Metaplanet Bitcoin accumulation game has grown stronger again with yet another purchase. This week, the Tokyo-listed investment firm announced the acquisition of 103 BTC, about $11.7 million, bringing its total holdings to nearly 19,000 BTC, worth around $2.2 billion. This puts Metaplanet in the top 7 Bitcoin treasury firms globally.

- Aggressive Accumulation Through August

- Institutional Recognition and Milestones

- The “Infinite Money Glitch”? Corporate Bitcoin Accumulation Grows

- Japan’s Bitcoin Future

- Conclusion

- FAQs

- Why is Metaplanet compared to MicroStrategy?

- How many BTC does Metaplanet hold now?

- What are Metaplanet’s future BTC goals?

- What does it mean to be in the FTSE Japan Index?

- Glossary

Aggressive Accumulation Through August

Metaplanet just filed a statement revealing its latest purchase of 103 BTC at $113,491. With this addition, its Bitcoin holdings are now 18,991. It’s now just a few dozen coins behind US firm Riot Platforms which currently holds the 6th place.

Earlier in August, the firm acquired 518 BTC for about $61 million, taking total holdings to 18,113. And before that, 775 BTC for $93 million, taking total holdings to 18,888.

This is the pace of accumulation as Metaplanet deploys capital to strengthen its Bitcoin treasury. Metaplanet’s share price has gone up over 345% in 2025 and its market cap is over ¥1 trillion ($7 billion).

Institutional Recognition and Milestones

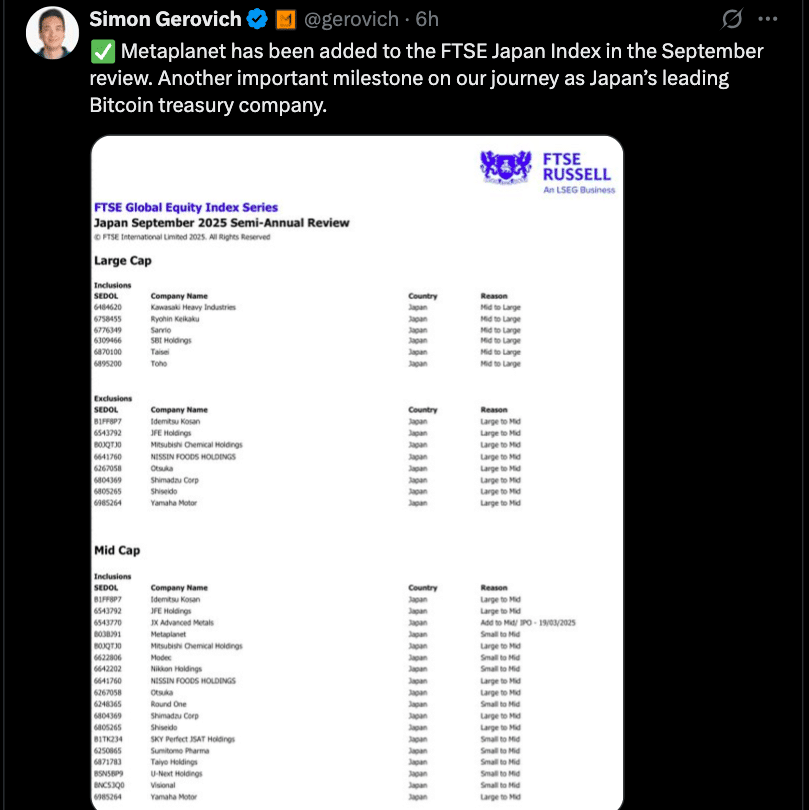

Metaplanet’s moves are being noticed globally. The firm has just been added to the FTSE Japan Index in its September review. Additionally, global visibility is increasing as Metaplanet approaches Riot Platforms’ ranking in the corporate Bitcoin treasury league, showing Asia’s growing presence in this space.

The “Infinite Money Glitch”? Corporate Bitcoin Accumulation Grows

Metaplanet Bitcoin moves follows a trend of public companies putting Bitcoin in their treasury either directly or through capital markets tools like stock offerings and preferred securities. A recent report says over 130 listed companies now hold around $87 billion in Bitcoin, or 3.2% of the total supply.

It’s been called the “infinite money glitch”; companies issuing equity to buy Bitcoin.

Japan’s Bitcoin Future

Metaplanet’s vision goes beyond accumulation. Its long-term goals include 30,000 BTC by the end of 2025, 100,000 BTC by 2026 and 210,000 BTC by 2027; about 1% of all Bitcoin.

CEO Simon Gerovich calls this a “Bitcoin gold rush” enabling Metaplanet to use Bitcoin as collateral for future business expansion and acquisitions. Sources claim they’re allegedly rebranding one of their properties as “The Bitcoin Hotel” and have secured rights to Bitcoin Magazine for Japanese crypto education.

Conclusion

Based on latest reports, Metaplanet Bitcoin strategy is boosting the company and Japan’s institutional crypto adoption.

With 18,991 BTC in reserves, inclusion in major equity indexes and acquisition targets, Metaplanet is leading Asia’s corporate Bitcoin frontier.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

Metaplanet’ Bitcoin strategy is accelerating with a recent purchase of 103 BTC bringing total holdings to 18,991 worth around $2.2 billion. Boosted this month by inclusion in the FTSE Japan Index, Metaplanet aims for 210,000 BTC by 2027.

FAQs

Why is Metaplanet compared to MicroStrategy?

Both started as non-crypto companies and switched to build large Bitcoin treasuries as institutional reserve assets.

How many BTC does Metaplanet hold now?

Metaplanet holds around 18,991 BTC, worth around $2.18 billion.

What are Metaplanet’s future BTC goals?

30,000 BTC by end-2025, 100,000 by 2026 and 210,000 (1% of total supply) by 2027.

What does it mean to be in the FTSE Japan Index?

It means Metaplanet is a mid-cap and they believe in their strategy and growth.

Glossary

Bitcoin treasury — Bitcoin held on a company’s balance sheet for long-term value storage.

FTSE Japan Index — A benchmark index of major Japanese stocks; inclusion means company size and investor confidence.

Corporate Bitcoin accumulation — Public companies buying Bitcoin via equity or debt issuance to hedge and diversify reserves.

MicroStrategy model — A corporate strategy pioneered in the US where a company invests heavily in Bitcoin as a treasury strategy.