Nobody does big Bitcoin moves better than MicroStrategy. The software intelligence company just doubled down on its title as the ultimate Bitcoin whale, splurging $1.1 billion to snag 10,107 BTC in its latest acquisition, the international media reported on Monday. This massive haul brings its total holdings to a jaw-dropping 471,107 BTC, with a cumulative cost of $30.4 billion. Yep, you read that right—billions.

- The Billion-Dollar Bitcoin Buy

- MicroStrategy’s Bitcoin Addiction: A Shopping Spree Timeline

- Why MicroStrategy Is Betting Big on Bitcoin

- A New Metric: Bitcoin Yield

- Is MicroStrategy’s Strategy Genius or Just Risky?

- What This Means for the Crypto Market

- Final Thoughts: The Future of Bitcoin and MicroStrategy

But what’s driving this seemingly insatiable Bitcoin hunger? Let’s break it down, human-style, and dig into how MicroStrategy has become the poster child for corporate crypto dominance.

The Billion-Dollar Bitcoin Buy

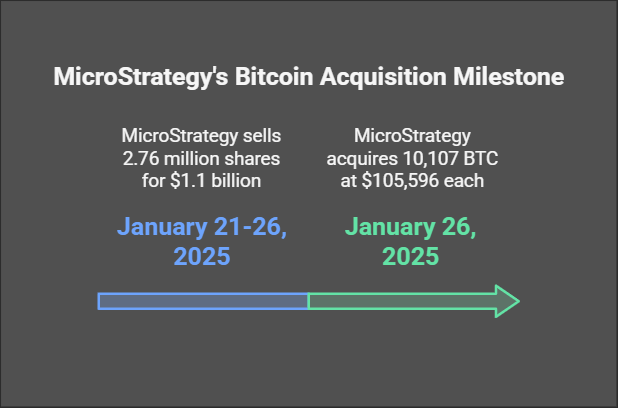

Between January 21 and January 26, 2025, MicroStrategy sold 2.76 million shares of its Class A common stock, raking in $1.1 billion in net proceeds. Instead of pocketing the cash or reinvesting in traditional ventures, the company went all in on Bitcoin. At an average price of $105,596 per BTC (including fees), the purchase added another 10,107 coins to their digital treasure chest.

Michael Saylor, the executive chairman and vocal Bitcoin evangelist, couldn’t help but boast about this milestone on X (formerly Twitter). “MicroStrategy has acquired 10,107 BTC for ~$1.1 billion at ~$105,596 per bitcoin and has achieved BTC Yield of 2.90% YTD 2025. As of 1/26/2025, we hodl 471,107 $BTC acquired for ~$30.4 billion at ~$64,511 per bitcoin,” he tweeted.

MicroStrategy’s Bitcoin Addiction: A Shopping Spree Timeline

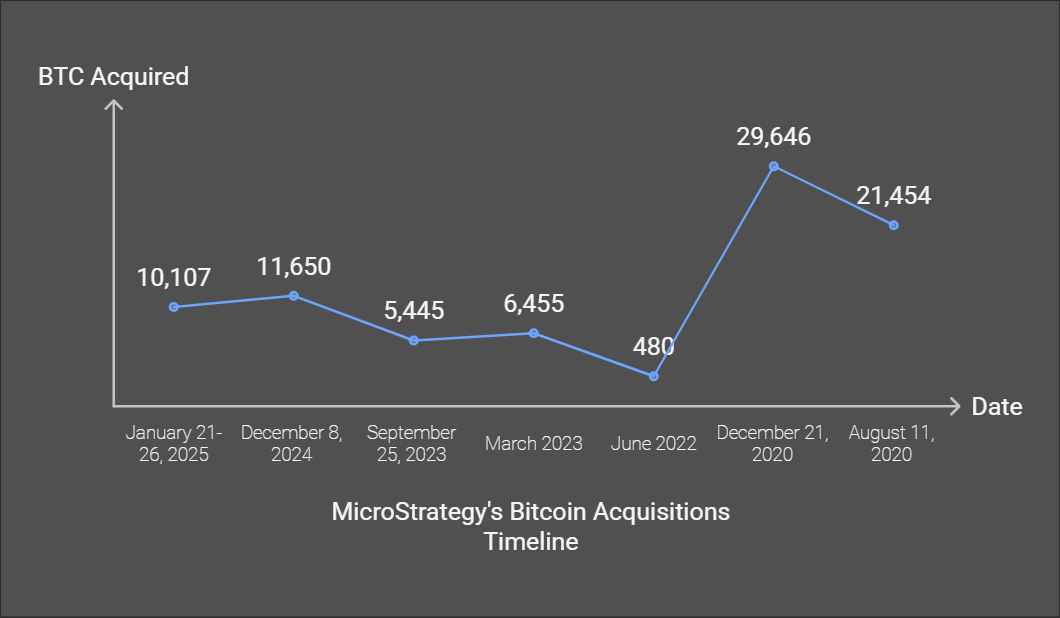

This isn’t MicroStrategy’s first (or second, or third…) Bitcoin rodeo. Since 2020, the company has been on a relentless buying spree, turning its balance sheet into a fortress of digital gold. To give you some perspective, here’s a look at their recent acquisitions:

| Date | BTC Acquired | Amount Spent (Approx.) | Average Price Per BTC |

| January 21-26, 2025 | 10,107 | $1.1 billion | $105,596 |

| December 8, 2024 | 11,650 | $1.25 billion | $107,296 |

| September 25, 2023 | 5,445 | $147.3 million | $27,053 |

| March 2023 | 6,455 | $161.6 million | $25,045 |

| June 2022 | 480 | $10 million | $20,800 |

| December 21, 2020 | 29,646 | $650 million | $21,925 |

| August 11, 2020 | 21,454 | $250 million | $11,653 |

Each entry on this timeline paints a picture of MicroStrategy’s long-term belief in Bitcoin’s potential. It’s like watching a collector amass rare coins—except these coins could eventually be worth millions apiece.

Why MicroStrategy Is Betting Big on Bitcoin

Michael Saylor’s Bitcoin gospel centers on a few key principles. First, Bitcoin is finite. With only 21 million coins ever to be mined, it’s the digital equivalent of owning land—there’s only so much to go around.

Second, Bitcoin is a hedge against inflation. As fiat currencies fluctuate and lose purchasing power, Bitcoin’s decentralized and deflationary nature makes it an appealing alternative. For companies like MicroStrategy, it’s a way to preserve and grow wealth outside the traditional financial system.

And finally, Saylor has big predictions. Huge, actually. He estimates Bitcoin could hit $13 million per coin by 2045, with scenarios ranging from $3 million in a bearish case to $49 million in a bull run. Talk about shooting for the moon—and maybe the stars, too.

A New Metric: Bitcoin Yield

MicroStrategy has introduced an interesting performance metric: Bitcoin Yield. For the year-to-date period ending January 26, 2025, the company reported a Bitcoin Yield of 2.90%. This metric measures the percentage change in the ratio between its Bitcoin holdings and diluted shares outstanding. In simpler terms, it shows how accretive their Bitcoin strategy is for shareholders.

Sure, it’s not a traditional financial metric—it doesn’t factor in debt or liabilities—but it’s a clever way to quantify the value of their crypto moves.

Is MicroStrategy’s Strategy Genius or Just Risky?

Not everyone is sold on MicroStrategy’s Bitcoin obsession. Critics argue that putting so many eggs in the Bitcoin basket is risky, especially in a market known for volatility. After all, Bitcoin’s price can swing wildly in just days.

But for Saylor and his team, it’s all part of the plan. “As Bitcoin adoption grows, its volatility will shrink,” Saylor predicts. He believes Bitcoin’s unique properties as an immutable and non-depreciating asset will eventually make it more stable than traditional investments.

What This Means for the Crypto Market

MicroStrategy’s aggressive buying spree sends a strong signal to the market: institutional players are here to stay. When a company bets billions on Bitcoin, it’s hard not to notice. It also inspires confidence among smaller investors who look to whales like MicroStrategy for cues on where the market might be heading.

But there’s another layer to this story. By taking such a massive amount of Bitcoin off the market, MicroStrategy is contributing to its scarcity. Less supply on exchanges could mean higher prices as demand grows.

Final Thoughts: The Future of Bitcoin and MicroStrategy

With 471,107 BTC in its vault, MicroStrategy has solidified its position as the largest corporate Bitcoin holder. And with Saylor’s lofty price predictions, it’s clear the company isn’t slowing down anytime soon.

So, what’s next? More buying sprees? Maybe. MicroStrategy still has $4.35 billion in shares available for future issuance, giving it plenty of firepower for additional purchases.

If Saylor’s predictions even come close to reality, MicroStrategy’s Bitcoin holdings could make it one of the most valuable companies in the world. Whether you see it as visionary or risky, one thing’s for sure: MicroStrategy is all in on Bitcoin, and the crypto world is watching closely. What do you think about MicroStrategy’s bold Bitcoin strategy? Are you inspired to HODL or hesitant to dive in? Share your thoughts, and stay tuned for more updates as this saga unfolds.

FAQs

Why is MicroStrategy buying so much Bitcoin?

MicroStrategy sees Bitcoin as a hedge against inflation and a long-term store of value, believing its finite supply and deflationary nature will preserve wealth better than traditional financial systems.

How much Bitcoin does MicroStrategy currently hold?

As of January 26, 2025, MicroStrategy holds 471,107 BTC, acquired for a total of $30.4 billion at an average price of $64,511 per Bitcoin.

What is MicroStrategy’s Bitcoin Yield, and why does it matter?

Bitcoin Yield is a performance metric that measures the percentage change in the ratio of Bitcoin holdings to diluted shares outstanding. It indicates how accretive their Bitcoin strategy is for shareholders.

What risks does MicroStrategy face with its Bitcoin strategy?

Critics highlight Bitcoin’s volatility and argue that such a large exposure to one asset could be risky. However, MicroStrategy believes Bitcoin’s volatility will decrease as adoption grows, making it a more stable investment in the long term.