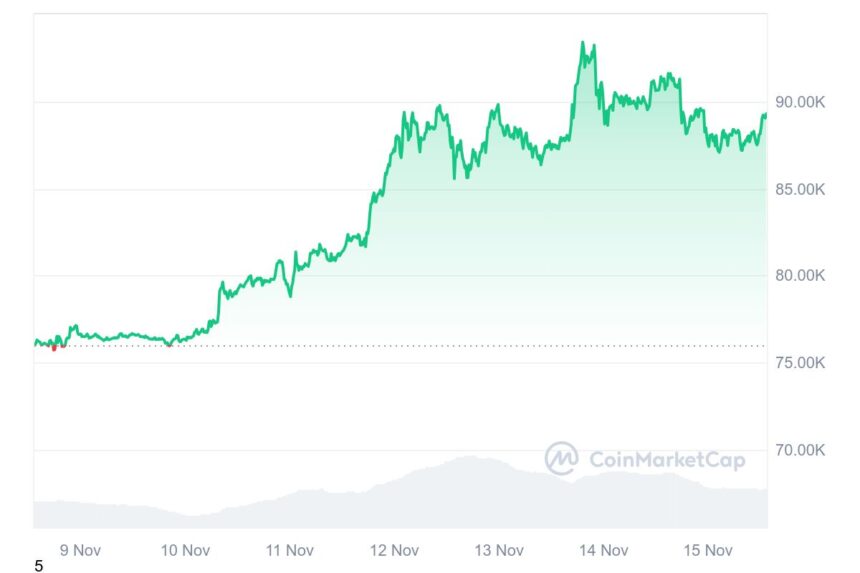

Bitcoin (BTC) is trading at $89,946, climbing steadily after the U.S. presidential election. Analysts at QCP Capital believe the cryptocurrency is poised to reach new all-time highs, with targets between $100,000 and $120,000 now considered realistic. However, they caution that market dynamics, particularly leveraged trading and investor behavior, must be closely monitored.

Market Risks and Leveraged Trades

According to QCP Capital, Bitcoin’s rally is being shaped by strategic moves from large investors. During this uptrend, many traders are selling call options to capitalize on price increases while buying put options to hedge against potential downturns. This has led to a decline in implied volatility, reflecting reduced market uncertainty.

In the altcoin market, the situation is riskier. Leverage levels in perpetual futures contracts have reached funding rates of 50% to 100% annually for some tokens. This exposes the market to heightened sensitivity and potential price swings. QCP Capital warns that any significant deleveraging event in the altcoin sector could have widespread consequences.

Bitcoin and the Trump Factor

QCP Capital attributes part of Bitcoin’s momentum to broader market transformations, including the return of former U.S. President Donald Trump to political prominence. Speculation about Trump initiating a strategic Bitcoin reserve during his presidency and potential shifts in U.S. monetary policy—such as replacing gold reserves with Bitcoin—are fueling bullish sentiment.

These developments, coupled with Bitcoin’s increasing institutional adoption, provide a solid foundation for its price to test new highs.

Navigating Exciting Yet Risky Markets

As Bitcoin approaches historic levels, the market remains both exhilarating and precarious. Investors are urged to consider the risks of volatility and leveraged positions while navigating this rapidly evolving space.

At Dey There, we’ll continue tracking Bitcoin’s ascent and the factors influencing its market dynamics. The cryptocurrency remains a focal point for those eyeing the next wave of growth.

Bitcoin, QCP Capital, leveraged trading, implied volatility, altcoin market