Plasma has taken a decisive step into Europe with a Virtual Asset Service Provider license through an Italian entity and a new office in Amsterdam. The company says the expansion will anchor a regulated, stablecoin native payments stack that can handle settlement, custody, and eventually card issuance across the bloc.

The timing aligns with the Markets in Crypto Assets regime taking hold, where licensing and compliance shape who can compete at scale. The strategy is straightforward. Build in public, secure permissions, and prove that stablecoins can serve everyday commerce rather than speculative churn.

The firm is also preparing applications under MiCA and for an Electronic Money Institution authorization. That combination would allow issuance, transfers, and embedded finance features that mirror traditional payments.

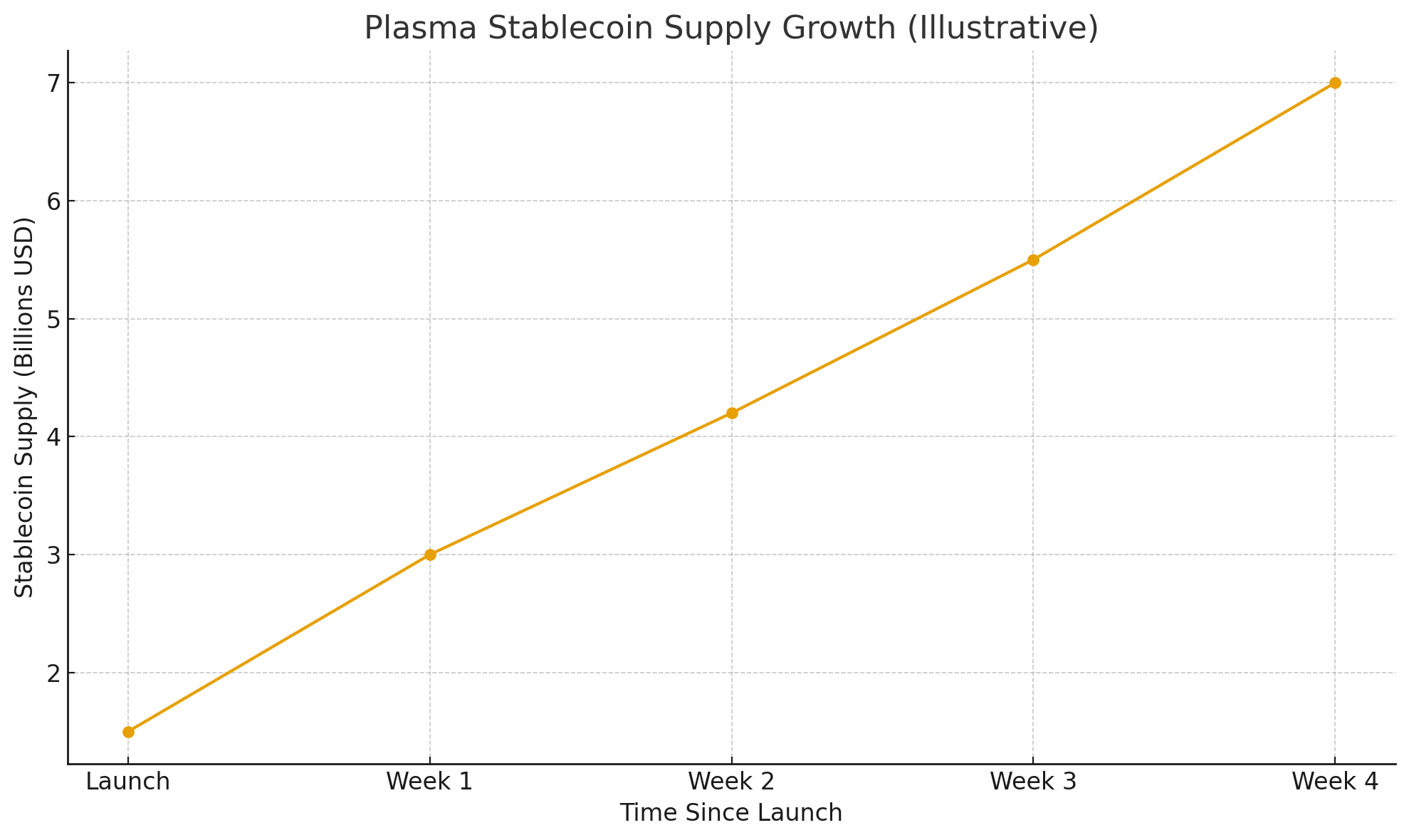

Early traction helps. Plasma reported billions of dollars in stablecoin deposits within weeks of public launch, quickly ranking among the largest chains by stablecoin supply. The signal is that regulated rails can attract flow if latency is low, fees are near zero, and custody options are clear.

Why a VASP License Matters Now

The VASP license unlocks a regulated footprint inside the European Union. It gives supervisors a point of accountability, and it gives businesses a clear counterparty. Under MiCA, firms that custody, trade, or facilitate stablecoin transfers must meet governance, capital, and disclosure standards. Executing on that list is not glamorous, but it is what makes a payments network bank-grade.

Plasma’s choice of Amsterdam reflects a familiar playbook. Use a hub with deep financial services talent, connect to European corridors, and scale with local hires in compliance and risk.

The European policy backdrop is also shifting in favor of clarity. Officials have said repeatedly that MiCA is designed to address stablecoin risks while allowing compliant innovation. As one European Commission spokesperson told Reuters,

“We believe MiCA provides a robust and proportionate framework for addressing risks stemming from stablecoins.”

That line sums up the opportunity for licensed players and the boundary for the rest.

Market Context and Signals to Watch

Stablecoins continue to sit at the center of crypto market structure. They are the cash leg for tokenized assets, the bridge for exchanges, and the settlement rail for cross border flows. European policymakers have warned that unregulated stablecoins can break parity during stress, which is why redemption, reserve, and disclosure rules are tightening.

In March, the European Central Bank highlighted how some stablecoins deviated from par and why strong oversight is needed. “Given the regulatory and supervisory vacuum in which these operate, some stablecoins can fail to maintain their intended stability,” the ECB noted. That is the problem MiCA means to fix.

Plasma’s early growth is notable in that context. Reports indicate stablecoin supply on the network crossed the multi billion dollar mark within days, placing it quickly into the top cohort by stablecoin capitalization.

Rapid supply growth does not guarantee durable demand, but it suggests a fit for high speed transfers and programmatic payouts where fees and finality matter. The near term test will be whether enterprise users continue to migrate payment flows off legacy rails in favor of tokenized money with granular controls.

Building a Stablecoin Payments Stack

Plasma describes its network as a purpose built Layer 1 for stablecoins, optimized for near instant and fee free transactions. If the firm secures an EMI license alongside MiCA permissions, it can stitch together issuance, custody, merchant acceptance, and cards in a single regulated stack. The commercial upside is obvious.

Lower costs for remittances, faster settlement for marketplaces, and programmable disbursements for platforms that run thousands of small payments per day. The regulatory lift is heavy, but the prize is a defensible moat based on licensure rather than a race to the lowest fee.

Industry voices have framed the stakes clearly. Fabio Panetta of the European Central Bank warned this year that poorly regulated crypto services can harm trust in banks and called for close supervision of stablecoins to prevent confusion with bank money. The takeaway for new entrants is simple. Operate under rules that make your liabilities crystal clear, or risk being sidelined by supervisors and counterparties.

The Futuristic Edge: What Changes by 2026

If the licensing roadmap holds, the near future looks less like speculative crypto and more like embedded payments. Card terminals, marketplace payouts, and payroll experiments could run on stablecoins without the consumer ever seeing a wallet. Tokenized euros and dollars would move under the hood, with receipts and audits living on chain for compliance teams.

A regulated stack also invites new risk tools. Real-time reserve attestations, circuit breakers during market stress, and programmable settlement windows can make stablecoin money behave like enterprise-grade infrastructure rather than a black box. The likely competitive field by 2026 includes banks issuing tokenized deposits, fintechs running stablecoin corridors, and networks like Plasma providing the plumbing.

Industry Impact and Competitive Landscape

The entrance of licensed payment chains pressures both crypto natives and incumbents. For crypto firms, the bar rises to bank style compliance and uptime. For banks and processors, the cost curve shifts as tokenized settlement collapses reconciliation cycles and reduces chargeback disputes. Europe’s stance is increasingly firm.

Stablecoins can operate, but they must meet the same high standards as domestic providers. As ECB President Christine Lagarde argued, foreign issuers should face equal rules to avoid regulatory arbitrage and runs on EU based reserves. That is the broader frame around Plasma’s move. Build to the same standard as everyone else and make speed, price, and developer experience the differentiators.

Public commentary has echoed the compliance-first theme. Plasma’s community posts have highlighted rapid growth and partnerships, while independent researchers have noted the scale of early deposits and the focus on payments rather than trading. One community message captured the tone simply, “The future is bright,” after reporting billions of dollars in stablecoin supply within days of launch. The optimism is not universal, but it is clear enough that regulated rails are winning attention from both enterprises and developers.

Conclusion

Plasma’s VASP license and Amsterdam launch do not guarantee dominance, but they show where the market is heading. Payments will reward speed and certainty, and regulators will reward firms that accept clear rules. If the firm secures MiCA and EMI permissions, the platform can operate a full stack for stablecoin settlements across Europe. The experiment to watch is whether enterprises treat stablecoins as everyday plumbing. If they do, the winners will be the networks that combine compliance, uptime, and developer convenience at scale.

Frequently Asked Questions

What is a VASP license and why does it matter

It is authorization for virtual asset service providers in Europe. It allows a firm to operate under supervision, which is essential for payments and custody in the EU.

What is MiCA and how does it affect stablecoin payments

MiCA sets EU wide rules for crypto issuance and services, including stablecoin oversight, reserve, and disclosure requirements. It creates a unified compliance framework.

Why open an office in Amsterdam

Amsterdam offers fintech talent, payment expertise, and access to European corridors. It is a common base for firms scaling regulated services across the bloc.

How large is Plasma’s stablecoin footprint today

Reports show multi billion dollar stablecoin supply within weeks of launch, placing the network in the upper tier by stablecoin capitalization.

What risks remain

Execution risk on licensing, competition from banks and fintechs, and policy shifts around reserves and redemptions. ECB and Commission officials have called for strict safeguards.

Glossary of Long Key Terms

Markets in Crypto Assets regulation

A European Union rulebook that governs issuance and services for crypto assets, including stablecoins, with requirements for authorization, reserves, and disclosures.

Electronic Money Institution license

An authorization that allows issuance of electronic money and related payment services in the EU. It enables wallet balances, card programs, and merchant acquiring under supervision.

Stablecoin supply

The total circulating value of fiat pegged tokens on a network. Rapid changes in supply can indicate adoption or stress, depending on reserve quality and redemption mechanics.

Tokenized deposits

Bank liabilities represented on a ledger that settle like crypto assets but remain inside the banking system. Seen as a potential competitor to privately issued stablecoins.

Settlement rail

The technical and legal infrastructure that moves value between parties. In a stablecoin system this includes issuance, transfer rules, and redemption guarantees under license.