This article was first published on Deythere.

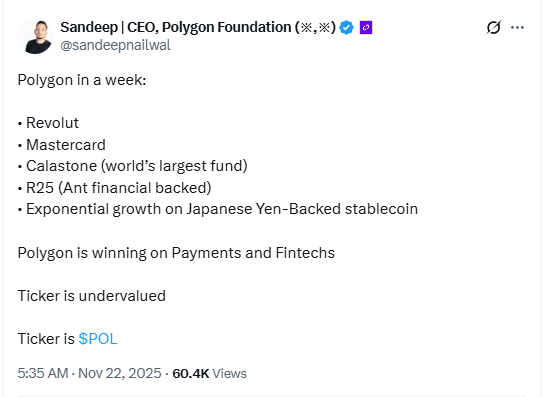

Polygon partnerships continue to gain attention in global finance. The network drew major players like Revolut, Mastercard, and Calastone within one week, adding real adoption and measurable volume. According to the source, these deals show that traditional platforms now rely on blockchain infrastructure for payments and fund operations.

Recent market data shows POL trading near 1.02 dollars, up 3.2 percent in 24 hours. Daily active addresses crossed 357 thousand, while network fees remained among the lowest across major chains. This performance supports the rising interest behind Polygon partnerships and broad integration across financial sectors.

Strong Institutional Movement Behind Polygon Partnerships

Revolut Sees Rising Volume Through Polygon

Revolut expanded its crypto tools with Polygon support for stablecoin transfers, trading, and staking. By mid-November 2025, the app had processed more than $690 million on Polygon. This volume reflects active retail usage rather than speculative spikes. Revolut’s on- and off-ramp system also lets users move funds between bank accounts and POL or stablecoins with ease.

Revolut’s decision strengthens Polygon partnerships across fintech and retail payments. The low fee structure allows users to avoid heavy settlement costs, especially in cross-border transfers where bank fees often rise.

Mastercard Adds Verified Wallet IDs on Polygon

Mastercard widened its Crypto Credential system earlier this month. The update lets users send crypto with simple aliases instead of complex wallet addresses. The company selected Polygon as the first chain for this rollout. A verified wallet receives a credential that proves the user’s identity on the chain.

Mercuryo verifies users before issuing credentials on the Polygon network. This step reduces the risk of incorrect address transfers and supports secure self-custody. It also adds another strong layer to Polygon partnerships in global payments.

Calastone Tokenises Funds With Polygon

Calastone, known for one of the largest fund networks, integrated its Tokenised Distribution system with the Polygon network. The move brings fund settlement on the chain and reduces operational delays. The platform now supports direct tokenised fund transactions on the Polygon infrastructure.

Calastone’s network includes more than 4,500 financial institutions. Moving part of this activity to Polygon shortens settlement cycles and gives fund managers clearer access to real-time data. This integration also pushes Polygon partnerships deeper into traditional asset management.

Asia Adds More Fuel to Polygon Partnerships

R25, a platform linked with Ant Financial, selected Polygon as its preferred EVM partner. The company launched rcUSD+, a yield-based stablecoin backed by money-market assets. It reflects a growing trend across Asia, where tokenised funds and stablecoins are attracting greater interest.

The platform also reported increasing activity in stablecoin flows tied to the Japanese Yen. These updates strengthen Polygon partnerships in Asia and bring fundamental tools for cross-border finance.

Conclusion

Polygon partnerships tell a clear story in 2025. Revolut’s rising transaction volume, Mastercard’s verified wallet system, and Calastone’s tokenised fund operations show real demand for scalable blockchain rails. These moves support a shift in which global finance gradually uses public networks for daily operations.

Polygon continues to build trust with institutions that once relied only on traditional systems. If this pace continues, adoption may grow even faster in 2026.

Glossary

- POL: The native currency of Polygon is used for staking and fees

- Stablecoin: A token linked to a stable value, such as the US dollar

- On and Off Ramp: A tool that lets users convert between fiat and crypto

- Tokenised Fund: A fund that issues shares directly on the blockchain

- Alias ID: A verified username used instead of long wallet addresses

FAQs About Polygon Partnerships

Q1. Why are institutions choosing Polygon

They value low transaction costs, fast settlement, and strong EVM compatibility.

Q2. How much volume did Revolut process through Polygon

Revolut recorded more than 690 million dollars in activity across transfers and trading.

Q3. What does Mastercard’s alias system do

It converts long wallet addresses into short verified usernames.

Q4. Does Calastone use Polygon for all fund activity

Calastone uses Polygon for tokenised fund distribution while keeping its core system.