Polymarket, a popular online prediction market platform, has filed a federal lawsuit to block Massachusetts from enforcing its sports wagering regulations against Polymarket’s business. The company argues that the Commodity Exchange Act gives the CFTC sole authority over “event contracts” (binary outcome bets) and pre-empts any state gambling laws.

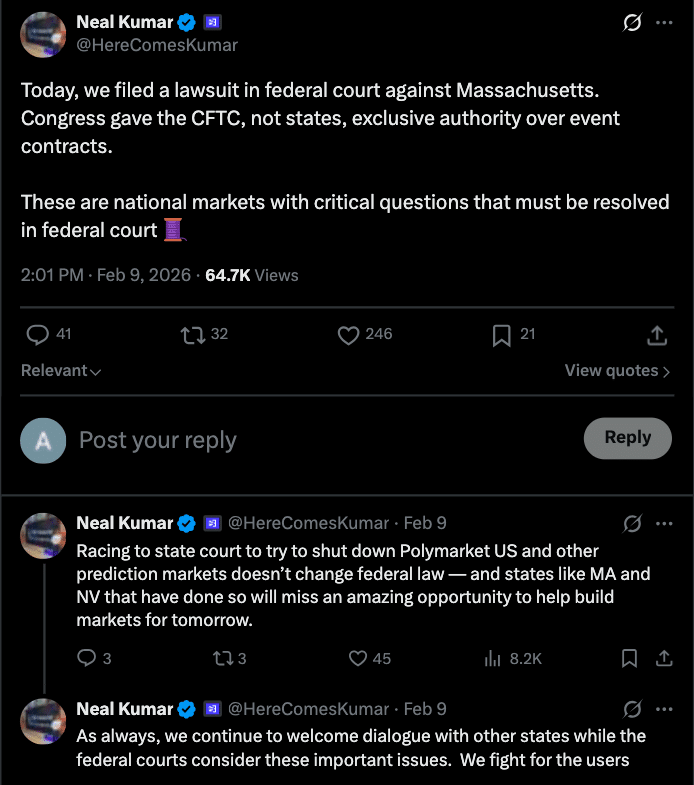

In a statement, Polymarket’s top lawyer, Neal Kumar, said: “Congress gave the CFTC, not states, exclusive authority over event contracts,” and that attempts by states to close down its markets would disrupt its operations and impact users.

The lawsuit seeks both injunctive and declaratory relief that would prevent Massachusetts regulators from enforcing local gambling laws against Polymarket’s platform.

Massachusetts’ action followed a state court ruling granting Kalshi, another prediction market, a preliminary injunction on the basis that its sports event bets constituted unlicensed sports betting.

Polymarket lawsuit was filed in anticipation of that ruling, and within days of it, to avoid having the same fate. Polymarket says it relaunched in the United States after its acquisition of a CFTC-licensed exchange (QCX), which allows them to operate under federal supervision across the country.

The company says that if the court approves such a system that allows each state to impose its own rules, Polymarket will have to forfeit some of its federal rights or abide by various state regulations.

Main Legal Issues: CFTC vs State Sovereignty

What makes the Polymarket lawsuit case particularly interesting is the clash between federal and traditional state police powers. Polymarket and its allies argue that, by establishing the trading of its products as commodity derivatives, Congress left their oversight exclusively to the CFTC.

The position has been articulated by the CFTC itself in public: In this very action, CFTC Chairman Michael S. Seligman filed a court brief reiterating that “states and other federal entities do not have the authority to further regulate markets within the CFTC’s exclusive jurisdiction”.

Under CFTC press release, event contracts (prediction markets) were deemed to be lawful futures decades ago and Congress adopted very general Commodity Exchange Act language so that new markets of this type would be covered.  Chairman Selig has stated more than once that the agency will defend its exclusive jurisdiction, and even vowed, “To those who seek to challenge our authority in this space… we will see you in court”.

Chairman Selig has stated more than once that the agency will defend its exclusive jurisdiction, and even vowed, “To those who seek to challenge our authority in this space… we will see you in court”.

Massachusetts regulators along with their counterparts on state gaming authorities, view Polymarket’s sports contracts no differently than bookmaking.

In the Kalshi case, a state judge sided with Massachusetts Attorney General Andrea Campbell that allowing bets on game outcomes without a license violates state gambling laws.

As one ruling put it, Kalshi’s claim of federal authority was “overly broad,” and “Congress didn’t intend to displace traditional state police powers,” such as the power to regulate gambling.

The judge noted that Kalshi adopted its business model with eyes wide open, challenging state laws that were decades old.

Massachusetts maintained that this ruling confirms its ability to enforce gambling laws and hold any sports betting operator (even one offering online) accountable.

The question now is whether prediction markets are financial futures that the federal government can regulate or gambling products that states could either outlaw or license.

Polymarket lawsuit takes the step of asking a court to settle that question, arguing that if it succeeds, states will be prevented from writing their own rules.

In its filing, Polymarket cautions that conflicting state laws would cause irreparable harm and break up a single national market. It mentions Massachusetts’ Kalshi action as a specific threat, pointing out that Kalshi (and thus Polymarket) could face criminal and civil penalties under state law if the state’s approach stands.

How the Regulation is In the States

US states have pursued a variety of measures against prediction market businesses, resulting in a host of lawsuits. Massachusetts came first, securing its injunction against Kalshi in February 2026. Nevada’s regulators quickly followed them, suing Kalshi in state court and requiring Kalshi to take the case to federal court after it argued that Nevada’s sports betting laws should apply to Kalshi.

Nevada officials emphasized Kalshi’s mad growth (27x on Super Bowl Sunday), and argued that it diminishes the business of licensed Nevada sportsbooks.” A Nevada judge subsequently blocked Kalshi’s sports contracts from the state, and Kalshi is appealing that ruling while claiming CFTC preemption.

Other states had also intervened. In May 2025, the Arizona Department of Gaming also issued cease-and-desist letters to several prediction platforms (including Kalshi and Polymarket) for operating in the state without licenses. New York’s gaming regulator told Kalshi to cease illegally operating sports contracts, causing Kalshi to sue New York under the federal preemption grounds.

Maryland, New Jersey, Connecticut and Tennessee have also seen similar orders for enforcement. Michigan and Illinois have proposed bills or given warnings, citing a general concern that prediction markets bypass state and tribal consumer protections.

| State | Regulatory Action | Target | Status/Example Outcome |

| Massachusetts | State court injunction banning Kalshi’s sports-event contracts; Polymarket filed federal suit | Kalshi, Polymarket | Kalshi barred pending appeal; Polymarket seeks federal ruling |

| Nevada | State lawsuit vs. Kalshi (sports bets); CFTC amicus in related Crypto.com case | Kalshi (and Crypto.com) | Kalshi moved case to federal court; CFTC asserts sole oversight |

| Arizona | Cease-and-desist letters to prediction market platforms (May 2025) | Kalshi, Polymarket etc. | Platforms warned; enforcement status unclear |

| New York | Cease & desist order by gaming commission on Kalshi’s sports contracts | Kalshi | Kalshi sued NY, claiming federal preemption |

| Maryland/New Jersey/Connecticut/Tennessee | State orders or warnings against sports-event contracts | Kalshi | Legal challenges filed by Kalshi on federal jurisdiction |

These examples reveal what’s at stake in a national tussle. While most prediction markets could technically serve the whole country as they are regulated by the federal CFTC, many states refuse to acknowledge that. Legal analysts say this fight could eventually go to the US Supreme Court to decide whether federal or state laws rule in such matters.

Federal Response and Industry Reactions

The CFTC under the current Chairman Michael Selig, has been much more assertive. The CFTC recently submitted a high-profile amicus brief to the Ninth Circuit in support of Crypto.com (another event-contract platform) against Nevada’s challenge, reiterating that event contracts are “commodity derivatives” under the Commission’s exclusive jurisdiction.

Selig has publicly supported the industry, contending that prediction markets perform useful functions by hedging commercial risk, informing markets, and forcefully opposing suggestions to label them as a form of gambling.

Selig withdrew a previous CFTC regulation to prohibit certain prediction contracts, and even formed an industry advisory committee when he entered government service, indicating that he at least brought some pro-market tendencies to the rule-making process.

Not everyone agrees however. The American Gaming Association (the trade group for casinos) says that sports event contracts should be treated as ordinary sports bets, because prediction markets are no different than legal sports betting and they escape taxes and consumer protections.

BetMGM’s CEO Adam Greenblatt had previously called for a ban on sports contracts from prediction markets without state licensing. Even members of Congress can’t come to an agreement: 23 Senate Democrats led by Adam Schiff wrote CFTC Chair Selig to urge restraint, asking the Commission not to stand in the way of state lawsuits and even proposing federal legislation to ban certain types of event contracts (such as those on elections or war, etc.).

The head of the CFTC’s public affairs department pushed back, arguing that this is not what the agency wants, re-stating the paramount principle under which the CFTC has always exercised its exclusive jurisdiction over these markets.

Meanwhile, traditional sportsbooks are reacting. Companies including DraftKings, FanDuel and Fanatics have created their own prediction platforms, likely hoping for an advantageous regulatory solution for prediction markets. Others, including Caesars and MGM, have shied away.

Even social media companies are taking notice: Trump’s Truth Social has launched its own “Truth Predict” tool that links predictions to current events.

Conclusion

Prediction markets regulation in the US are currently in a state of considerable flux. The CFTC’s exclusive rule, if upheld by Polymarket lawsuit, would likely preempt any state ban on event contracts. If that happens, it would mean a national regime in which prediction market platforms could operate throughout the country under federal derivatives rules, assuming there are no changes from the CFTC.

On the other hand, if states win out, every state gaming commission could shutdown or tightly license these platforms as it sees fit, as Massachusetts has done with sports contracts.

Both sides are now gearing up for major appeals. Long story short, the lawsuit has potential to determine who really regulates US prediction markets.

Glossary

Prediction Market: An online exchange where users place bets around future events (elections, games, awards). Traders purchase “yes” (the event will happen) or “no” (it won’t happen) contracts, with profits determined by the amount traded.

Event Contract: A binary or futures-like contract where the payoff is dependent on a particular event. Example: $1 contract that pays $1 if a sports team wins the game; otherwise it pays out nothing. Such contracts are defined by the CFTC as commodity derivatives if they satisfy certain conditions.

Commodity Futures Trading Commission (CFTC) : The U.S. federal agency that oversees commodity futures, swaps and some other derivatives.

State Gambling Regulation: Statutes and regulations overseen by state gaming commissions or lottery regulators, which generally require sports betting licenses and include consumer protections.

Federal Preemption: A legal principle that holds supremacy of valid federal laws over any inconsistent state laws. Polymarket’s suit argues that the federal.

Frequently Asked Questions About Polymarket Lawsuit and Prediction Markets

What exactly is the Polymarket lawsuit contesting?

Polymarket has filed a lawsuit against what it argues is Massachusetts’ effort to enforce state gambling laws on its platform. The company contends that its markets are “event contracts” that fall under the jurisdiction of the federally controlled commodity futures, and only the federal Commodity Futures Trading Commission has authority over them.

What was going on with Kalshi in Massachusetts?

In Feb. 2026, a Massachusetts judge turned down Kalshi’s request to put on hold a state injunction that prohibits Kalshi from taking bets on sports events without gaming licenses. The judge sided with the Massachusetts attorney general that Kalshi was operating an unlicensed sports wagering enterprise and upheld state law. Polymarket brought its pre-emptive federal lawsuit in response to that ruling, which seeks to prevent such state action.

Who currently oversees prediction markets?

By current federal law, prediction markets (sometimes known as “event derivatives”) are considered commodity futures under the Commodity Exchange Act. The CFTC has regulated them for decades. Under the Trump-appointed leadership, the agency has repeatedly made it clear that it alone has jurisdiction over these markets. But state regulators say that any contracts related to sports or other gaming events are governed instead by the state gambling laws.

Why are some states opposed to prediction markets?

In the eyes of many state regulators and gambling commissions, sports and political contracts on prediction markets are the equivalent of illegal sports bets or other types of illegal wagers. They say such platforms sidestep state licensing, taxes, age limits and protections for consumers.