This article was first published on Deythere.

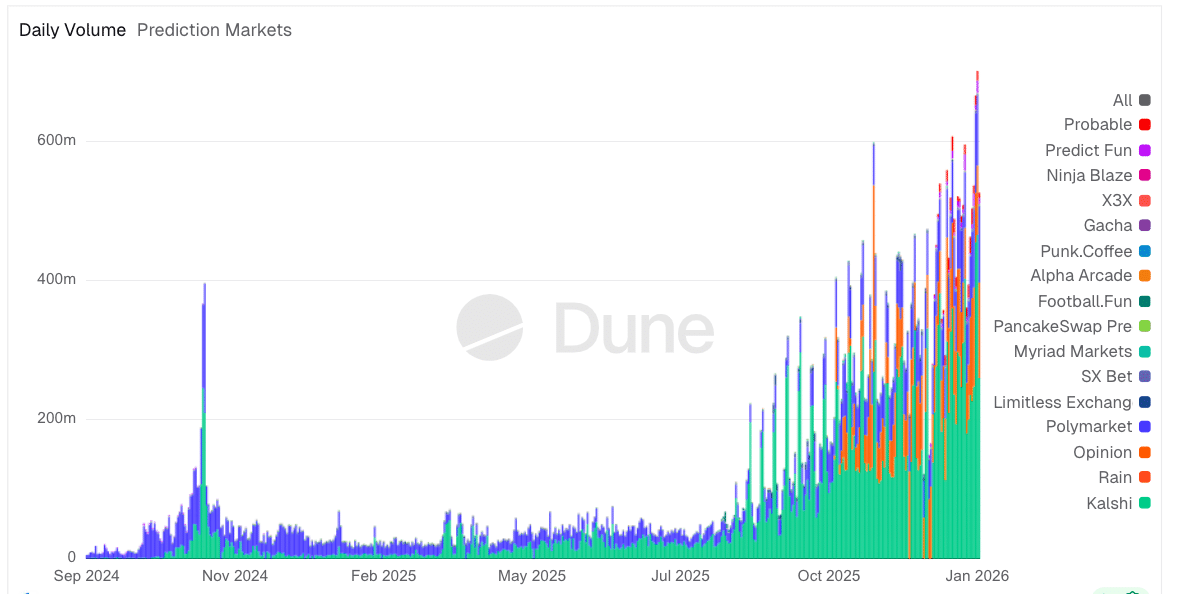

Prediction markets hit an all-time high in early 2026, with total trading volume reaching $701.7 million in a single day, outstripping the previous high of $666.6 million.

Even as the U.S. state regulators have turned a closer eye towards trading markets like Kalshi, Polymarket and Opinion, these platforms still appear to gain reasonable traction on the market.

According to data from Dune Analytics, Kalshi saw about two-thirds of the total volume, with competing platforms like Polymarket and Opinion also seeing substantial activity.

Booming Trading: Who’s Sparking The Most Interest?

Kalshi led the charge, accounting for $465.9 million of total volume, while Polymarket and Opinion each contributed about $100 million each.

Kalshi has built a commanding position in the market, supported by the federal regulation through the Commodity Futures Trading Commission guidelines that treat its event contracts as derivatives subject to oversight.

This regulatory position has enabled Kalshi to trade more widely across the United States than decentralized, or less regulated, competitors are able to do because of access restrictions and legal complications.

Regulatory Scrutiny and Legal Battles

In the United States, prediction markets have come under heavy regulation from regulators, especially state authorities who want to categorize these platforms as gambling websites instead of financial derivatives exchanges.

Several states, including Connecticut and New York, Nevada and Tennessee have issued cease-and-desist orders or filed actions to enforce their bans against platforms like Kalshi and Polymarket, saying event based contracts are in violation of state laws regarding gaming.

Platforms have responded by arguing that their products are governed by federal law as regulated derivatives, based on a reading of the Commodity Exchange Act and oversight by the CFTC.

The regulatory pushback has led to several federal court fights. A federal judge in Tennessee, for instance, issued a temporary restraining order recently, that prohibited the state’s regulators from stopping Kalshi from offering contracts on sports events.

The ruling supported Kalshi’s view that federal jurisdiction trumps local gambling laws. The judge’s decision suggested that Kalshi had a good shot at winning its constitutional challenge to the enforcement of the state law.

Even with these legal safeguards, however, prediction market operators must face a patchwork of state action. Some states classify access as illegal gambling, leading platforms to limit service or pursue litigation in defense of their business models.

This disjointed regulation spells the tension between state definitions of gaming and federal derivatives frameworks, causing headaches for market participants.

High-Profile Trades and Insider Concerns

Some of the current interest in prediction markets developed from a widely reported trade involving a large profitable wager on the removal of Venezuela’s President Nicolás Maduro.

A Polymarket user reportedly wagered some $30,000 that Maduro would be removed from power, and when it finally did happen with Maduro’s capture during a U.S. military operation, the trader’s position paid out well over $400,000 because so much money had been bet on this outcome.

This payout again raised allegations about insider trading practices and calls for greater regulation of prediction markets, notably in politically contentious contracts.

Industry reaction includes calls for formal prohibitions on insider trading by government officials in prediction markets. Kalshi’s CEO has endorsed forthcoming legislation that seeks to prevent insider trades by public officials, emphasizing the industry’s efforts to align with traditional financial crime standards and bolster market integrity.

Institutional and Market Ecosystem Growth

Prediction markets have attracted attention from both retail investors and institutional actors and traditional financial firms. Wall Street trading companies like DRW, Susquehanna and other major liquidity providers have been taking a greater interest in prediction markets, hiring experts to examine arbitrage and hedging opportunities.

Crypto and traditional finance platforms, such as Coinbase, Gemini and Crypto.com, have already linked or will link with the prediction market, indicating a widespread recognition of the trading event contract in various financial products.

Such integrations have been instrumental in driving adoption and growing traction beyond niche communities.

The rapid surge in volumes has also attracted political advocacy efforts. A newly formed Coalition for Prediction Markets led by influential former U.S. lawmakers aims to protect the industry from restrictive state‐level regulation and promote its use as an information aggregation tool.

Conclusion

With daily trading of over $701.7 million, driven mostly by Kalshi and further buoyed by participants on Polymarket and Opinion, prediction markets have continued to expand despite regulatory attention and legal challenge.

Amid headline-grabbing trades and internal concerns, regulators have escalated scrutiny, bringing demands for clearer regulations and legislative action to address market integrity.

Meanwhile, institutional interest and mainstream platform integration suggest that prediction markets are stepping into wider financial significance.

Glossary

Prediction markets: Financial exchanges where traders buy and sell contracts tied to the outcome of events; with prices providing collective probabilities of each outcome.

Event contracts: Prediction market contracts that pay a fixed amount if a particular event happens and zero if it does not, similar to binary options.

CFTC: (Commodity Futures Trading Commission): A U.S. federal regulator that has authority over derivatives, which trading in some prediction market contracts represents.

Cease-and-desist order: A regulatory command to cease certain activities, usually made by state gaming authorities against prediction markets seen as unlicensed gambling.

Insider trading (prediction markets): The use of non-public information by a trader to place bets on future events.

Frequently Asked Questions About Prediction Markets

What platforms helped drive the record volume?

Kalshi had about two-thirds of the volume, while Polymarket and Opinion each saw around $100 million in activity.

Why are prediction markets coming under the lens now?

State regulators say that event contracts function as unregulated bets and, thus, leasing to legal battles about whether CFTC regulation pre-empts state law.

Has there been controversy over big payouts?

Yes. A winning bet on the removal of Venezuela’s former president Nicolás Maduro became a target for insider trading allegations and congressional action.

Are institutional players involved?

Some trading firms on Wall Street are dipping their toes into the prediction markets and researching arbitrage and hedging strategies.

Reference