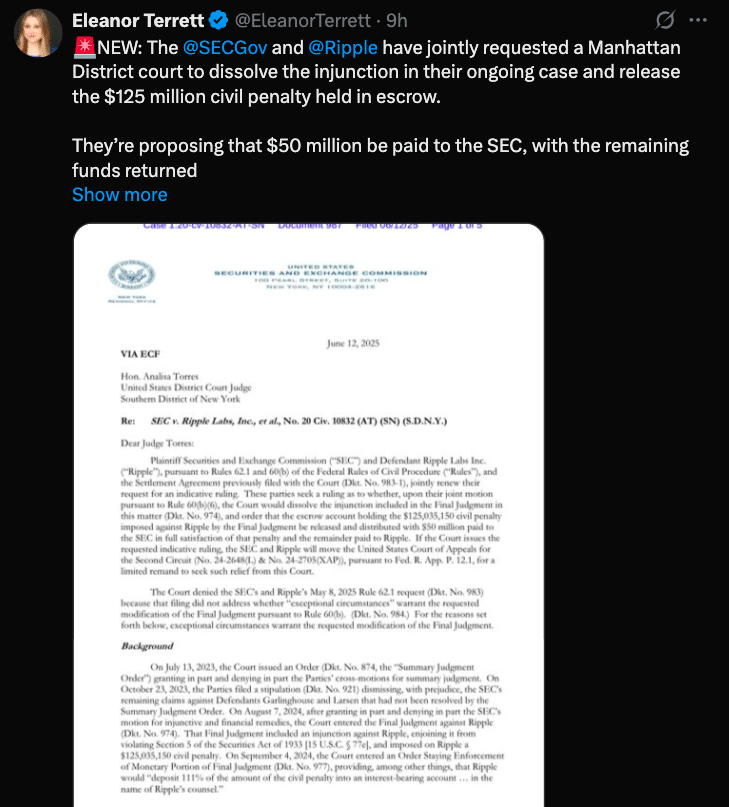

According to the latest reports on the Ripple SEC XRP Settlement case, both parties have filed a joint motion to dissolve the injunction and release $125 million held in escrow. Filed in the Southern District of New York on Thursday, the joint motion asks US District Judge Analisa Torres to lift the injunction on institutional XRP sales, transactions previously ruled by the court as securities violations.

- From Regulatory Flashpoint to Resolution Attempt

- New Administration, New Regulatory Winds

- Market and Industry Reaction: XRP Down 5.2%, Sentiment Mixed

- Conclusion: Judge Torres’ Role and What’s Next

- FAQs

- What is the Ripple SEC XRP settlement about?

- Is XRP still a security?

- What happens to the $125 million in escrow?

- Has the settlement been approved by the court?

- Why is the SEC backing off now?

- Glossary

Ripple would pay $50 million to the SEC and the rest of the escrowed funds would go back to the company. This comes after months of stalled appeals and backchannel talks and as the SEC is recalibrating its approach to crypto enforcement following the recent US presidential transition.

The Ripple SEC XRP settlement is now pending judicial approval but is hopefully the final step in a legal battle that started nearly 4 years ago.

From Regulatory Flashpoint to Resolution Attempt

The SEC lawsuit was filed in December 2020 and accused Ripple of raising $1.3 billion through XRP sales without registering the token as a security. Ripple denied the charge and fought back, calling the case regulatory overreach and a threat to innovation.

In 2023, Ripple won a partial victory when Judge Torres ruled that XRP’s programmatic sales on public exchanges were not securities offerings. But institutional sales to sophisticated investors were deemed to be securities violations. That split ruling set the grounds for the reduced penalty and motion.

The SEC originally sought up to $2 billion in penalties. But under new leadership, the agency has agreed to the current terms: $50 million fine and dismissal of appeals. Ripple views the escrow release as both financial and symbolic win but had no comment beyond pointing to court filings.

The proposed Ripple SEC XRP settlement would release the remaining $75 million back to Ripple and end the escrow obligations tied to the contested sales.

New Administration, New Regulatory Winds

Under the Trump administration, federal agencies, including the SEC, have dropped several high-profile crypto enforcement cases started under the Biden administration. Former SEC Chair Gary Gensler’s crypto litigation push had been criticized from within and outside the government.

According to reports, Commissioner Caroline Crenshaw dissented last month, saying the agency’s new approach would “encourage bad behavior” and leave retail investors unprotected. So far, there has been more settlements, Ripple being the latest.

Ripple SEC XRP settlement shows SEC is moving towards resolving long standing crypto cases rather than dragging them out in court. While Ripple still had institutional violations, the reduced fine is a sign of de-escalation within the agency.

Market and Industry Reaction: XRP Down 5.2%, Sentiment Mixed

Just after the release of the joint motion on Thursday, XRP was at $2.13, down 5.2% according to CoinGecko. However, XRP is currently trading at $2.10 as at the time of this publication. Short term market reaction was muted but analysts see the settlement as removing a major source of legal uncertainty for XRP and the overall crypto space.

“There’s still damage to repair in terms of market trust but the end of this litigation is a net positive,” said crypto attorney Preston Byrne. “The Ripple SEC XRP settlement gives both sides closure and a chance to regroup. More importantly it shows the SEC is open to compromise.”

Legal critics argue that the mixed messages from regulators: litigation and settlement, creates more ambiguity rather than less. They say the lack of clear statutory guidance leaves the door open for similar lawsuits in the future.

But for Ripple and its leadership, the deal if approved would be a reputational turn around. The company’s long standing position that XRP is not a security may not have been fully vindicated but avoiding the full weight of SEC enforcement will help its standing with global partners and institutional clients.

Conclusion: Judge Torres’ Role and What’s Next

Now, all eyes are on Judge Torres who has been the judge in this case since 2020. While her earlier decision gave partial relief to Ripple, she previously declined to rule on the settlement due to procedural constraints related to the appeals process. With both sides now filing to suspend those appeals, she may now be able to give proper go-ahead for the deal.

The court’s decision is expected in weeks and could be the end of one of the biggest enforcement actions in crypto history. Ripple which has continued to expand overseas and build partnerships despite the lawsuit may now be in position for a rebound in key markets such as Asia and Middle East.

The Ripple SEC XRP settlement is a glimpse into the future of US crypto regulation. With institutional sales violations acknowledged and penalties paid, Ripple may soon be free of the regulatory cloud that has hung over it for nearly 5 years.

FAQs

What is the Ripple SEC XRP settlement about?

The proposed resolution of the SEC’s lawsuit against Ripple over alleged unregistered XRP sales, including a $50 million fine and return of $75 million to Ripple.

Is XRP still a security?

Judge Torres ruled that XRP sales on public exchanges are not securities, but institutional sales were securities.

What happens to the $125 million in escrow?

$50 million goes to the SEC and $75 million goes back to Ripple.

Has the settlement been approved by the court?

Not yet. The proposal is pending Judge Analisa Torres in the Southern District of New York.

Why is the SEC backing off now?

The new SEC leadership under President Trump is prioritizing settlements over lawsuits, a change in tone.

Glossary

XRP: The native cryptocurrency of the XRP Ledger, for cross border payments and enterprise liquidity solutions.

SEC (Securities and Exchange Commission): The US regulatory body that oversees securities markets and enforces federal securities laws.

Escrow: A financial arrangement where a third party holds funds until certain legal or regulatory conditions are met.

Institutional Sales: Sales of digital assets to sophisticated investors or entities, often treated differently than public retail sales in legal contexts.

Indicative Ruling: A preliminary judicial opinion meant to guide settlement discussions, not binding.