NEAR Protocol is a sharded layer-1 blockchain designed for scalability and AI applications. It uses Thresholded Proof-of-Stake (TPoS) and Nightshade sharding to process thousands of transactions per second. NEAR is also EVM compatible via the Aurora layer so development can migrate from Ethereum. The network has fast finality (1 second blocks) and low fees.

On chain activity for NEAR records that Q4 2024 saw 7.9% QoQ growth in daily transactions and 15.8% growth in active addresses, showing increasing adoption. These fundamentals along with its tokenomics (5% annual inflation mostly to validators, 70% of fees burned) are set to impact NEAR Protocol price prediction 2025 in the long run.

Recent Developments

NEAR’s roadmap and ecosystem updates can impact its price. In late 2024; the protocol launched cross-chain bridges and tools: notably, a TokenBridge to Solana went live on July 25, 2024; and Chain Signatures (launched March 2024) now enable NEAR accounts to sign transactions on Bitcoin, Ethereum, Dogecoin, XRP and soon Solana and TON.

These features improve interoperability and liquidity access. The NEAR Foundation is also focusing on AI integration: it introduced an AI Research Hub, AI Assistant, and hosted AI accelerator programs, while debuting NEAR Intents to let AI agents transact autonomously across chains.

Ecosystem partnerships (e.g. Penrose, Mountain Protocol, Wormhole) and continued development of sharding (aiming for 100+ shards) and account abstraction further bolster NEAR’s utility. Such advancements tend to attract users and capital, acting as bullish catalysts for NEAR Protocol price Prediction 2025.

NEAR Protocol Price Prediction 2025

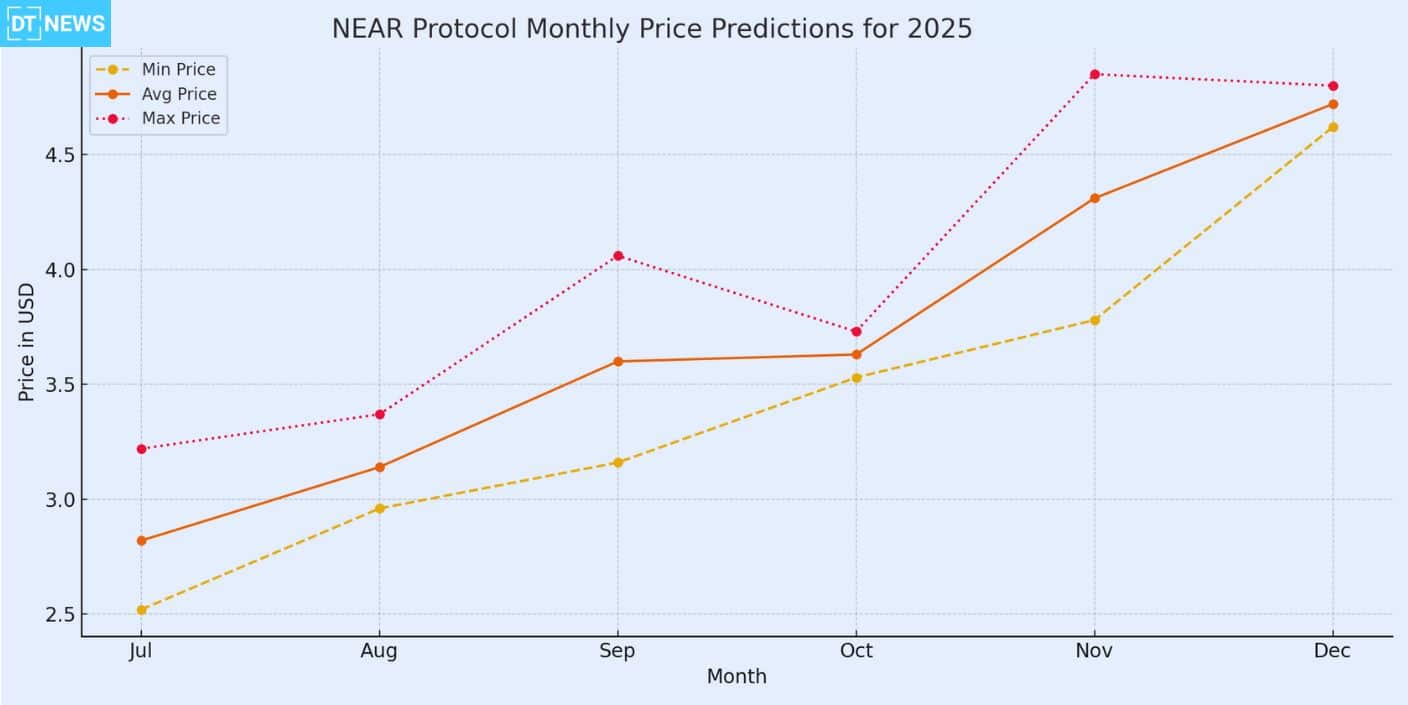

The table below summarizes NEAR Protocol Price Prediction 2025:

| Month | Min Price ($) | Avg Price ($) | Max Price ($) |

| Jul 2025 | 2.52 | 2.82 | 3.22 |

| Aug 2025 | 2.96 | 3.14 | 3.37 |

| Sep 2025 | 3.16 | 3.60 | 4.06 |

| Oct 2025 | 3.53 | 3.63 | 3.73 |

| Nov 2025 | 3.78 | 4.31 | 4.85 |

| Dec 2025 | 4.62 | 4.72 | 4.80 |

Annual NEAR Protocol Price Prediction

The table below summarizes the projections for NEAR Protocol Price in the near future

| Year | Potential Low ($) | Potential Avg ($) | Potential High ($) |

| 2025 | 1.95 | 4.34 | 9.00 |

| 2026 | 3.70 | 7.75 | 11.80 |

Expert Price Predictions

NEAR Protocol Price Prediction 2025 and 2026 ranges:

TradingView analysts: The analysis has the 2025 low/high projection range between $1.95–$9.00, with an average trading price of $4.34. Extending this to 2026, the projection low/high ranges between $3.70–$11.80. They project that if NEAR gets bullish (weekly close above $4.345) a retest of $8–9 by end 2025 is possible.

CoinStats : Similar figures are mentioned in a CoinStats summary: a 2025 high target of $9 and an even 2030 high of $71.78 (if the network grows).

BeInCrypto: Their technical-forecast table has 2025 forecasts of $1.90–$6.00 (min/max) with average $3.13. For 2026, they project $2.09–$6.60 (min/max) with an average of $3.44. This is a very gradual growth.

Algorithmic models (3Commas): Aggregate predictions (from AI/quant models like LiteFinance, TradingBeasts, WalletInvestor) are much flatter. One 3Commas compilation has NEAR Protocol Price 2025 ranging only $1.93–$2.04, which is almost no change. By mid-2026, their models still have NEAR at $2.00.

SwapSpace projection: The SwapSpace analysis notes a 2025 NEAR Protocol price of $2.87. It also flags volatility in 2026, citing a forecast of $4.35.

Overall, these range-wide forecasts are uncertain; bullish scenarios depend on adoption and market recovery, while conservative estimates assume modest growth.

Factors Affecting NEAR Protocol Price

NEAR’s future price depends on both crypto-wide and project-specific factors. They include:

Market sentiment and cycles: Like other altcoins, NEAR follows broader crypto trends. A bullish Bitcoin or macroeconomic easing could lift NEAR, a bear market could suppress it.

Adoption & network growth: Increased on-chain activity (transactions, DApps, TVL) will drive demand for NEAR tokens.

Supply dynamics: NEAR’s token supply is inflationary (5% annual) but the effective supply growth is being moderated by staking. These features can create scarcity pressure if demand rises.

Staking incentives: NEAR offers staking yields (8–9% nominal annual) to validators and delegators. Attractive yields can lock up tokens and reduce the circulating supply, which may support the price.

Regulatory and macro factors: Global regulations on crypto, interest rate changes and institutional flows can impact NEAR.

Whales: Large token holders (“whales”) can move NEAR’s price with big buys or sells.

Competition: Competing L1 blockchains (Ethereum, Solana, Avalanche, etc.) also impact NEAR. If NEAR’s AI and cross-chain features gain traction, it may take market share; otherwise, it will lag behind faster-growing competitors.

Overall it’s the interplay of growing demand (from adoption and new use cases) vs supply and market sentiment that will drive the future of NPrediction 2025.

Conclusion

Long-term NEAR price forecasts are mixed. Some experts see NEAR retesting multi-year highs ($8–9) by 2025 end if crypto markets hold up; and NEAR’s tech wins users. Others expect a steady climb to mid-single digits based on current metrics. Key drivers will be NEAR’s ecosystem growth; (staking participation, DeFi, new dApps) and macro-financial conditions.

If NEAR’s developments (AI tools and cross-chain bridges) gain traction; demand could push the price higher. If not; any loss of network momentum or a broad crypto downturn could slow gains. Investors should consider the wide forecast range (roughly $2–9 in 2025) and stay up to date on NEAR’s project news and market trends.

Summary

Combining ecosystem developments, technical trends and expert consensus. NEAR Protocol Price forecasts vary. Some analysts project $1.95–$9.00 in 2025 and $3.70–$11.80 in 2026; algorithmic sources more conservative. Monthly 2025 forecasts show a rise from $2.5 in July to $4.8 by December. Overall NEAR may reach mid-single digits in 2025 and strengthen in 2026 if the ecosystem executes and markets are kind.

FAQs

What is NEAR Protocol?

NEAR Protocol is a smart-contract blockchain platform for scalability and usability. It uses sharding (Nightshade) and Proof-of-Stake consensus for fast, low-cost transactions. NEAR has developer-friendly features such as easy account names, EVM compatibility via Aurora and is aiming for AI-powered applications (NEAR Intents and other AI initiatives).

What affects NEAR’s price?

NEAR’s price is influenced by network usage, adoption of its technology, and market sentiment. Increased demand for NEAR tokens occurs as more apps and users join the network (growing transactions, staking, TVL). Major protocol upgrades like new bridges or features can be bullish. Conversely, macro factors like crypto market cycles, regulation, and large token-holder actions can move the price in the other direction.

What do experts predict for NEAR in 2025 and 2026?

Some see NEAR at $6–9 by end 2025, others at $3–6. Algorithmic models see only a small move to ~$2. By 2026, price targets are $4–12 in various forecasts.

Can NEAR reach $10 by 2025?

$10 is above most 2025 targets, but not impossible. Many analysts see $8–9 as an optimistic end-of-2025 target.

Glossary

Layer-1 blockchain: base blockchain protocol (like NEAR; Ethereum) that processes and records transactions on its own network.

Sharding (Nightshade): a way to split the network into parallel shards (sub-chains) to increase throughput.

Proof-of-Stake (PoS): a consensus mechanism where validators stake (lock up) tokens to secure the network and validate transactions.

Chain Bridge / Interoperability: a bridge that allows tokens or data; to move between different blockchains.

TVL (Total Value Locked): total amount of assets (in USD) locked in smart contracts on a blockchain.

ROI (Return on Investment): percentage gain or loss on an investment.