This article was first published by Deythere.

- What Does the Solana PumpFun Lawsuit Allege?

- How Has the Crypto Community Responded?

- Why Is PumpFun Significant to the Solana Ecosystem?

- What Are the Latest Legal Developments?

- Could This Lawsuit Impact Solana’s Market and Reputation?

- Conclusion

- Glossary

- Frequently Asked Questions About Solana PumpFun Lawsuit

The Solana PumpFun lawsuit has entered an important phase after a U.S. federal court allowed a class-action case involving PumpFun and entities linked to Solana to move forward. This ruling brings Solana Labs and the network’s underlying structure under close legal scrutiny.

The case raises concerns about fairness, how transactions are ordered, and possible insider advantages during meme coin launches. Experts emphasize that it is not limited to a single application but question how Solana’s validators and transaction mechanisms operate across the network.

What Does the Solana PumpFun Lawsuit Allege?

The Solana PumpFun lawsuit claims that some insiders took advantage of validator-level access to get ahead during meme coin launches. According to the complaint, transaction ordering tools allowed certain participants to move ahead of others and buy tokens before retail traders had time to respond.

Plaintiffs argue that these built-in advantages let insiders sell early for profits, while everyday investors chase rising prices and suffer losses when values drop. The case extends beyond individual applications and addresses how Solana’s network functions. The claims have not been established, and discovery is ongoing.

How Has the Crypto Community Responded?

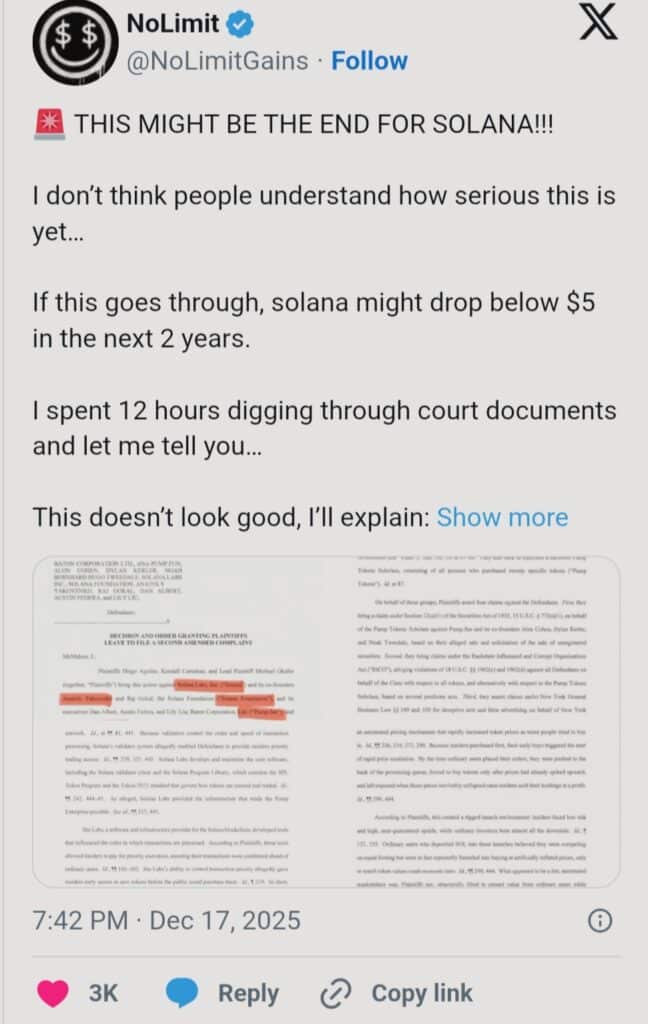

The lawsuit has fueled discussion across crypto social media, particularly on X, where NoLimit highlighted what the case could mean for the Solana network as a whole. The post pointed out that the complaint goes beyond individual apps and connects the alleged conduct to Solana’s validator structure and transaction-ordering systems.

It argued that if this view holds, Solana would not simply be hosting problematic actors but could be seen as part of the mechanism under scrutiny, increasing the level of risk. The post said Solana could drop below $5 within the next two years if the case goes against the defendants, based on a review of court filings.There has been no ruling on the claims so far.

Why Is PumpFun Significant to the Solana Ecosystem?

PumpFun is a large platform built on Solana and is not considered a small or niche project. At its peak in January, the protocol reportedly generated more than $7 million in daily revenue and has collected over $935 million in total fees since launching in early 2024, based on DeFiLlama data.

As of this week, PumpFun is still earning around $3 million in daily fees, briefly surpassing platforms such as Hyperliquid. Its native token, $PUMP, has come under pressure alongside the lawsuit and is trading near $0.002, down nearly 31% over the past week. Due to the platform’s size, observers say the Solana PumpFun lawsuit carries greater weight and could affect how fairness and network reliability are viewed across Solana.

What Are the Latest Legal Developments?

Plaintiffs in the Solana PumpFun lawsuit were allowed to file a second amended complaint. The filing adds internal messages involving PumpFun staff and Solana engineers, along with information from confidential informants.

The revised complaint says some participants got access to token launches earlier than others through validator-level tools. The case has not gone far yet. Solana Labs has not said anything publicly about the allegations.

Could This Lawsuit Impact Solana’s Market and Reputation?

The legal attention surrounding the Solana PumpFun lawsuit has already had an impact on how some investors view the network, even though the case has not reached any outcome. Much of the concern in the market is tied to how the lawsuit is being interpreted rather than to any court decision.

If judges eventually accept the claims raised by the plaintiffs, it could raise wider questions about market fairness, transparency, and how Solana’s token launch systems are set up. None of the claims have been proven yet. What happens next depends on discovery and whether regulators step in. Right now, the lawsuit is just another unknown. It may affect how investors see Solana projects and how they price them.

Conclusion

The Solana PumpFun lawsuit marks an important point for the blockchain space and shows how a network’s structure and transaction setup can end up facing legal review. PumpFun is a large platform, and with its token under pressure, the case has drawn attention to how Solana’s validator system and transaction ordering work.

The allegations have not been proven. The case could still change how meme coin launches are judged. Regulators and investors may also react differently to similar projects. In that sense, the Solana PumpFun lawsuit shows that legal challenges can focus on network design itself, not just the apps built on top of it.

Glossary

PumpFun: A Solana platform for trading memecoins and joining token launches.

Transaction Ordering: How the blockchain decides which transactions happen first.

Class-Action Lawsuit: When a group of people sues a company together.

Validator: A Solana participant who confirms and orders transactions.

Network Fairness: Making sure all users have equal chances on the blockchain.

Frequently Asked Questions About Solana PumpFun Lawsuit

Who is involved in the Solana PumpFun lawsuit?

The case involves PumpFun, Solana-linked entities, and questions about how the Solana network works.

What did the court decide?

U.S. federal court allowed lawsuit to move forward. But did not decide who is right or wrong.

What unfair activity is being claimed?

The lawsuit claims some insiders could buy tokens earlier than others during launches.

Is this case only about PumpFun?

No, the case also questions Solana’s validator system and transaction ordering.

Why does this lawsuit matter for Solana users?

The lawsuit could affect trust in Solana’s fairness and how future token launches work.