Despite all the speculation around the Ripple SEC case, experts have revealed that there’s no delay from the regulators or the court. According to Marc Fagel, a former SEC enforcement attorney, what the crypto community sees as stalling is just the process. With XRP now pushing towards $3.00 and Crypto Week 2025 underway, timing, perception and procedure are colliding in ways that could turn XRP’s regulatory future and its price.

No Delay, Just Due Process

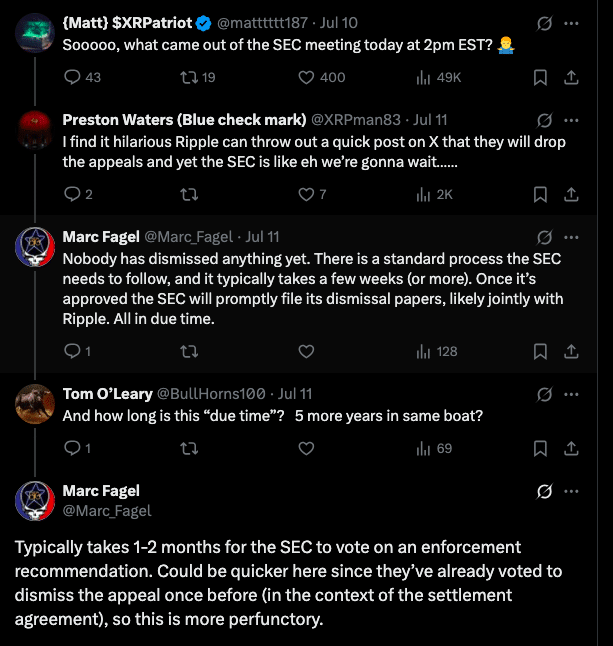

Marc Fagel’s recent tweet struck a chord across crypto Twitter. Addressing the growing concern that the U.S. Securities and Exchange Commission (SEC) is dragging its feet in the long-running case against Ripple, Fagel said there’s no foul play involved. The holdup is procedural.

Ripple and the SEC agreed to drop the remaining issues, mostly institutional sales. The commission is now going through a mandatory internal voting process to formally approve the dismissal. According to Fagel, this is a “standard step that takes one to two months”, not a stalling tactic. The SEC must authorize enforcement staff to file dismissal papers jointly with Ripple before the case can be officially closed in court.

Fagel also addressed the speculation around SEC closed door meetings, like the one on July 10.

“Anyone claiming the Ripple case is on the agenda is just making it up” he posted, saying such meetings are regular administrative events.

XRP Surges as Legal Clouds Clear

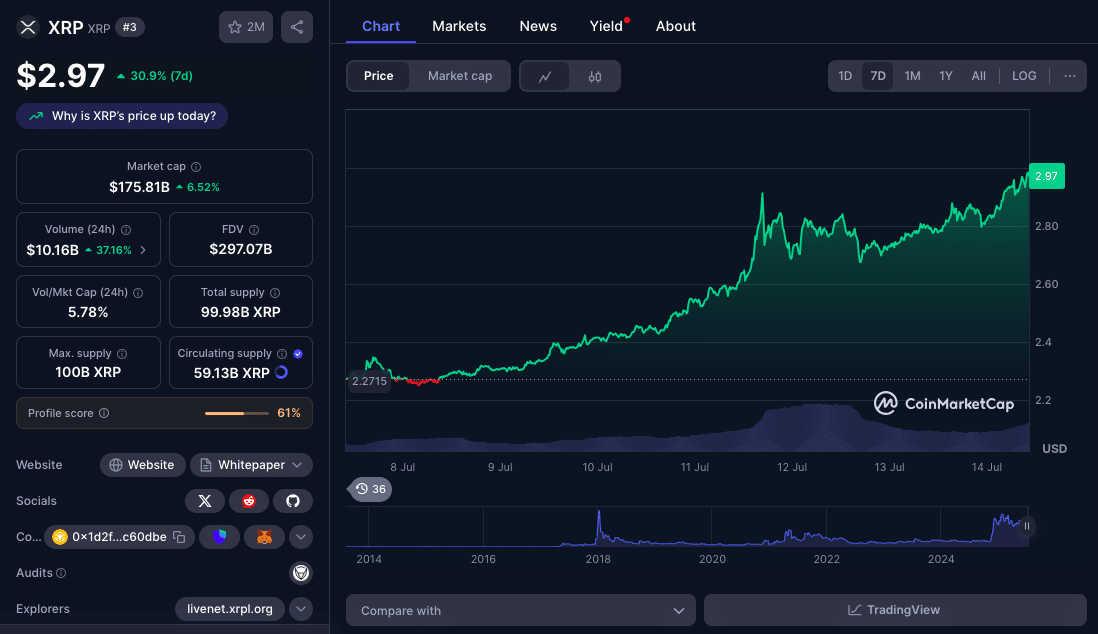

While the legal formalities play out, XRP has been anything but stagnant in the markets. Over the last 19 days XRP has surged 50%. At the time of this writing, XRP trades at $2.97, testing the resistance levels last seen during the 2021 rally.

A break above the psychological $3.00 could send the asset to its all-time high of $3.84, last seen in January 2018. Analysts attribute the surge to improving investor sentiment around Ripple’s regulatory clarity and renewed interest across the broader crypto market which recently reclaimed a market cap of over $3.7 trillion.

Why Timing Matters: Crypto Week 2025 and Pending Regulation

Based on available data, the legal resolution is also coinciding with an important moment in the U.S. legislative calendar. Crypto Week 2025 is happening from July 14 to 17 and will focus on three major bills that could change the face of digital asset regulation

These are: CLARITY Act to Categorizes crypto assets as securities or commodities; GENIUS Act which is A regulatory framework for stablecoins and Anti-CBDC Act which limits the U.S. Federal Reserve’s ability to issue central bank digital currencies.

If these bills pass, it will clarify Ripple’s regulatory status even more; especially around the XRP token.

Conclusion: Perception vs Procedure

In a news cycle driven by speculation, it’s easy to make assumptions. But the reality, as Fagel points out, is more reassuring. The Ripple SEC case isn’t being stalled; it’s wrapping up with normal legal due diligence. That said, the convergence of procedural timing, XRP’s price rally, and a politically charged regulatory week makes for an interesting backdrop.

If the SEC votes and files the dismissal as expected, Ripple could soon put an end to a legal saga that started in December 2020. But more importantly, it may do so just as the next phase of crypto regulation begins.

Summary

The Ripple SEC case isn’t being delayed due to obstruction but is going through a normal process, according to former SEC lawyer Marc Fagel. An internal SEC vote precedes the official dismissal filing. Meanwhile, XRP has surged to near $3.00 as investors get more optimistic. With U.S. Crypto Week 2025 underway, legislation like the CLARITY Act will impact XRP’s regulatory status.

FAQs

Is the SEC stalling the Ripple case?

No. The delay is procedural. The SEC is voting internally to approve the dismissal before filing with the court.

How long will the vote take?

1-2 months. But Fagel says it could be faster since the SEC already voted once during an earlier phase of the settlement.

Why is XRP rising now?

Investor confidence is growing due to expected legal closure and also broader market optimism, especially ahead of U.S. Crypto Week 2025.

Will upcoming legislation affect Ripple?

Bills like the CLARITY Act and GENIUS Act will define XRP’s regulatory status and impact future institutional adoption.

Glossary

Ripple: A blockchain-based payment protocol and fintech company focused on cross-border payments using the XRP token.

SEC: U.S. regulator for securities markets, including digital assets.

XRP: The token used in the Ripple network for settlement and liquidity in cross-border payments.

Dismissal Vote: Internal SEC process to approve the dismissal of an enforcement case.