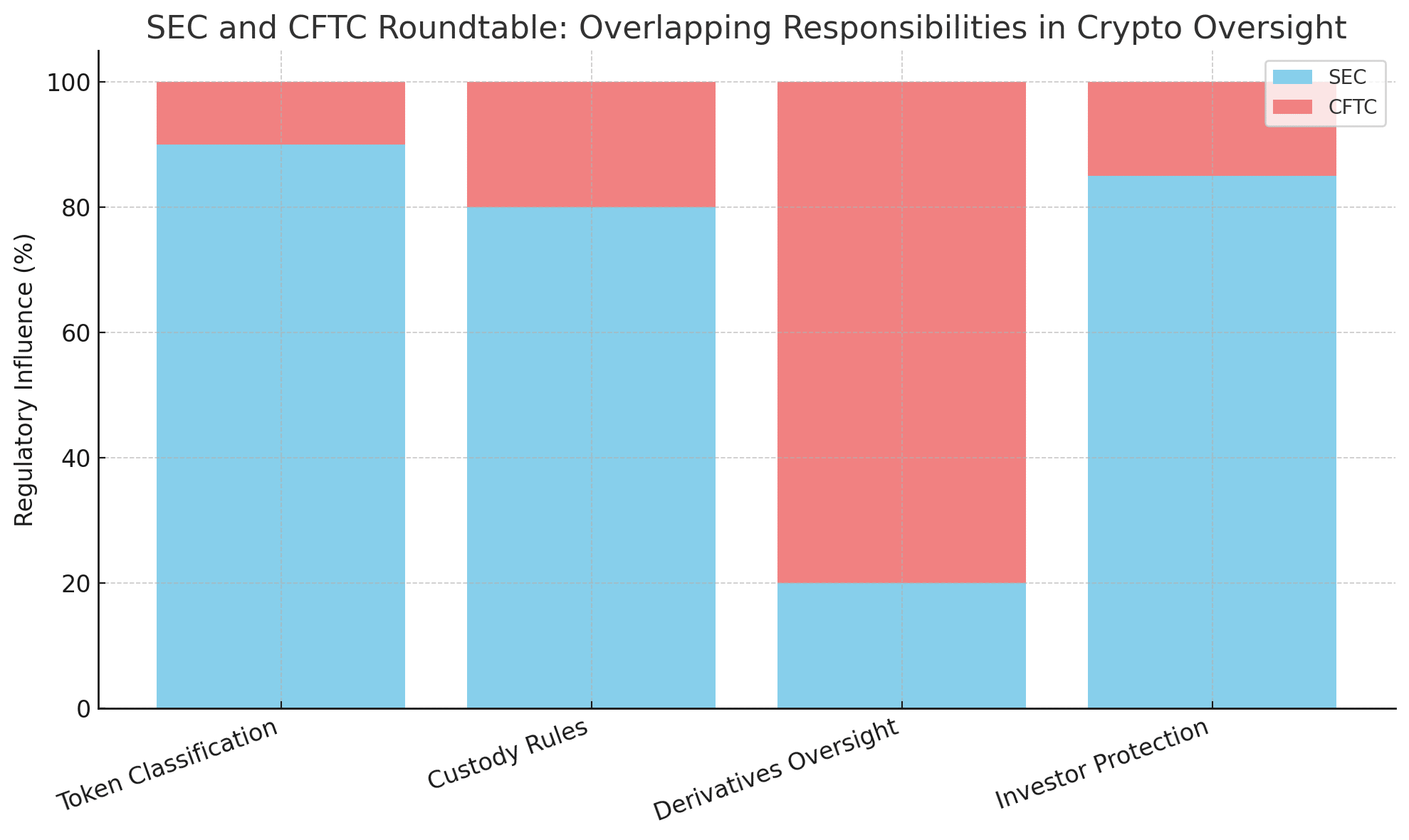

The meeting is designed to tackle the long-standing regulatory gray areas that have divided markets, especially the classification of tokens, custody standards, and derivatives oversight.

The crypto industry has long demanded clarity. With billions in institutional money flowing into the sector and retail traders navigating uncertain rules, the SEC and CFTC roundtable signals that Washington is finally listening.

Bridging the Divide Between Agencies

For years, the Securities and Exchange Commission and the Commodity Futures Trading Commission have shared an uneasy jurisdiction over crypto.

The SEC insists that many tokens are securities requiring disclosures and compliance, while the CFTC often views them as commodities suitable for futures and derivatives markets. This dual stance has left exchanges and investors in limbo.

The SEC and CFTC roundtable aims to bridge these divides. Officials plan to discuss clearer boundaries between commodities and securities, how custody rules should be enforced, and whether a framework can be drafted for tokenized derivatives.

The goal is harmonization, giving businesses a consistent set of rules to follow.

A prominent market strategist posted on X, “The SEC and CFTC roundtable is the moment the U.S. can finally provide clarity instead of contradictions.” This sentiment resonates throughout the industry, where firms have long sought certainty to attract global capital.

Industry Voices Join the Conversation

The upcoming SEC and CFTC roundtable will include executives from major exchanges, asset managers, and custodians. Their participation is not symbolic.

Leaders will present challenges faced by their platforms, such as fragmented compliance burdens, unclear listing rules, and the ongoing debate over self-custody rights.

Some industry executives view the roundtable as a rare chance to shape the rules before they are finalized. A U.S. exchange CEO commented, “This is a pivotal time. The SEC and CFTC roundtable lets us explain real-world challenges regulators might overlook.”

The presence of industry insiders ensures that dialogue moves beyond theory into practical solutions.

Global Ripple Effects

The U.S. is not alone in redefining digital finance. Across the Atlantic, the U.K. recently announced a joint task force with American regulators to harmonize rules for capital markets and digital assets.

The European Union’s MiCA framework already sets a precedent, and Singapore’s licensing regime has drawn international praise.

By hosting a high-profile SEC and CFTC roundtable, the U.S. is signaling that it does not intend to fall behind. The discussions will not only shape domestic policy but also influence global standards.

International investors are closely monitoring outcomes, as American clarity often sets the tone for worldwide regulation.

What This Means for Investors

For retail traders, the SEC and CFTC roundtable could result in stronger protections, including clear disclosure requirements and better custody safeguards. For institutions, harmonized rules could unlock larger inflows, as compliance risk declines and confidence grows.

If the roundtable achieves consensus, it could be the first step toward legislation that clarifies the definition of digital assets, thereby creating a more predictable environment.

While the market should not expect overnight changes, this initiative could mark the end of regulatory fragmentation that has hindered adoption.

Conclusion

The SEC and CFTC roundtable represents more than a bureaucratic meeting. It is a critical milestone in the evolution of crypto oversight.

By bringing regulators and industry leaders together, it has the potential to unify fractured rules, boost investor confidence, and align U.S. policy with global peers.

As the digital asset space matures, moments like this shape the path forward. The outcome of the SEC and CFTC roundtable will not only determine the future of American crypto markets but could also redefine the global financial order.

FAQs about SEC and CFTC Roundtable

Q1: What is the SEC and CFTC roundtable?

It is a joint meeting between the two top U.S. regulators and industry leaders to discuss crypto oversight and harmonization.

Q2: Why is this roundtable significant?

It could end years of conflicting rules and provide clear guidelines on token classification, custody, and derivatives.

Q3: Who will participate in the roundtable?

Regulators, crypto exchange leaders, asset managers, and policy experts are expected to attend.

Q4: How might it impact investors?

It may bring stronger consumer protections and attract more institutional capital into digital assets.

Glossary

SEC (Securities and Exchange Commission): U.S. agency overseeing securities and protecting investors.

CFTC (Commodity Futures Trading Commission): U.S. agency regulating futures, derivatives, and commodities markets.

Custody: The safekeeping of digital assets, often requiring compliance with strict financial standards.

Derivatives: Financial contracts like futures or options tied to the value of an asset.

Token Classification: The process of deciding whether a crypto token is a security, commodity, or other financial instrument.

MiCA (Markets in Crypto-Assets): The European Union’s regulatory framework for digital assets.