This article was first published on Deythere.

- How does Robert Kiyosaki’s early warning connect to the current Bitcoin crash outlook?

- Why does Robert Kiyosaki see opportunity in the Bitcoin crash?

- How does current market data align with the Robert Kiyosaki Bitcoin crash outlook?

- Are macro signals reinforcing the Robert Kiyosaki Bitcoin crash warning?

- How low could Bitcoin fall under the Robert Kiyosaki Bitcoin crash scenario?

- Conclusion

- Frequently Asked Questions About Robert Kiyosaki Bitcoin Crash

Robert Kiyosaki’s Bitcoin crash returned to focus this week after the Rich Dad Poor Dad author again shared his view that a major market downturn is no longer a distant possibility but an emerging reality. In a message posted on X, he addressed investors directly and pointed to the sharp swings seen across stocks and digital assets.

He linked this volatility to deeper weaknesses in the financial system that he has been warning about for more than a decade. Kiyosaki added that periods of panic in the market often highlight both serious risks and meaningful opportunities at the same time.

How does Robert Kiyosaki’s early warning connect to the current Bitcoin crash outlook?

The Robert Kiyosaki Bitcoin crash view is rooted in warnings he shared as far back as 2013, when he cautioned that the global financial system was heading toward an unprecedented stock market collapse. Robert Kiyosaki said the conditions he outlined at that time are now becoming visible in today’s markets.

In Rich Dad’s Prophecy published 2013 I warned of the biggest stock market crash in history still coming. That giant crash is now imminent.

Robert Kiyosaki

He explained that investors who prepared in advance may be positioned to benefit, while those who overlooked deeper financial risks could face serious pressure during the downturn.

Why does Robert Kiyosaki see opportunity in the Bitcoin crash?

For Kiyosaki, the Bitcoin crash narrative is not a reason to leave the market, but a way to measure discipline and long-term belief. He has explained that his money is placed in assets he considers real and limited in supply, including physical gold, silver, Ethereum, and Bitcoin, while he stays away from leveraged or artificial products.

He said he remains strongly confident in Bitcoin and continues buying more as the price falls, because the total supply will never exceed 21 million coins and most of that supply is already in circulation. He also stressed that when fear drives investors to sell, it often allows others to buy scarce assets at much lower prices.

How does current market data align with the Robert Kiyosaki Bitcoin crash outlook?

The Robert Kiyosaki Bitcoin crash discussion is unfolding during a period of active movement across the crypto market. Bitcoin is trading at $68,380.91, showing a 0.02% gain over the past 24 hours. Despite the slight uptick, broader momentum remains weak.

The Relative Strength Index (14) stood at 36, signaling a neutral trend rather than strong buying pressure. For February, the asset has already declined by 13.98%, placing Bitcoin at risk of recording a fifth straight monthly loss if the current trend holds, a streak not seen since June 2018.

Ethereum is priced at $1,980.38, posting a 0.87% gain in the last 24 hours. Among other major tokens, XRP is 0.9% up, BNB rose 1.94%, and Solana gained 1.87%. While select assets showed modest strength, overall market conditions remained fragile.

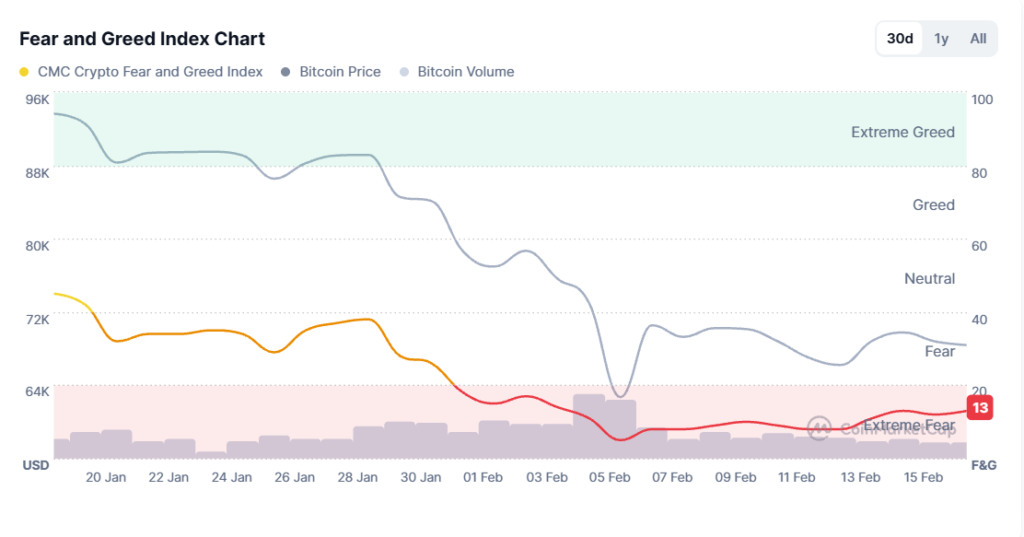

Total cryptocurrency market value edged lower by 0.16% to $2.35 trillion, while 24 hour trading volume dropped sharply by nearly 18% to $83.53 billion. Investor sentiment continues to reflect caution, with the Fear and Greed Index falling to 13, indicating extreme fear.

Meanwhile, the Altcoin Season Index remained low at 31, pointing to a Bitcoin dominant market as traders pull back from higher risk assets. Market structure data further shows capital concentrating in Bitcoin.

Bitcoin dominance has climbed to 58.2%, up 0.73%, signaling increased investor preference for BTC during uncertainty. Ethereum accounts for 10.2% of total market share, while other altcoins collectively make up the remaining 31.6%.

Are macro signals reinforcing the Robert Kiyosaki Bitcoin crash warning?

Wider market signals are adding a cautious tone to the Robert Kiyosaki Bitcoin crash discussion. Bloomberg Intelligence macro strategist Mike McGlone warned that ongoing losses in digital assets could be an early sign of deeper economic pressure building across markets.

He explained that falling prices in Bitcoin and other cryptocurrencies may point toward a possible recession and suggested that the long-running habit of buying every dip since 2008 may no longer work in the current environment.

McGlone highlighted several risk factors supporting this view. U.S. stock market value compared to GDP has reached levels not seen in roughly a century, while long-term volatility in the S&P 500 and Nasdaq 100 has dropped to its lowest point in about eight years.

He also said the crypto bubble appears to be breaking down, while gold and silver are delivering strong performance at a pace last observed around 50 years ago. In addition, he linked the fading impact of Trump-driven market optimism to growing spillover risks across global financial markets.

How low could Bitcoin fall under the Robert Kiyosaki Bitcoin crash scenario?

McGlone’s analysis offers a more restrained counterpoint to the Robert Kiyosaki Bitcoin crash outlook. Using a chart based on Feb. 13 market data, he compared Bitcoin, adjusted by dividing its value by ten, with the S&P 500 and showed both positioned below the 7,000 mark at that time.

He highlighted 5,600 on the S&P 500 as a level that could represent a typical market pullback, which would translate to roughly $56,000 for Bitcoin. He added that continued weakness in U.S. equities could place further pressure on Bitcoin. In a wider recession scenario, his assessment allows for the possibility that Bitcoin could decline significantly beyond that point, potentially moving toward $10,000.

Conclusion

Robert Kiyosaki Bitcoin crash captures a market phase shaped by rising fear, underlying imbalances, and different views on risk. Kiyosaki treats market declines as times when preparation can pay off, while broader economic signals point to high valuations and unusually low volatility as warning signs.

Together, these views suggest the market is not moving in one clear direction but going through a period of adjustment. As investors weigh scarcity-based confidence against macro-level caution, the data shows that volatility is changing expectations, making discipline more important than optimism in the months ahead.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency markets are highly volatile, and readers should conduct their own research or consult a qualified financial advisor before making any investment decisions.

Glossary

Buy the Dip: Purchasing an asset after a price drop expecting it to rise again.

Bitcoin Dominance: The share of total crypto market value held by Bitcoin.

Fear and Greed Index: A tool that measures whether investors feel fear or greed.

Limited Supply: A fixed total amount of an asset that cannot be expanded.

Recession: A period when the economy slows down and financial pressure increases.

Frequently Asked Questions About Robert Kiyosaki Bitcoin Crash

What is Robert Kiyosaki warning about?

The author of Rich Dad Poor Dad warns that a historic stock market crash may happen soon.

Why is Bitcoin part of his warning?

Robert Kiyosaki believes Bitcoin can protect wealth during a financial crisis.

Why does Kiyosaki see opportunity in a crash?

He believes market crashes allow investors to buy strong assets at lower prices.

What assets is Kiyosaki buying now?

He says he is buying Bitcoin, Ethereum, gold, and silver.

What is the $10K Bitcoin risk about?

Bloomberg strategist Mike McGlone warned that Bitcoin could fall toward $10,000 if markets weaken.