A Billionaire’s Wake-Up Call to Global Markets

Ray Dalio, the founder of Bridgewater Associates, has once again sparked global markets with his stern warnings about debt, fiat stability, and alternative assets. His most recent statements highlighted Ray Dalio cryptocurrency hedge approach, in which Bitcoin and digital assets are considered as critical complements to gold in wealth protection.

Dalio labeled the US fiscal situation as “unsustainable,” citing record-high federal debt of more than $37 trillion and yearly interest payments of more than $1 trillion. He compared the economic situation to a “patient on the verge of a heart attack,” implying that investors should brace themselves for fiat devaluation and the probable deterioration of the US dollar’s reserve position.

Why is Dalio turning to crypto?

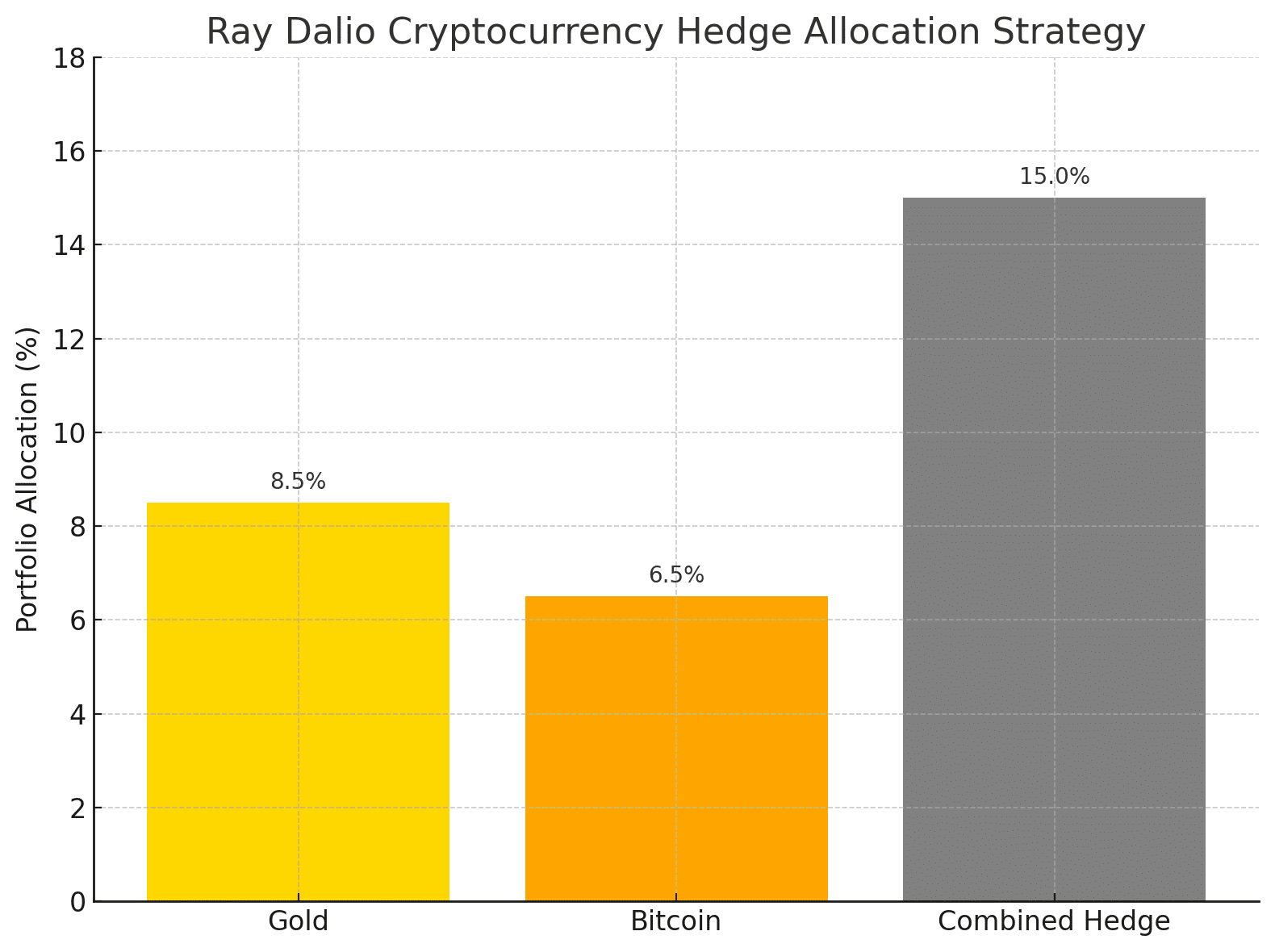

Ray Dalio’s Bitcoin hedging stance has altered dramatically in recent years. Dalio, who was previously wary about digital assets, now recommends up to 15% of a portfolio in gold and cryptocurrency together.

This shift shows a rising recognition of cryptocurrency as a unique store of wealth with scarcity, decentralization, and independence from central bank policies. “In an environment where fiat is losing purchasing power, the combination of gold and cryptocurrency becomes indispensable,” Dalio said in a recent interview.

Gold and Bitcoin: Parallel Safe Havens

Dalio has traditionally supported gold, but his enlarged position now includes Bitcoin as a potential hedge. The Ray Dalio cryptocurrency hedge thesis contends that Bitcoin’s limited quantity of 21 million coins parallels gold’s scarcity while providing improved mobility and programmability.

According to observers, this changing perspective indicates a bigger change in institutional portfolios. Investment banks like Goldman Sachs and JPMorgan have lately expanded their crypto research units, echoing Dalio’s warning about the future of fiat.

Comparing Dalio’s Hedge Assets

| Asset | Key Strengths | Weaknesses | Allocation Advice (Dalio) |

|---|---|---|---|

| Gold | Centuries of stability, inflation hedge | Slower adoption in digital economy | 7–10% of portfolio |

| Bitcoin | Scarcity, decentralization, portability | Volatility, regulatory uncertainty | 5–8% of portfolio |

| Combined | Balanced safe-haven protection | Market risks remain | ~15% of portfolio |

Predictions: Future Hedge

The Ray Dalio cryptocurrency hedge may become a cornerstone of institutional strategy as global debt levels grow. If fiscal imbalances in the United States continue, analysts predict that Bitcoin will outperform gold in terms of capital inflows.

By 2030, the International Monetary Fund predicts that global debt would top $100 trillion, driving up demand for alternative assets. If Dalio’s 15% allocation approach is widely followed, billions of dollars in institutional money might pour into cryptocurrencies, driving prices to record highs.

Conclusion

The Ray Dalio cryptocurrency hedge is more than just a billionaire’s view; it reflects rising market concern about unsustainable debt and weak fiat currencies. Dalio’s embrace of both gold and cryptocurrency demonstrates a varied road ahead for investors facing difficult times.

As institutional use of Bitcoin and stablecoins grows, Dalio’s warnings might serve as a roadmap for financial survival in a future where faith in money is waning and digital assets are taking on the role of safe-haven assets.

Glossary

Hedge – An investment made to reduce the risk of adverse price movements in an asset.

Gold Standard – A system where a country’s currency is directly tied to gold.

Fiat Currency – Government-issued money not backed by a physical commodity.

Portfolio Allocation – The distribution of investments across asset classes.

Store of Value – An asset that preserves wealth over time without depreciating significantly.

FAQs for Ray Dalio cryptocurrency hedge

What is the Ray Dalio cryptocurrency hedge?

It is Ray Dalio’s investment strategy of allocating part of a portfolio into Bitcoin and digital assets as protection against fiat devaluation.

How much does Dalio recommend?

Dalio suggests about 15% of portfolios should be in gold and crypto, with Bitcoin representing 5–8%.

Why does Dalio see debt as a risk?

The U.S. debt has surged past $37 trillion, raising concerns about inflation, interest burdens, and the weakening U.S. dollar.

Does Dalio prefer gold or Bitcoin?

He leans toward gold but acknowledges Bitcoin’s unique role as a digital hedge, especially for younger generations.