This article was first published on Deythere.

An unusual occurrence in blockchain activity has shown that Polygon overtakes Ethereum in fees for the first time ever as decentralized applications process huge volumes of transactions on both networks.

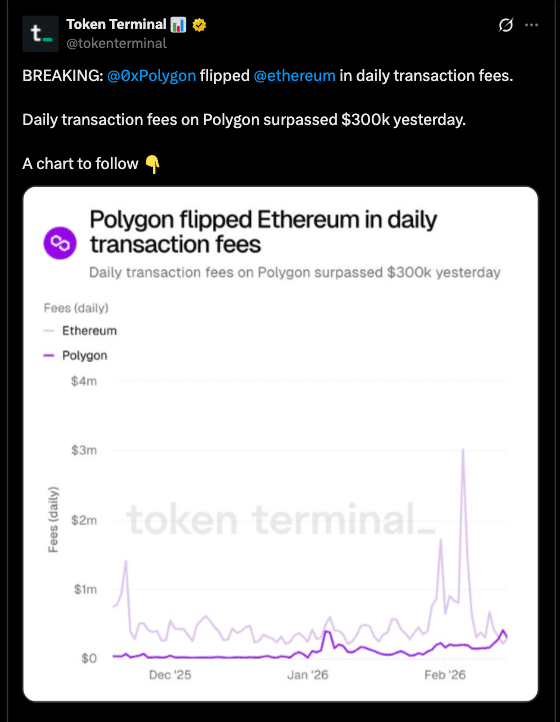

Data from Token Terminal shows that more daily transaction fees were being spent on Polygon than Ethereum, generating $407,100 vs. $211,700 (nearly double), respectively.

This rare occurrence was mostly driven by a surge in activity on the prediction market platform Polymarket, which saw over $15 million wagered on a single Oscars betting category during one weekend, creating unexpected fee income on the Polygon network.

Fee Race Update: How Polygon Overtakes Ethereum

For the first time in history, Polygon, the Layer-2 networ,k actually generated more in daily fees than Ethereum, something that was previously considered impossible because of Ethereum’s well-established ecosystem and an increase in its use.

On Friday, February 13, 2026, transaction fees on Polygon came in at around $407,100 with Ethereum standing at approximately $211,700. This is a first in the history of blockchain fee metrics and indicates a change in how transactions are being used.

The surge was said to have been fueled by Polymarket where heavy betting action, including more than $15 million in Oscars wagers, pushed the trading activity to extraordinary levels. In seven days, Polymarket alone generated over $1 million in fees, making up a large majority of the fee revenue on Polygon.

Low transaction cost also contributed to this. Polygon’s average fee on transactions is about $0.0026 compared to about $1.68 on Ethereum.

What This Means for Blockchain Today

Experts are of the opinion that the fact that Polygon overtakes Ethereum in fees shows real network demand. Though Ethereum continues to lead in total economic value and developer ecosystem, the surge in Polygon fees shows that activity-driven demand, especially from applications with high transaction counts ,can flip traditional hierarchies, even if it is temporary.

Price and Market Reaction

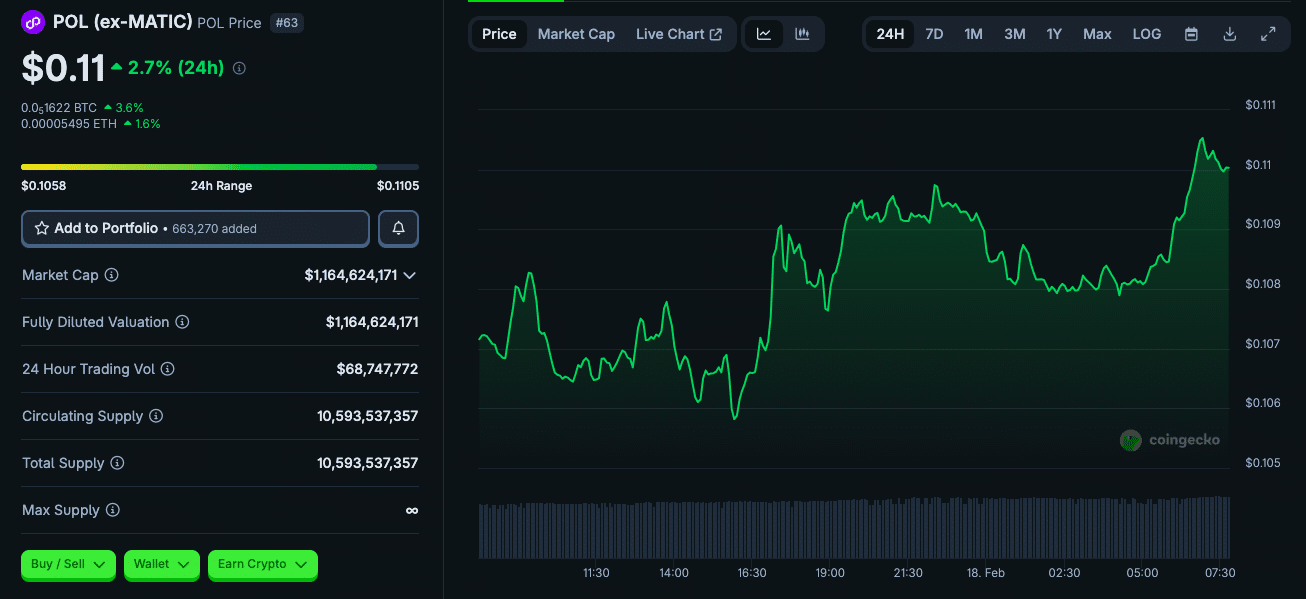

Despite this record high level of surplus fees, POL’s pricing response has been relatively modest.

Over the past week, the token climbed roughly 15%, pushing from the $0.09 range to settle around $0.11 at press time. POL moved within a steady upward range, which means buyers were still in control.

From what the market currently is showing, the token looks to be consolidating at recent price levels, not climbing in value.

Analysts caution that while fees reflect the usage, price action will be influenced by overall liquidity and investor sentiment as well as tokenomics beyond fee revenue.

Market chatter on social channels also imply that higher fees do not mean a price spike is imminent, particularly if fees are being driven by stablecoin transactions rather than spending of POL tokens.

Polygon’s token burn numbers have been picking up as well, with more token burns in January corresponding to a greater transaction volume. This, however, hasn’t led to sustainable fee-driven price pressure, proving the point that fee dominance and price movement are related but distinct phenomena..

The Big Picture: Layer-2 Networks and Adoption Changes

Though Polygon overtakes Ethereum in fees at the moment, it still shows a trend about how users interact with blockchain networks. Layer-2 solutions like Polygon provide cheaper, faster settlement and are better-suited for retail adoption, micro-transactions or high-frequency use cases such as gaming or prediction markets.

This has led to intense usage that in rare cases outstrip Ethereum in short-term metrics like profits.

These effects just show the importance of application-driven growth, especially in ecosystems where transactions are numerous but individually small.

If network structures can enable such diverse use cases, from prediction markets to payments and lightweight transfers, short-term network rankings can change even though most of the value may in the long term remain in larger base layers.

Conclusion

Polygon shocked the world as it surpassed Ethereum in terms of daily transaction fees, mostly riding on Polymarket activity and microtransactions.

This shows the potential of real usage patterns, particularly those of higher-frequency decentralized applications, to affect revenue metrics even in a context known for being ruled by base layer networks.

Even if ETH remains ahead overall when it comes to ecosystem size and economic value, the spike in Polygon’s fees provides a view of network behavior where application engagement and low costs can reverse the dominance along certain metrics.

Glossary

Polygon: Layer-2 blockchain scaling solution for Ethereum known to keep transaction fees low and speeds high.

Ethereum : this is the biggest smart contract platform by market cap and size of its ecosystem.

Polymarket: A decentralized prediction market platform built on Polygon.

Daily Fees: The sum of fees that a blockchain network has collected in the last 24 hours, indicating usage volume.

Layer-2 Network: Additional layers on top of a main blockchain (Layer-1) to improve scalability and reduce transaction fees.

Frequently Asked Questions About Polygon Overtakes Ethereum

What does it mean that Polygon overtakes Ethereum in fees?

It was the first time in history that Polygon generated more in daily transaction fees than Ethereum and an effectively unexpected outcome, due to network congestion on applications like Polymarket.

Is Polygon now bigger than Ethereum?

Not in total economic size. Ethereum continues to dominate in the total value locked, developer activity and long term ecosystem adoption. The fee flip is a short-term game, not long-term dominance.

Why did Polymarket add so much to Polygon’s fees?

Polymarket had more than $15 million in wagers on a bet relating to one Oscars category, at volumes of transactions that generated fees.

Could this affect POL price in a long-term perspective?

Fees spikes do not really translate to real usage, but longer-term price movement is determined by broader market liquidity, demand and tokenomics. The price has so far been fairly unresponsive to the fee jump.

References