Michael Saylor has introduced one of his most ambitious ideas yet. Instead of treating Bitcoin as a speculative asset on the side of the financial system, he wants it seated at the core of a new banking model. At the recent Bitcoin MENA gathering, he outlined a structure that uses Bitcoin-backed banking as the engine for high-yield, regulated savings products that could compete directly with low-yield government and corporate bonds.

His target is not small retail accounts as he is aiming at an estimated $20 trillion to $50 trillion parked in low-yield credit markets across regions such as Japan, Europe, and Switzerland. In those economies, institutions have accepted near-zero returns for years, largely because there has not been a credible alternative that combines yield, regulation, and perceived safety.

Saylor argues that the first nation to embrace this model could become a “digital banking capital of the world,” much like Switzerland became synonymous with private banking in the previous century.

How Bitcoin-backed banking differs from traditional deposits

Traditional bank accounts sit on top of a mix of loans, bonds, and reserves. In many developed markets, that structure produces minimal yield for depositors, even when banks earn more behind the scenes. Bitcoin-backed banking turns that hierarchy on its head by using Bitcoin as the core form of digital capital that underwrites the system.

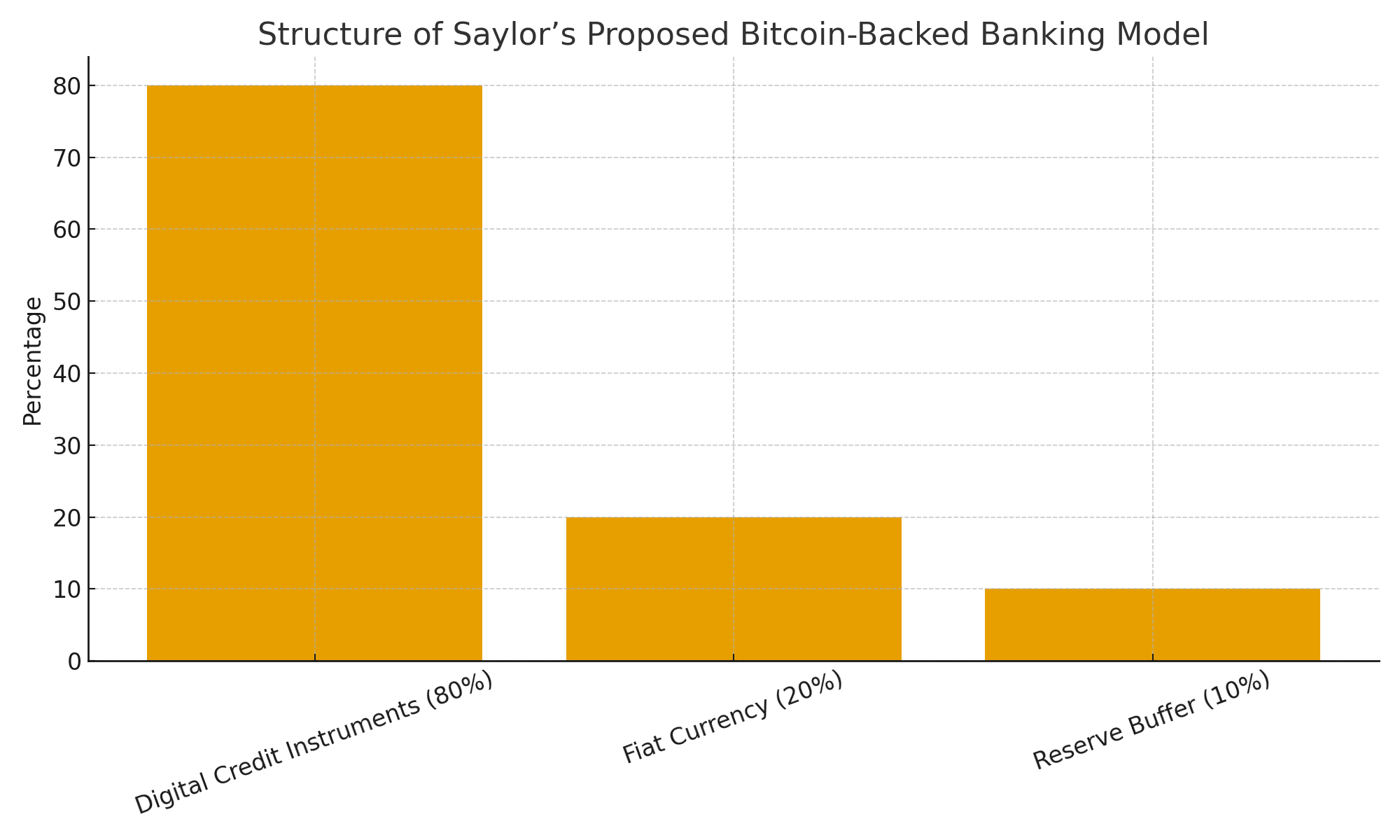

In Saylor’s blueprint, the flagship product is a regulated bank account that aims for an 8% dividend with what he describes as “zero volatility” at the account level. The backing structure is designed as:

Around 80% in digital credit instruments that are tied to Bitcoin

Around 20% in fiat currency

A 10% reserve buffer intended to absorb shocks and smooth volatility

According to Saylor, this structure would allow depositors to enjoy higher income without directly facing the day-to-day price swings of Bitcoin, while still drawing on its long term performance as digital collateral.

Inside Saylor’s Bitcoin-backed banking structure

At the heart of the pitch is the idea that Bitcoin can serve as “high-powered digital money.” Saylor frames corporations and banks holding Bitcoin as a natural evolution of the original vision for decentralized digital cash.

In practical terms, the proposed Bitcoin-backed banking structure relies on a regulated bank, overseen by a national supervisor, that issues a yield-bearing account in the depositor’s preferred currency. Behind that account, the institution uses Bitcoin-backed credit strategies similar to those that Saylor’s own company already employs, combining equity capital, debt markets, and Bitcoin reserves to scale exposure.

To highlight his conviction, Saylor’s firm recently acquired 10,624 BTC at an average price of $90,600, for a total near $1 billion, using capital raised through its at-the-market program. That purchase, one of the largest in the second half of 2025, reinforced the message that the same playbook could support a national-level digital banking structure.

The geopolitical play behind Bitcoin-backed banking

The geopolitical angle is central. Saylor argues that any country that greenlights Bitcoin-backed banking in a fully regulated format could attract global capital that currently accepts near-zero yields simply because of a lack of alternatives. Offering even 100 to 300 basis points more than competing jurisdictions, with similar or better perceived safety, could redirect trillions.

He has highlighted Middle Eastern financial hubs as potential candidates. Cities that already promote innovation in digital assets, strong banking infrastructure, and clear licensing regimes could position themselves as magnets for global savings seeking both yield and regulatory clarity. In that scenario, Bitcoin-backed banking becomes not only a financial product, but also a diplomatic and strategic tool for nations that want a larger role in global finance.

Key crypto indicators behind the pitch

Saylor’s argument rests on several crypto and market indicators that analysts watch closely:

Long-term Bitcoin performance: Multi-cycle returns have outpaced most major asset classes, although with significant volatility along the way. The thesis behind Bitcoin-backed banking assumes that long-horizon appreciation can support generous yields even after buffers and risk controls.

Sharpe ratio and risk adjusted returns: Saylor has described the ideal product as one where volatility at the account level trends toward zero while returns remain high, pushing the Sharpe ratio toward very attractive levels.

Global credit market size: With the worldwide credit market estimated around $200 trillion, even a small shift from conventional bonds into a new structure could represent enormous flows.

Institutional allocation trends: Gradual movement by corporations, asset managers, and treasuries into Bitcoin provides a real world backdrop for the idea that Bitcoin-backed banking could scale beyond niche crypto circles.

For supporters, these indicators point to a system that can potentially de risk yield for depositors while still relying on Bitcoin as the ultimate collateral base. For critics, they also highlight how dependent the model is on continued long term strength in Bitcoin markets.

Risk, regulation, and the path to real Bitcoin-backed banking

No central bank is likely to embrace this structure without strict controls. Price volatility, liquidity management, bank capital rules, and macroprudential oversight all sit at the center of any serious discussion around Bitcoin-backed banking. Regulators would need clear answers on how reserves are held, how collateral is marked, and how losses are absorbed during severe drawdowns.

Saylor has argued that risk can be tuned by adjusting the mix between digital credit, currency, and reserves. A higher reserve buffer, for example, would reduce potential yield but also lessen the probability of stress. In theory, this gives policymakers a dial to control the strength of Bitcoin-backed banking inside their broader financial system.

Still, the model touches the core of YMYL concerns. Citizens rely on bank deposits for salaries, savings, and business operations. Any move that links those deposits to crypto backed structures would require deep due diligence, transparent disclosure, and clear safeguards.

Conclusion

Saylor’s proposal is not a minor product idea. It is an attempt to turn Bitcoin from a portfolio satellite into the anchor of a new class of regulated yield accounts. If any nation adopts the framework at scale, Bitcoin-backed banking could reshape how global capital hunts for income, especially in regions where traditional bonds pay close to zero.

Whether policymakers accept that trade off between innovation and risk will decide whether Bitcoin-backed banking remains a conference talking point or becomes a defining feature of the next era of global finance. For now, the blueprint places one more high stakes option on the table for countries that want to lead in digital assets rather than follow.

FAQs about Michael Saylor’s Bitcoin-backed banking

1. What does Bitcoin-backed banking mean in this context?

It refers to a regulated banking model where yield-bearing accounts are supported by structures that use Bitcoin as core digital collateral, combined with currency and reserves.

2. Why is Saylor focusing on $20 trillion to $50 trillion in bonds?

He is targeting large pools of capital in low-yield sovereign and corporate debt, where institutions accept weak returns because there are few regulated alternatives with better income.

3. How could a country benefit from adopting this model?

A first mover could attract global savings, strengthen its status as a financial hub, and gain geopolitical influence by becoming a primary venue for regulated crypto-backed yield products.

4. What are the main risks for depositors?

Key risks include Bitcoin price shocks, liquidity stress, and potential mismatch between promised yield and actual performance of the underlying structure. Strong regulation and transparent risk management would be essential.

Glossary of key terms

Bitcoin-backed banking

A banking framework where regulated accounts and yield products are supported by strategies that hold Bitcoin as core collateral, together with currency and reserves.

Digital credit

Credit instruments that use digital assets, such as Bitcoin, as backing for loans, structured products, or funds that generate yield.

Reserve buffer

An extra pool of liquid assets held by a bank or fund to absorb volatility, protect depositors, and reduce the chance of losses during market stress.

Sharpe ratio

A measure of risk adjusted return that compares excess return over a risk free rate to the volatility of that return. Higher values usually indicate more attractive performance for the level of risk taken.

Sovereign bond

Debt issued by a national government, often viewed as low risk relative to corporate bonds but in some regions currently associated with very low yields.

For advertising inquiries, please email . [email protected] or Telegram