In Washington, the argument over who should police digital assets is back at the center stage, and the SEC vs CFTC rivalry is sharper than ever. After the House approved the Digital Asset Market Clarity Act earlier this year, two new Senate drafts now aim to define who oversees what in the United States crypto market. Together, they attempt to turn a long-running SEC vs CFTC dispute into a stable rulebook for exchanges, issuers, and investors, rather than another round of regulation by lawsuit.

Agriculture Committee Draft: CFTC Grabs The Spot Market Wheel

The first draft, issued by the Senate Agriculture Committee, zeroes in on so-called digital commodities. Under this proposal, spot markets for assets such as Bitcoin would sit primarily under the Commodity Futures Trading Commission, widening that agency’s mandate over platforms that list and trade these tokens. For years, unclear SEC vs CFTC boundaries have discouraged some institutional players from entering the market, especially as high-profile enforcement actions created the sense that many tokens could be reclassified overnight.

The Agriculture text would require platforms that handle digital commodities to register, segregate customer assets, and work with qualified custodians. The structure resembles established commodity venues, with clearer expectations for capital, governance, conflict management, and surveillance across order books. In practice, this recalibrated SEC vs CFTC split could help exchanges expand listings while lifting basic safeguards for retail traders, although smaller firms may still feel the weight of higher compliance and technology costs.

Banking Committee Draft: Ancillary Assets And A Path Out Of “Security” Status

A second draft from the Senate Banking Committee tackles the gray zone where many tokens actually sit and deepens the SEC vs CFTC debate. It introduces the concept of an ancillary asset, a token sold through an investment contract that can evolve toward a more decentralized, commodity-like profile over time. Issuers would owe the Securities and Exchange Commission focused disclosures on distribution, governance, token economics, and conflicts of interest, while the agency faces a deadline to define when such assets move beyond securities treatment.

That timetable matters for the SEC vs CFTC balance. The draft would push the securities regulator to describe investment contracts and decentralization through formal rulemaking instead of relying mostly on enforcement actions. Under the framework analysts expect, Bitcoin remains a digital commodity under CFTC oversight, while enterprise-linked or actively managed tokens begin life in the ancillary asset lane until they can show that control has shifted to a broad community of validators and users.

Exchanges In The Crossfire

In practice, the largest centralized exchanges could end up living in both legal worlds at once. They may register as digital commodity platforms for spot markets while also coordinating with the SEC on listings that fall into the ancillary asset or full securities category. Investors who follow the SEC vs CFTC story see in this architecture a tentative path from early-stage token offering to a mature, widely held asset class, with clearer milestones for disclosure, custody standards, and market structure.

Global Competition And The Quest For Clarity

The international backdrop raises the stakes. Jurisdictions that introduced comprehensive regimes for stablecoins, exchanges, and token issuers already present regulatory clarity as a competitive advantage for capital and talent.

If the United States remains stuck in an unresolved SEC vs CFTC dispute, developers may continue to build core infrastructure in friendlier markets, while domestic users depend on offshore venues for liquidity and leverage. The Senate drafts try to answer that risk by pairing broader CFTC spot authority with a more predictable SEC disclosure lane for project teams.

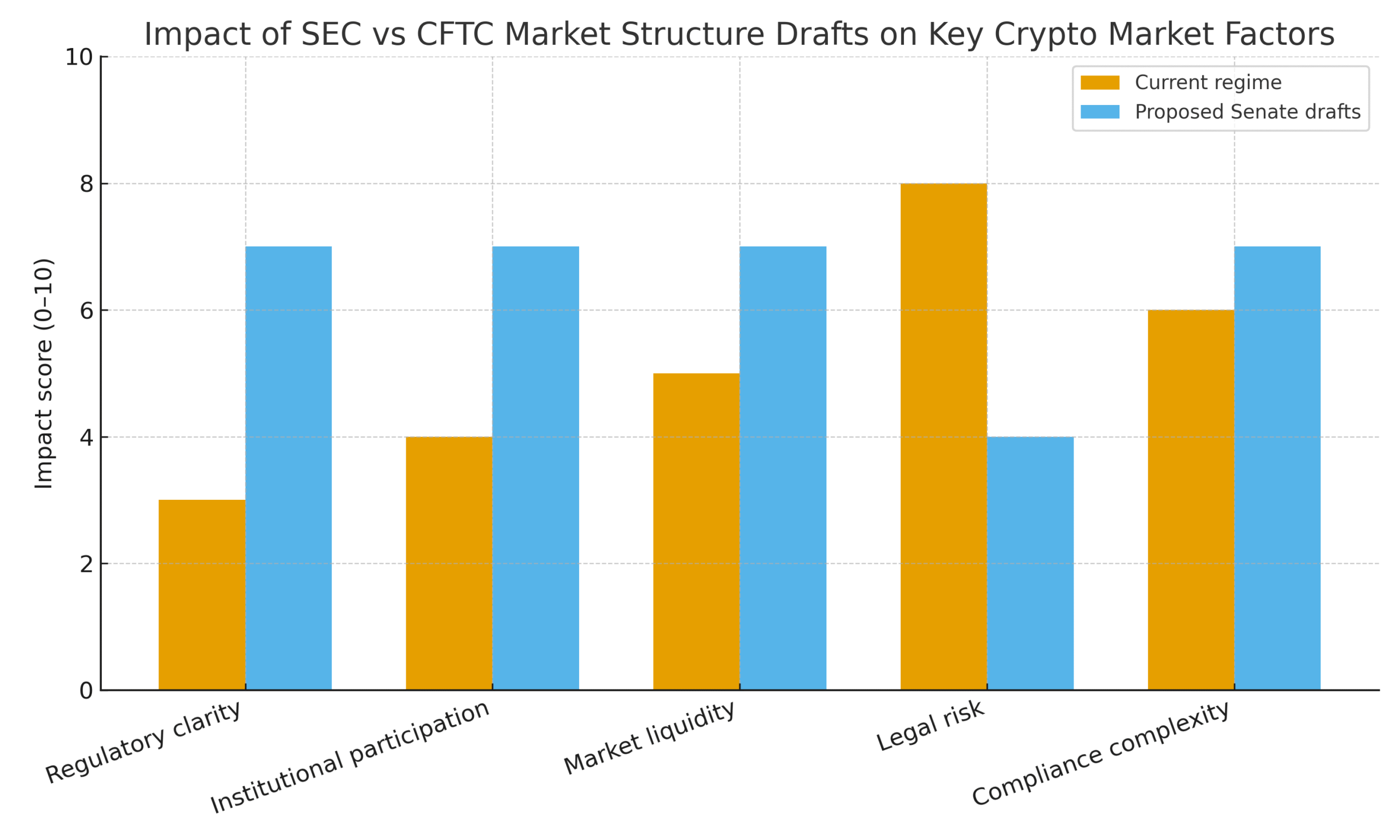

For crypto holders, this is not a theoretical exercise. A durable settlement of the SEC vs CFTC question could mean more consistent listing standards, stronger asset safekeeping, and clearer routes for redress in the event of fraud or failure.

It also shapes key indicators that traders track every day, from onshore liquidity and ETF depth to volatility around enforcement headlines and delisting risk. In simple terms, regulatory clarity feeds directly into liquidity, spreads, and long term participation in flagship assets such as Bitcoin and Ethereum.

Conclusion

The latest Senate proposals rank among the clearest efforts so far to turn the SEC vs CFTC rivalry into a functional map for U.S. crypto markets. By expanding CFTC oversight of digital commodities and pressing the SEC to write stable rules for ancillary assets, lawmakers are trying to move from case by case battles to transparent categories that the industry can understand and model. Whether these drafts move swiftly or stall in negotiation, they send a strong signal that regulatory clarity has become a core pillar of any serious digital asset strategy in the United States.

Frequently Asked Questions

Q1: Does this mean Bitcoin is now officially a commodity in the United States?

A1: The new drafts reinforce the idea that Bitcoin sits in the digital commodity bucket under CFTC oversight, but they are still proposals. Until a final law is passed and implemented, agencies and courts will continue to rely on existing statutes and prior guidance.

Q2: What changes for altcoins and newer token projects?

A2: Many newer tokens would likely be treated as ancillary assets at launch, with tailored disclosures and ongoing obligations to the securities regulator. As networks decentralize and governance spreads out, projects could seek treatment more in line with commodities, but that path would depend on detailed rules that have not yet been finalized.

Q3: How could this affect major crypto exchanges?

A3: Large exchanges may need to satisfy both securities and commodities style requirements. That could include registering certain activities with the CFTC, strengthening custody and surveillance controls, and aligning listing reviews with whatever disclosure regime the SEC adopts for ancillary assets. Operational complexity rises, but so does the potential for more predictable oversight.

Q4: Are decentralized finance protocols covered here?

A5: DeFi remains one of the most contested areas. The drafts acknowledge the issue, but many details are left for later rulemaking and consultation. That means protocol teams and liquidity providers still need to monitor how future guidance interprets concepts such as control, front ends, and governance tokens.

Glossary of Key Terms

Digital commodity: A digital asset, such as Bitcoin, treated more like a commodity than a security, often with trading overseen by the CFTC.

Ancillary asset: A digital token tied to an investment contract at launch that may evolve toward a more decentralized, commodity like profile as control spreads across a network.

CFTC (Commodity Futures Trading Commission): The U.S. agency responsible for overseeing derivatives and, under the new drafts, many spot markets in digital commodities.

SEC (Securities and Exchange Commission): The U.S. agency that regulates securities markets, issuer disclosures, and many token sales that fall under investment contract rules.

Decentralization certification: A proposed process through which a project could demonstrate that no single party controls the network, potentially shifting its token out of securities style treatment.