Based on the latest industry developments, PayPal is getting deeper into cryptocurrency by allowing US users to send and receive Bitcoin, Ethereum and its own stablecoin PYUSD through peer-to-peer (P2P) payments. New features like “PayPal Links,” a shareable one-time link for payments, are being added along with Venmo integration and support for external crypto wallets.

This PayPal crypto P2P expansion comes as demand for cheaper, more efficient cross-border transfers grows and the world is pushing to modernize remittances and reduce payment costs.

What PayPal is Doing Now

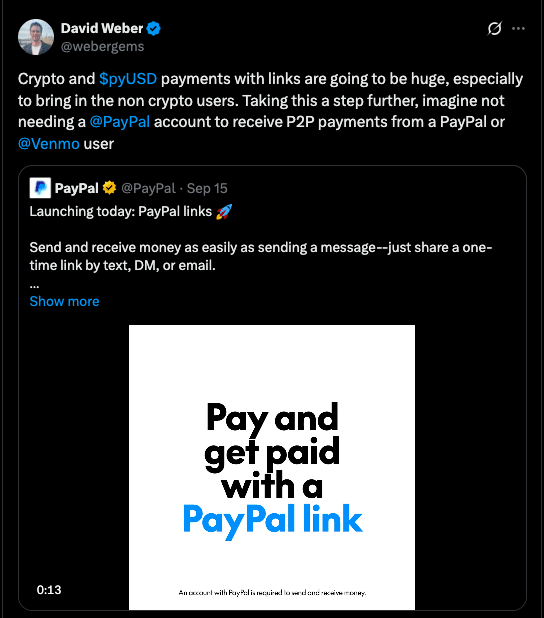

From mid-September 2025, PayPal started rolling out a feature that allows US users to generate personal payment links (“PayPal Links”) that support cryptocurrency transfers. These include Bitcoin, Ethereum, PYUSD and other supported digital assets.

Users will be able to send money through these links via chat, email, SMS or text to PayPal, Venmo or compatible crypto wallets.

Crucially, P2P transfers between friends or family via these tools are exempt from IRS tax reporting requirements under 1099-K rules. This PayPal crypto P2P expansion will be US-only for now and will expand to international markets (UK, Italy, etc.) later.

Also read: Could PayPal’s PYUSD Expansion Revolutionize Global Payments?

Why This Matters

PayPal is making it easier for users who aren’t crypto traders to send money. The inclusion of stablecoins like PYUSD means PayPal expects these assets to play a role in payments, not just investment. Meanwhile, cross-border remittance costs are still high globally.

According to World Bank data, the average cost to send $200 in remittances is around 6.49%. Stablecoin-based rails can reduce this cost to under 3% or even to cents per transfer in some cases.

Like Binance Pay and Bybit Pay, Kraken crypto exchange recently launched the ‘Krak’ for worldwide payments. But all these platforms allow a pool of assets, including stablecoins from USDC to USDT. For P2P, it was unsure whether rival stablecoins besides PYUSD would be supported.

Yet David Weber, the head of PYUSD, said it would“bring in non crypto users.” PYUSD is sitting as the tenth largest stablecoin by market capitalization ($1.25B). USDC stands at number two with $72B, and USDT tops the list with $170B.

Since the passing of the stablecoin law, the GENIUS Act, the market has almost reached a total of $290 billion for the first time, with about a +$40 billion growth within the timeframe.

Stablecoins vs Legacy Rails

Stablecoins have several advantages over traditional payment networks. Traditional systems require multiple intermediaries, only work during banking hours and have slower settlement times. Stablecoin rails offer near-instant settlement (including outside normal hours), transparency, programmability and much lower fees.

Fintech and payment infrastructure reports show that for many cross-border corridors, stablecoins reduce the time and cost dramatically.

Regulatory clarity and institutional infrastructure are increasingly cited as enabling factors for stablecoin adoption, especially in regions underserved by traditional banking.

Risks, Limitations, and What to Watch

There are still risks and limitations to PayPal crypto P2P expansion. One is regulatory oversight of stablecoins; PayPal must comply with financial, KYC/AML and possibly securities-like regulations. Another is user education and security: sending crypto is irreversible and mistakes or fraud could erode trust.

Market volatility of crypto assets could expose senders and receivers to price swings. Also expansion beyond the US will require adapting to different jurisdictions’ regulations which may slow roll-out and adoption.

Finally, infrastructure readiness (wallet compatibility, crypto-fiat on/off ramps) will determine how seamless the experience is for users globally.

Also read: PayPal’s PYUSD Stablecoin Bridges to Cardano: A Leap in Blockchain Interoperability?

Conclusion

Based on the latest research, PayPal’s move to add Bitcoin, Ethereum and stablecoins to its P2P payments via PayPal Links is a big step in mainstreaming crypto payments. By reducing friction, lowering cost and adding convenience, this may help shift public perception of crypto from speculative asset single-use to everyday utility.

As PayPal expands globally, its success could change how money is sent, locally and cross border.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

PayPal is adding crypto and stablecoins to its P2P payments, including Bitcoin, Ethereum and its own PYUSD via PayPal Links. Sending and requesting money via chats, texts or email is now more seamless, small personal transfers are tax-reporting-exempt.

Glossary

Peer-to-Peer (P2P) Payments – Sending money directly between individuals without intermediaries.

Scalar Stablecoin (PYUSD) – PayPal’s stablecoin, pegged to the U.S. dollar.

Legacy Payment Rails – Traditional financial systems (banks, correspondent networks) used for transfers and remittances.

Settlement Time – Time until a transaction is final and cannot be reversed.

Remittance Fee – Cost charged to send money across borders, often high due to FX costs, intermediaries and regulations.

FAQs about Paypal Crypto P2P Expansion

Will using crypto via PayPal Links trigger taxes?

Reports claim personal transfers between friends/family using crypto are exempt from 1099-K in the U.S., so gifts or shared expenses won’t generate tax forms.

Does this mean merchants will accept PYUSD everywhere?

This P2P expansion is focused on individuals sending crypto. Merchant acceptance will come later.

Are cross-border transfers cheaper with stablecoins?

Yes, in many corridors. Remittance data shows legacy fees are 6.5% on average. Stablecoins can reduce that, sometimes by a lot.

When will this roll out to other countries?

PayPal says after the U.S. rollout; U.K., Italy and others are next, possibly by the end of the month.