While Thursdays typically favor bullish momentum in crypto markets, this week tells a different story. The upcoming U.S. Personal Consumption Expenditures (PCE) data, due Thursday, has cast a shadow on altcoin activity, with investors bracing for the possibility of higher-than-expected inflation numbers. Both POPCAT and CRV are now at critical technical levels, and market watchers are split: warning or opportunity?

POPCAT Faces a Make-or-Break Moment

Altcoin Sherpa, a widely followed crypto analyst, remains cautiously engaged with POPCAT. Despite being one of his favored tokens, he warns that most altcoins are still trending downward. For POPCAT, two potential paths lie ahead: either it consolidates at current lows and holds ground over the coming weeks, or it continues its descent into lower price territory.

Technical analysis suggests that if POPCAT fails to hold the $0.2305 support, a sharp decline toward $0.11 could follow. On the flip side, a positive shift in macro sentiment—particularly surrounding international tariff negotiations—could set the stage for a gradual climb toward $0.50.

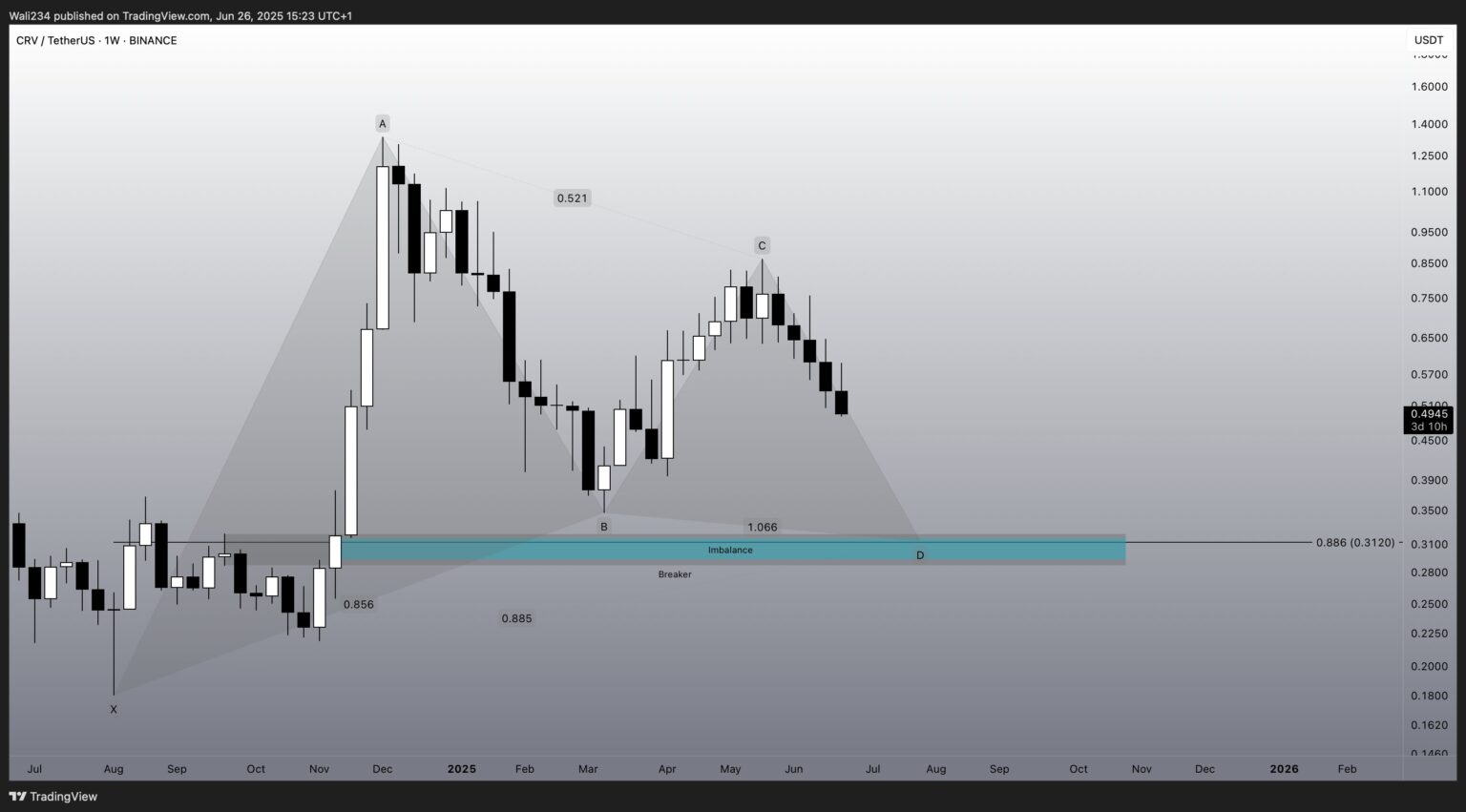

CRV Draws Dip-Buying Interest at Key Support

Curve DAO’s CRV token is also showing signs of vulnerability. According to crypto analyst Waleed Ahmed, a dip toward $0.312 would be seen as a prime accumulation zone. Ahmed has signaled readiness to buy heavily at that level, suggesting confidence in CRV’s long-term structure despite the current market uncertainty.

Inflation, Tariffs, and Fed Signals in Focus

The market is closely watching the outcome of ongoing tariff discussions, which could impact inflation by 2–3 percentage points. A 10% base tariff is seen as manageable, but unresolved negotiations with the EU and other trade partners could lead to rates as high as 50%, significantly stoking inflation.

This macro backdrop is influencing the Federal Reserve’s stance. Officials have stated that rate cuts are off the table unless tariffs do not exert meaningful inflationary pressure. The final outcome is expected around July 9, which could ease some of the market’s current uncertainty.

Market Awaits Key Speeches and Data Releases

Investors are also eyeing a series of important events:

8:15 PM ET: Remarks from Fed Vice Chair Michael Barr

9:00 PM ET: U.S. Senate briefing on Iran

9:30 PM ET: ECB President comments on tariffs

11:00 PM ET: Speech by former President Trump

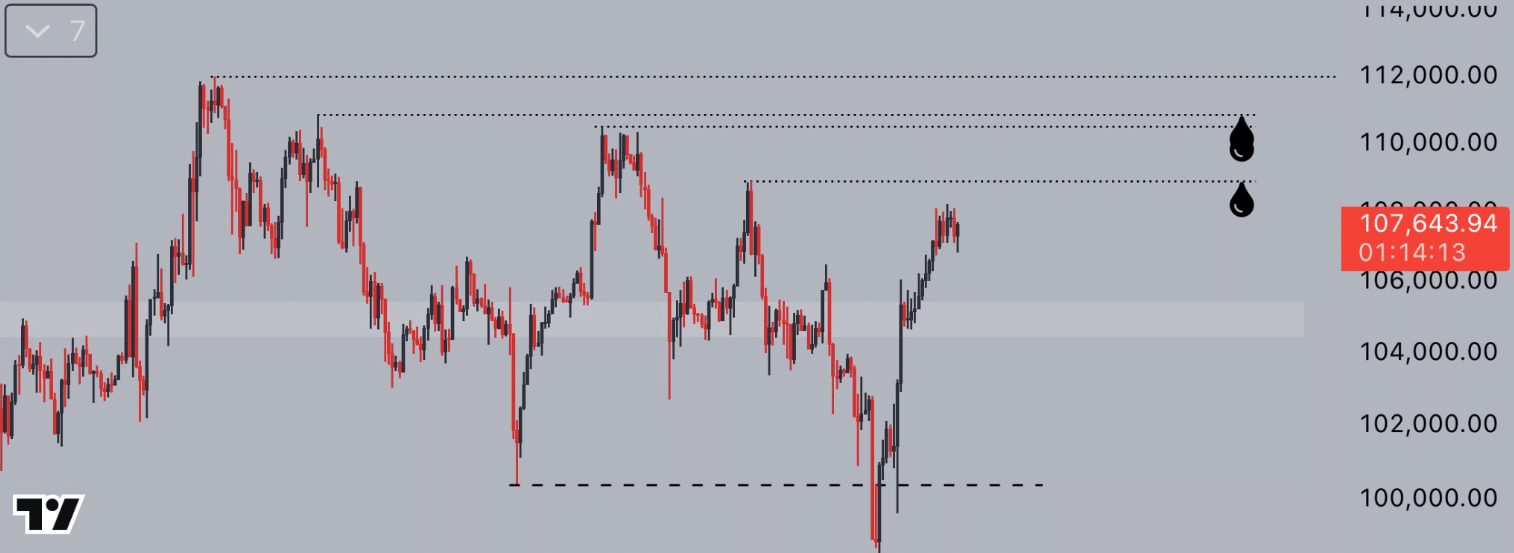

These updates could bring volatility to both BTC and altcoins. Analyst Jelle notes that Bitcoin’s current position between support and all-time highs is a zone of high liquidity. A surge from BTC could liquidate many short positions, reinforcing the bullish outlook for the broader market.

Dey There will continue to provide timely updates on how macroeconomic trends and investor sentiment are shaping altcoin performance, especially for high-interest tokens like POPCAT and CRV.

References:

U.S. Bureau of Economic Analysis — https://www.bea.gov

Federal Reserve Board Statements — https://www.federalreserve.gov

Bloomberg Crypto Market Coverage — https://www.bloomberg.com/crypto