The crypto community is once again on high alert, this time turning its attention to Pi Network, a project that once captivated millions with its mobile mining model. Concerns are now mounting over centralization, transparency, and questionable practices, which have prompted comparisons to Terra Luna’s infamous downfall.

- Analysts Sound the Alarm on Pi Network’s Token Structure

- Pi Network Attempts to Reassure With Decentralization Promises

- KYC Automation and Privacy Risks Add to the Debate

- Reality Check: Are Pi Network’s Users Actually Active?

- How Close Is Pi Network to a Tipping Point?

- Pi Network Supply Overview

- Conclusion

Analysts Sound the Alarm on Pi Network’s Token Structure

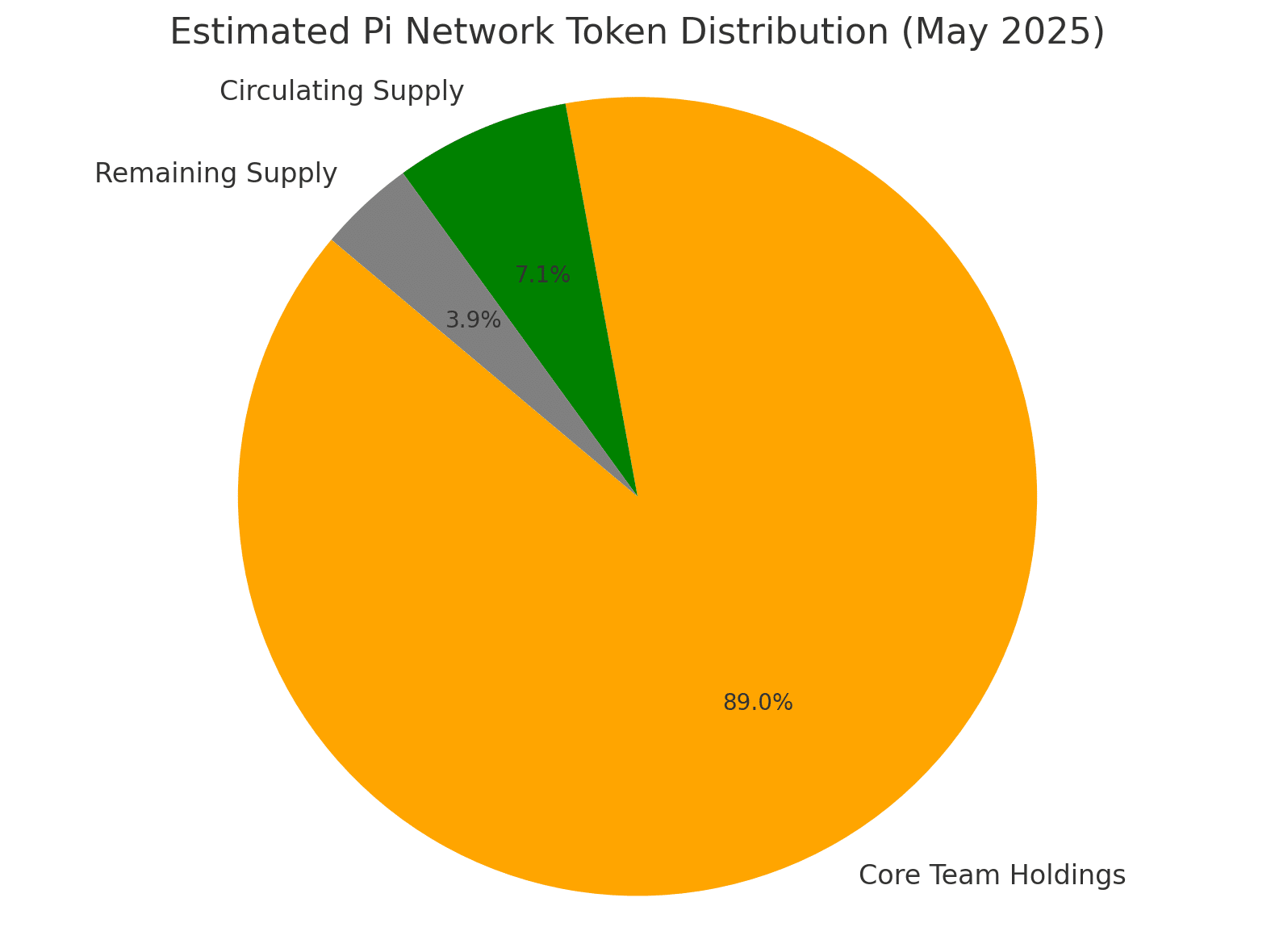

A growing number of industry voices are raising red flags about Pi Network’s internal mechanics. Reports reveal that out of the 100 billion tokens projected in the supply, a staggering 89 billion remain under the control of the project’s core development team. With only a small portion—approximately 7.1 billion, in actual circulation- critics fear that Pi may be sitting on a ticking time bomb.

This level of centralization is sparking fears of a sudden flood of tokens hitting the market, a scenario eerily reminiscent of Terra Luna’s hyperinflation and catastrophic value wipeout in 2022. While Pi Network hasn’t yet opened public trading on major exchanges, some experts believe the potential for manipulation remains high if these tokens are ever released without safeguards.

Pi Network Attempts to Reassure With Decentralization Promises

In response to growing scrutiny, the Pi team announced two major initiatives. First, they plan to shut down their central operational node to give more control to the community. Second, they intend to open-source the project’s codebase, which would, in theory, allow developers and users to inspect and contribute to the protocol.

These announcements were strategically timed with the Consensus 2025 conference, where Pi Network aims to redefine its image and roadmap in front of the global crypto industry. While these moves are framed as steps toward decentralization, many believe they are reactionary rather than visionary.

KYC Automation and Privacy Risks Add to the Debate

Another point of concern revolves around Pi Network’s integration of AI-based tools for its Know Your Customer process. Some users were surprised to find that ChatGPT-powered tools had been employed in parts of the identity verification process. While AI might seem efficient, privacy advocates argue that the implementation lacked transparency and adequate disclosure.

With over 60 million users reportedly signed up to Pi Network, questions remain about how securely that data is stored and whether it complies with international data protection laws.

Reality Check: Are Pi Network’s Users Actually Active?

Despite boasting massive registration numbers, actual user engagement on the platform appears to be far lower. On-chain data and app usage statistics indicate that only a small fraction of Pi Network’s user base is actively participating. Many users have grown frustrated by the lack of liquidity and the long delay in enabling token transfers.

In the absence of real trading activity, the value of Pi remains speculative and largely community-driven. Peer-to-peer trades taking place in informal markets have pegged the token’s value anywhere from 20 to 40 dollars, but established exchanges or price tracking services verify none of these figures.

How Close Is Pi Network to a Tipping Point?

With decentralization promises, delayed utility, and centralized holdings, Pi Network seems to be walking a fine line between promise and peril. The crypto market has seen projects with strong narratives but weak fundamentals falter before. Terra Luna was one such project that had both institutional backing and widespread community belief, until it collapsed under the weight of unsustainable tokenomics.

Now, the spotlight is on Pi. Can it transition into a truly decentralized ecosystem and prove its long-term utility? Or will it remain a speculative mobile mining app with a loyal but increasingly skeptical community?

The coming months, especially any updates shared post-Consensus 2025, will be crucial in answering these questions.

Pi Network Supply Overview

| Metric | Estimate |

|---|---|

| Total Token Supply | 100 Billion |

| Circulating Supply | 7.1 Billion |

| Core Team Holdings | 89 Billion |

| Estimated OTC Price | $20–$40 (Unofficial) |

| Reported User Signups | 60+ Million |

| Estimated Active Users | Significantly lower |

Conclusion

Pi Network sits at a critical junction. The project has managed to capture the imagination of millions worldwide but now faces legitimate concerns about its structure and transparency. While its core team is taking steps to address these issues, time is of the essence. Trust in crypto is hard-earned and easily lost.

Whether Pi Network evolves into a robust decentralized platform or fades into obscurity may ultimately depend on how it handles the next phase of its journey.

Frequently Asked Questions FAQs

What is the controversy surrounding Pi Network?

The core issue is centralization. The development team reportedly holds about 89% of Pi’s token supply, raising fears of manipulation.

Is Pi Network a legitimate crypto project?

It is a real platform with a large user base, but it lacks critical features like open trading and a fully decentralized network, which limits its credibility.

Can you trade Pi Network tokens?

Currently, Pi tokens cannot be traded on major exchanges. Some OTC peer-to-peer trades exist, but they are unofficial and carry risks.

Glossary

Decentralization: A system where control is distributed among many users, not concentrated in a central authority.

OTC (Over-the-Counter): Direct peer-to-peer trading that happens outside centralized exchanges.

KYC (Know Your Customer): A regulatory process requiring identity verification to prevent fraud and money laundering.

Consensus 2025: A major crypto industry event where key blockchain projects make announcements and network with investors.