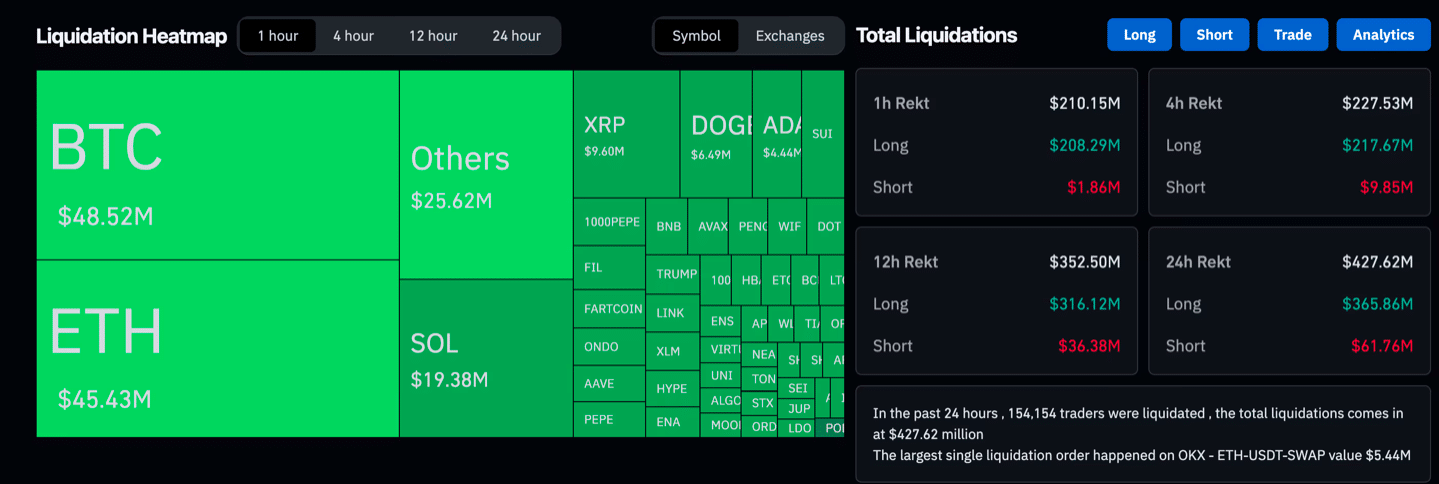

Crypto markets had one of their wildest crypto liquidation days in months on Wednesday after Federal Reserve Chair Jerome Powell’s comments spooked traders. The market reaction was fast and brutal, with leveraged traders losing over $200 million in an hour, according to CoinGlass. Bitcoin dipped below $116,000; its lowest in nearly three weeks, before bouncing back to $118, 577 as at the time of writing.

The Fed kept interest rates unchanged, which initially calmed investors. But Powell’s comments on persistent inflation risks worsened by tariffs, changed the mood quickly.

“The market is starting to think the Fed is behind the curve,” said Matt Mena, analyst at 21Shares.

Mena said the combination of soft inflation numbers and weakening consumer spending was a dangerous situation.

“Tight policy risks overtightening into a broader slowdown,” he warned.

Bitcoin and Ethereum Struggle

Bitcoin’s dip below $116,000 was brief but intense, showing how fragile the market is. By the end of Powell’s press conference, $BTC had recovered slightly. Ethereum (ETH) followed the same pattern, dropping as much as 3% before settling near $3,863, at the time of writing.

Both assets have been stuck in tight ranges for weeks. $BTC has been between $116,000 and $118,000 for three weeks, while ETH has been trying to break above $3,800 for months.

Altcoins Reel, Then Rebound

The volatility wasn’t limited to Bitcoin and Ethereum. Altcoins had some of the biggest initial declines, only to recover later. Solana’s SOL, Avalanche’s AVAX, and Hyperliquid’s HYPE tokens fell 4-5% at the worst. Meme coins BONK and PENGU dropped 10% before recovering by the end of the session.

Despite the rebounds, traders are still spooked. Analysts say speculative assets will remain under pressure if the Fed stays hawkish.

Traditional Markets Mixed

Equities were mixed. Meta (META) and Microsoft (MSFT) crushed their quarterly numbers; with shares up 10% and 6% in after hours. But overall market sentiment is still cautious; especially with political uncertainty rising and the global economy still a concern.

Matt Mena compared the current situation to Q4 2023, with soft inflation, political volatility and the Fed constrained by lagging indicators.

Can Bitcoin hit $150,000 by year-end?

In the midst of all this, Mena was surprisingly optimistic. He said the setup is for the Fed to turn to lower rates and release a new wave of capital into risk assets.

“If the Fed pivots as expected, Bitcoin can easily reach $150,000 by year-end,” he said.

This relies on continued ETF inflows, corporate Bitcoin buys and a possible easing of monetary policy. But any deviation from that could blow off the bullish case.

Conclusion

Based on the latest research, the crypto liquidations going on in the market is the new sentiment indicator. Over $200 million in leveraged positions wiped out shows how fragile the current market is, especially with the Fed doubling down on hawkish talk.

Bitcoin and Ethereum staying in their ranges is a good sign but altcoins are still suggesting uncertainty. If the Fed pivots later this year, Matt Mena thinks Bitcoin could hit $150,000.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

Crypto markets were rocked by $200 million in crypto liquidations after Fed Chair Jerome Powell’s hawkish comments sent Bitcoin below $116,000 before a rebound. Ethereum and altcoins like SOL, AVAX, BONK and PENGU also dropped before recovering. Analysts say tight Fed policy could extend volatility

FAQs

What triggered the $200M crypto liquidations?

Fed Chair Jerome Powell’s hawkish comments, as markets were already nervous about inflation.

How did Bitcoin react to Powell’s comments?

Bitcoin fell below $116,000 before recovering.

Which altcoins were most affected?

SOL, AVAX and HYPE dropped 4-5%, BONK and PENGU 10% before bouncing back.

Can Bitcoin hit $150,000 this year?

Matt Mena thinks a Fed pivot could send Bitcoin to that by year-end.

Glossary

Liquidation: A leveraged position being forced to close when losses exceed margin.

ETF Inflows: Money flowing into ETFs, a measure of institutional demand.

Hawkish Policy: A central bank stance favoring higher interest rates to control inflation.