This article was first published on Deythere.

Pump.fun extraction has become a defining phrase of this crypto cycle, not because of a failure, but because of scale. A Solana-based memecoin launchpad is generating eye-watering profits amid a market downturn when most traders are losing. That contrast has pushed an old question back into the spotlight. When does success stop feeling neutral and start feeling unfair?

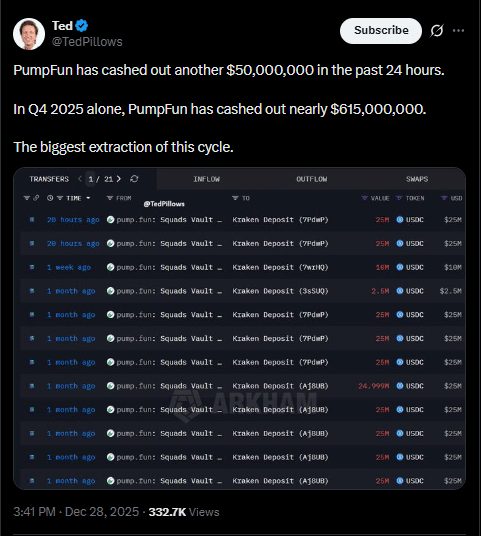

According to the source, blockchain data shows that large sums were transferred from the platform’s wallets to centralized exchanges during the fourth quarter of 2025.

Those movements, paired with unusually high profit margins, turned routine treasury activity into a public debate across analyst forums, developer chats, and financial classrooms.

Profits at Scale Change the Conversation

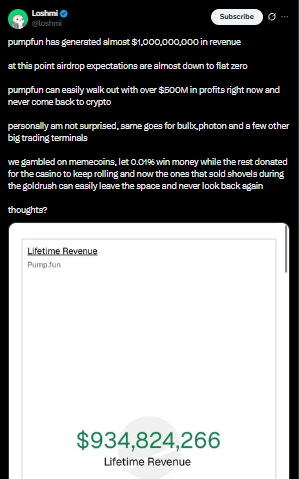

At the center of the Pump.fun extraction debate is the numbers. Analysts tracking wallet flows estimate that nearly $615 million was moved off-chain during Q4 2025. During the same period, quarterly revenue reached about $74 million, pushing lifetime revenue close to $1 billion.

Supporters argue that moving funds off-chain is normal for any profitable business. Critics say the scale feels extreme in an ecosystem where retail participants often walk away with losses. This tension fuels the Pump.fun extraction narrative, even though no wrongdoing has been proven.

The platform benefits from Solana’s low transaction costs and high speed. With no disclosed cost of revenue, most fees flow straight into profit. Academic research on crypto market structure shows that fee-based platforms often remain profitable even after speculative activity cools.

Why “Extraction” Became the Chosen Word

The word extraction carries weight in Web3. In traditional finance, profit signals efficiency. In crypto, it often signals an imbalance. The Pump.fun extraction label reflects traders’ frustration over the expectation of broader upside from participation.

Some commentators compare memecoin platforms to casinos. Traders take risks. The house collects fees. Over time, the house wins. Others reject that framing, noting that users are not forced to trade and that no airdrop or revenue share was formally promised by Pump.fun.

This divide highlights a deeper issue. Many users still expect platforms to reward participation beyond access. When those expectations fade, profit begins to feel personal.

Token Failure Rates Add Fuel

Usage data complicates the story further. More than 14 million tokens have launched on the platform. Fewer than one percent ever gain lasting traction. In November 2025 alone, over 500,000 tokens launched, while only a few thousand advanced.

This imbalance strengthens the Pump.fun extraction argument. Fees remain steady even as most tokens fail. Analysts note that low barriers invite experimentation, but also extreme churn. A detailed breakdown of protocol revenue and activity trends can be reviewed through this analytics dashboard.

Despite lower speculative peaks compared to early 2025, daily revenue and active wallets remain stable. That persistence suggests the model is durable, even as criticism grows.

Treasury Moves and Public Response

Earlier in the cycle, claims circulated that hundreds of millions had been cashed out. A co-founder publicly denied those accusations, explaining that the transfers reflected treasury management tied to earlier fundraising. While that clarification aligned with standard operational practices, scrutiny continued.

Once Pump.fun extraction entered the public conversation, every transaction became symbolic rather than routine.

Conclusion

The Pump.fun extraction debate marks a shift in crypto culture. Profit alone no longer settles the argument. Users now ask how value flows and who captures it. For students, developers, and analysts, the lesson is clear. Efficient systems can thrive, but without trust and clarity, success will always invite suspicion.

Glossary of Key Terms

Pump.fun extraction: A term describing perceived value capture through fees without shared upside.

Memecoin launchpad: A platform that enables rapid creation and trading of speculative tokens.

On-chain data: Public blockchain records showing transactions and wallet activity.

Treasury management: The handling of operational and reserve funds by a project.

FAQs About Pump.fun Extraction

Why is Pump.fun extraction trending now?

Large Q4 fund movements drew renewed attention to platform profits.

Is the platform accused of illegal activity?

No. The debate is about ethics and structure, not legality.

Why do most tokens fail?

Low entry barriers create oversupply and short-lived speculation.

Can fee-based platforms survive long-term?

Yes, as long as trading demand continues.