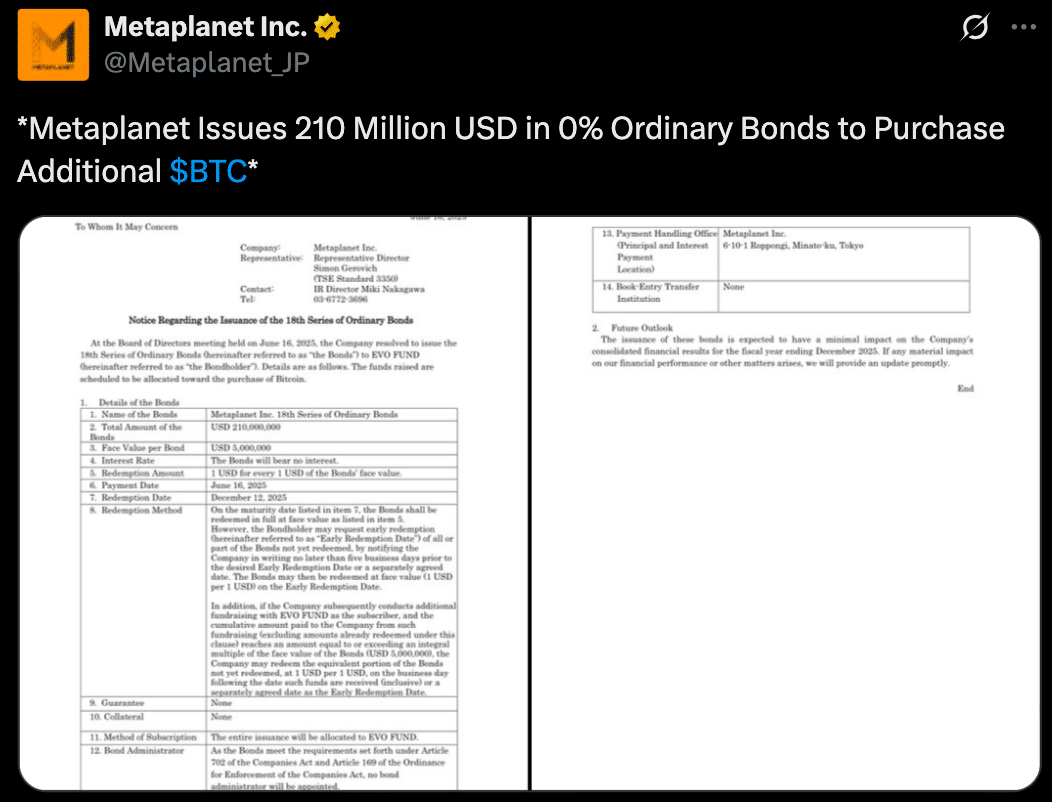

According to latest reports, Metaplanet has issued a new $210m zero-interest bond to Evo Fund and all proceeds will go towards buying more BTC to expand their Bitcoin treasury. This was announced as a continuation of Metaplanet’s high conviction in Bitcoin strategy as they adapt to Japan’s macro environment which includes a sustained depreciation of the yen.

- Metaplanet’s Bitcoin-First Strategy is Raising Eyebrows and Short Interest

- Bitcoin as a Defensive Treasury Asset in a Weak Yen Environment

- Beware as Corporate Strategies Go Big

- Why This Will Spread Across Asia’s Institutional Crypto Market

- Conclusion: A High-Risk Bet with Global Consequences

- FAQs

- What is the Metaplanet Bitcoin bond?

- Who subscribed to Metaplanet’s bond?

- Why is Metaplanet buying so much Bitcoin?

- How much Bitcoin does Metaplanet hold now?

- Is this a risk for shareholders?

- Glossary

The announcement confirms that all bond proceeds will go towards Bitcoin, just like MicroStrategy.

“The funds raised will be allocated to the purchase of Bitcoin” Metaplanet said in their board filing. CEO Simon Gerovich also tweeted: “All Bitcoin”

With the addition of 1,088 BTC, Metaplanet now holds 8,888 BTC and is one of the top publicly listed companies in the world according to Bitcoin Treasuries.

Metaplanet’s Bitcoin-First Strategy is Raising Eyebrows and Short Interest

Metaplanet’s aggressive Bitcoin buying has seen their stock price surge 4,800% in the last year, but it’s also attracted a lot of attention from traditional finance. Metaplanet is now Japan’s shortest stock as hedge funds bet against what they see as a crypto-fueled bubble.

Analysts say Metaplanet’s playbook is similar to MicroStrategy’s but Japan’s fiscal situation is very different. With high national debt and a weakening yen, Metaplanet’s crypto strategy is being tested against macro headwinds and changing investor sentiment.

The 18th series of ordinary bonds mature on December 12, 2025 and has an early redemption clause. The entire tranche was underwritten by Evo Fund, a Cayman Islands based institutional investor that backs high risk high conviction digital asset plays.

Bitcoin as a Defensive Treasury Asset in a Weak Yen Environment

Based on available data, the Japanese yen is under pressure and has been depreciating against the US dollar for 18 months. Market participants expect the Bank of Japan to tighten monetary policy, but the overall environment is very uncertain. For Metaplanet, Bitcoin may be a hedge against fiat depreciation and if Japan’s monetary risks continue to rise, this could be a very prescient move.

Analysts say this is a long term thesis that fiat currencies especially those from high debt economies like Japan will continue to weaken. Bitcoin is a non-sovereign alternative and Metaplanet is one of the few companies that will make that argument in public markets.

The company’s latest move also fits into the growing trend of corporate Bitcoin adoption among institutions looking for yield neutral, inflation resistant reserves.

Beware as Corporate Strategies Go Big

While Metaplanet and MicroStrategy are often held up as examples of conviction-driven treasuries, not everyone is convinced they can be replicated. Seamus Rocca, CEO of Xapo Bank, warned in a note to Cryptonews that such moves should be approached with discipline and long-term thinking.

“Patience and discipline can be underrated virtues in this space,” Rocca said. “Our view has been, and remains, that Bitcoin deserves serious consideration, but with a disciplined, long-term framework: focus on the asset itself, avoid speculative trading, and size positions responsibly.”

Rocca also noted that companies like Metaplanet and Strategy (MicroStrategy) are “high-conviction outliers,” whose risk appetite might not be suitable for more traditional corporations.

For now, Metaplanet seems unfazed. Despite short interest and institutional criticism, the company is amassing its Bitcoin treasury in word and deed.

Why This Will Spread Across Asia’s Institutional Crypto Market

As Hong Kong and Singapore develop more robust digital asset frameworks, Japan’s regulatory clarity and public equity access may be the perfect channel for crypto-focused investors.

According to some analysts, this is a sign to the rest of Asia. A publicly listed company is openly issuing debt to buy Bitcoin. That was unimaginable three years ago. Metaplanet is testing the regulatory and financial boundaries of corporate treasury management in the digital age.

Conclusion: A High-Risk Bet with Global Consequences

Metaplanet’s $210m bond issuance expanding its Bitcoin treasury means the intersection of traditional finance and crypto-native conviction is getting real. As Japan faces deepening economic woes and currency uncertainty, companies like Metaplanet are writing the new rules of corporate finance with crypto-native playbooks.

Investors and analysts are on high alert, waiting to see how this plays out in the next 12-18 months.

FAQs

What is the Metaplanet Bitcoin bond?

$210m zero-interest bond issued by Metaplanet to buy more Bitcoin. All of it is being used to grow their Bitcoin treasury.

Who subscribed to Metaplanet’s bond?

Evo Fund, a Cayman Islands fund, was the sole subscriber to the bond.

Why is Metaplanet buying so much Bitcoin?

They view Bitcoin as a long term store of value especially with Japan’s economic instability and yen depreciation.

How much Bitcoin does Metaplanet hold now?

After their latest purchase, Metaplanet holds 8,888 BTC according to Bitcoin Treasuries.

Is this a risk for shareholders?

While some applaud the move, Metaplanet is now Japan’s most shorted stock due to the perceived risks in their Bitcoin strategy.

Glossary

Bitcoin Treasury Strategy – A corporate financial strategy of holding Bitcoin as a reserve asset instead of or in addition to cash.

Zero-Interest Bonds – Bonds that don’t pay interest, often sold at a discount or with a performance-linked return.

Yen Depreciation – Japan’s currency weakening against others like the USD, reducing purchasing power and increasing import costs.

Short Interest – The percentage of a company’s shares that have been shorted and not yet covered, indicating market skepticism.

Cayman Islands Fund – Investment funds based in the Cayman Islands, often due to tax and regulatory advantages.

Sources

Disclaimer: This article is for information purposes only and is not financial advice. Investing in cryptocurrencies involves risk of loss.