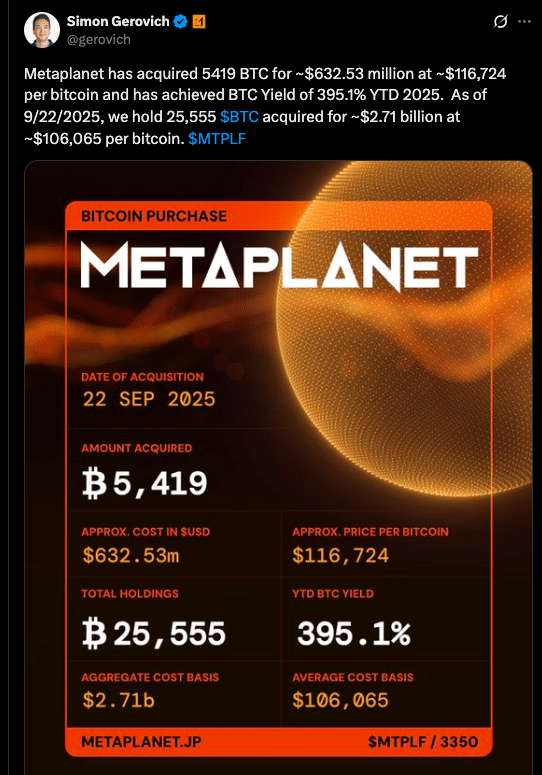

According to latest reports, Metaplanet has just made its biggest single Bitcoin purchase to date, buying 5,419 BTC for approximately $632.53 million. This latest Metaplanet Bitcoin accumulation brings its total holdings to 25,555 BTC, with an average cost basis of $106,065 per coin, and puts it in the top 5 corporate Bitcoin holders worldwide.

What Did Metaplanet Do

Metaplanet bought 5,419 BTC in one transaction, for around $632.53 million, at an average price of $116,724 per Bitcoin. This brings Metaplanet’s total holdings to 25,555 BTC. The average cost across all its holdings is $106,065 per coin.

CEO Simon Gerovich confirmed the numbers in a post on X. Sources report the company now has a Bitcoin treasury of around $2.91 billion based on current prices. The purchase came after raising over $1.4 billion in new share offerings to fund more Bitcoin buying.

Also read: $1.4 Billion Raised, 210,000 BTC Goal: Can Metaplanet Pull It Off?

Rank and Comparison

With this latest Metaplanet Bitcoin accumulation, the firm passes Bullish (with 24,300 BTC) to become the 5th largest listed corporate Bitcoin holder. Only MicroStrategy, Marathon Digital, Bitcoin Standard Treasury and a few others are above it.

According to BitcoinTreasuries, Metaplanet is now among the public companies with large Bitcoin treasuries. Its growth has been fast. In mid-April 2025, it had 4,525 BTC; by September, it had 25,000+ BTC. This is momentum and serious capital deployment into Bitcoin as a reserve asset.

Strategy, Yield and Ambition

Metaplanet Bitcoin accumulation is built around three pillars: aggressive accumulation via capital markets (share offerings), using equity financing to fund $BTC purchases and reporting BTC Yield metrics (i.e. growth of Bitcoin per fully diluted share) to show performance.

Looking at YTD 2025, its BTC yield is around 395.1%. That means the company has grown its Bitcoin holdings per share by nearly 4x this year, though the number includes share dilution. The company has public targets of 30,000 BTC by end of 2025 and an even more ambitious “210,000 BTC by 2027” under its so-called “555 Million Plan”.

Also read: Eric Trump to attend Metaplanet Tokyo meeting and why it matters

Conclusion

Metaplanet Bitcoin accumulation is a big up for Bitcoin as a corporate reserve asset. The purchase of 5,419 BTC for about $632 million puts the firm in the top 5 of corporate Bitcoin holders.

Its strategy, yield reporting and public targets show not just accumulation but intentional, structured reserve building. For markets, it’s another serious corporate player in the BTC treasury ecosystem.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

Metaplanet bought 5,419 BTC ($632.5M) at $116,724 per coin, bringing their BTC holdings to 25,555 coins valued $2.9-$3B. Their average cost is $106,065 per coin. They surpassed Bullish to become the 5th largest corporate Bitcoin holder with aggressive targets like 30,000 BTC by the end of 2025 and 210,000 by 2027.

Glossary

Bitcoin Treasury: The portion of Bitcoin a company holds on their balance sheet rather than selling or using operationally.

Yield (BTC Yield): A performance metric measuring how much Bitcoin the company gains per share

Average Cost Basis: The average price per coin paid by a holder, which matters for profit and loss thresholds.

Corporate Accumulation: When public companies, rather than individuals or funds, buy and hold Bitcoin as a reserve.

Equity Dilution: When new shares are issued, existing shareholders own a smaller percentage of the company.

Frequently Asked Questions About Metaplanet Bitcoin Accumulation

What is “corporate Bitcoin accumulation”?

It means publicly listed companies buying and holding significant amounts of Bitcoin as part of their treasury strategy, rather than trading or using it operationally.

Why does average cost matter?

A high average cost basis means the company needs Bitcoin’s market value to exceed that cost for profits; low market price relative to cost basis poses unrealized loss risk.

What is BTC Yield for Metaplanet?

Reported at about 395.1% year-to-date 2025, meaning they have increased their Bitcoin holdings per share a lot. But share dilution and financing methods are part of that calculation.

How does Metaplanet compare to others?

Metaplanet now holds 25,555 BTC, overtaking Bullish (24,300 BTC), they are among the top corporate holders globally.