This article was first published on Deythere.

- Clash of Perspectives: Schiff vs. Saylor

- Strategy’s Position: Holdings and Market Pressure

- Community Reaction and More Debate

- Conclusion

- Glossary

- Frequently Asked Questions About Strategy Bitcoin Controversy

- What is the Strategy Bitcoin controversy?

- How much Bitcoin does Strategy own?

- Why are critics concerned?

- What is Michael Saylor’s stance?

- Is Strategy looking to sell Bitcoin?

- References

A tense argument has resurfaced in the crypto space between two familiar characters: gold advocatePeter Schiff and Bitcoin supporter Michael Saylor. Their clash is over the large Bitcoin position that Saylor’s company, Strategy, has accumulated.

With Bitcoin falling near the company’s average purchase price of around $76,000 per coin, critics, including Schiff, have speculated that Strategy Bitcoin approach has not delivered on the hype around it.

Saylor’s supporters counter that the controversy overlooks macro trends and the long-term nature of the plan.

Clash of Perspectives: Schiff vs. Saylor

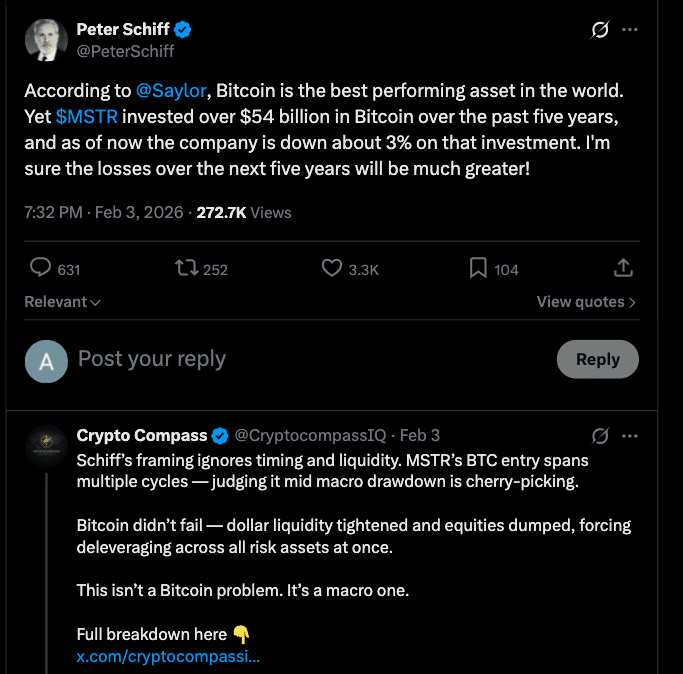

The latest spat between Schiff and Saylor began after Schiff questioned Strategy’s performance when Bitcoin was trading at around the average price the company paid for it. Strategy has invested around $54bn to acquire its BTC, making it the world’s largest corporate Bitcoin holder.

Schiff further contended that a corporation that hasn’t made notable profits despite the large sum poured in, doesn’t just reflect badly on Saylor’s approach but also Bitcoin itself as an asset class.

“I’m sure the losses over the next five years will be much greater!” Schiff was quoted as saying, noting that he believed the approach was practically certain to produce more losses over time.

Schiff’s criticism is not so surprising, as he has been a long-time proponent of gold and vocal critic of Bitcoin. He also hinted that Strategy’s slower buying pace relative to previous years may have had something to do with Bitcoin’s stall.

Writing on social media he said:

“Strategy’s Bitcoin purchases are one of the main reasons Bitcoin’s price rose 550%. But now that Strategy can’t keep buying as much, the price is falling.”

Saylor’s advocates, contend that Schiff’s analysis fails to consider several important factors. “MSTR’s BTC entry spans multiple cycles, judging it mid macro drawdown is cherry-picking,” one user noted, implying that Bitcoin’s price was at the mercy of a variety of factors including volatile markets and tightening liquidity that were proving to be too much for its ascent rather than inherent flaws in the strategy.

Amid the back-and-forth, Schiff also doubled down on remarks that Bitcoin has not been around long enough for anyone to say with any degree of certainty whether or not it is a store of value: “Bitcoin doesn’t have a long enough history to make that conclusion.”

Strategy’s Position: Holdings and Market Pressure

Despite the debate, Strategy Bitcoin accumulation has continued into 2026. SEC disclosures and Saylor’s updates show that the company increased its BTC holdings, acquiring additional units even as prices fluctuate.

In the beginning of February, it was reported that Strategy has bought another 855 BTC at an average price of around $87,974, and raised total holdings to 713,502 BTC worth about $50 billion based on current prices. This acquisition was financed through at-the-market sales of MSTR Class A common stock, in line with the company’s existing program to generate funds for BTC buys.

However, Bitcoin’s plunge below $75,000 has knocked the value of the company’s Bitcoin holdings into an unrealized loss for the first time since 2023. The unrealized loss on Strategy’s Bitcoin holdings is now over $900 million, according to Lookonchain data.

Strategy’s stock, traded as MSTR on NASDAQ, has long tracked Bitcoin performance closely. Its shares have fallen behind as Bitcoin has tumbled, adding to concerns from investors.

Recent trading has driven MSTR stock down as its Bitcoin holdings slipped into the red, essentially showing how the company’s financials now move with Bitcoin prices.

Community Reaction and More Debate

Advocates of Saylor Bitcoin strategy say those current unrealized losses are part of the long game and should not be interpreted as a strategic failure.

They stress that BTC purchases were made over various market cycles. Bitcoin supporters also note that Strategy has not dumped any of its Bitcoin holdings in the face of market pressure, owing to faith in the asset’s long-term prospects.

Other observers argue that such disagreements are simply a symptom of larger ideological divides within crypto and finance. Schiff is skeptical that digital assets can hold value, and he prefers traditional safe havens such as gold. Saylor, however, sees Bitcoin as a hedge against inflation and currency debasement, a position he has taken for years.

Some claim that the large Strategy Bitcoin buying in prior years contributed to price momentum and may be dampening upward buying pressure now.

Schiff’s argument aligns with this view, and speculates that a lack of buying could be tied to lower Bitcoin prices.

This isn’t the first time, as in the past, too, Schiff had condemned Strategy’s approach of being unsustainable and predicted bankruptcy.

“Regardless of what happens to Bitcoin, I believe $MSTR will eventually go bankrupt. Let’s go!”

Even with the unrealized losses on its Bitcoin stash, Strategy maintains its acquisition program and capital raises. The company’s continued reliance on equity offerings to fund Bitcoin acquisitions is at the top of its plan.

Conclusion

The Strategy Bitcoin controversy is about sharply contrasting views of corporate involvement in Bitcoin and its risks.

Peter Schiff’s harsh criticism spells it out that he sees a fundamental and unsustainable flaw in Strategy’s plan, while Michael Saylor and many in the crypto space stand firmly behind the long-term plan of acquiring as much Bitcoin as possible.

Though Strategy briefly fell into unrealized losses, it has held course with its position, accumulating more of the asset and enduring market cycles.

Glossary

Strategy ( formerly known as MicroStrategy): corporate Bitcoin treasury firm run by Michael Saylor and currently the world’s largest corporate BTC holder.

Unrealized loss: the theoretical loss on an asset that has fallen below its purchase price but has not been sold.

Average purchase price: this means weighted cost per capital, and it represents the “average” purchase price based on cumulative acquisitions over time.

MSTR is the symbol for Class A common stock of Strategy on NASDAQ, and it occasionally trades in line with Bitcoin performance.

Frequently Asked Questions About Strategy Bitcoin Controversy

What is the Strategy Bitcoin controversy?

This involves criticism from gold proponent Peter Schiff about the large Strategy Bitcoin holdings under Michael Saylor, particularly as the company’s unrealized losses continue to grow as Bitcoin trades near key cost levels.

How much Bitcoin does Strategy own?

As of February 2026, Strategy’s total BTC holdings exceeds approximately 713,500 BTC funded mainly via equity issuance and at market share sales.

Why are critics concerned?

Critics say Strategy’s flat returns and unrealized losses tell that Bitcoin as an asset is no safer, just more complicated, and exposes the company to financial risk through the end of the year if prices remain weak.

What is Michael Saylor’s stance?

Saylor has continued to push for the accumulation of Bitcoin over the long term.

Is Strategy looking to sell Bitcoin?

There is no indication that Strategy will sell any Bitcoin, the company has been financing its purchases with issuance of MSTR shares so far.