This article was first published on Deythere.

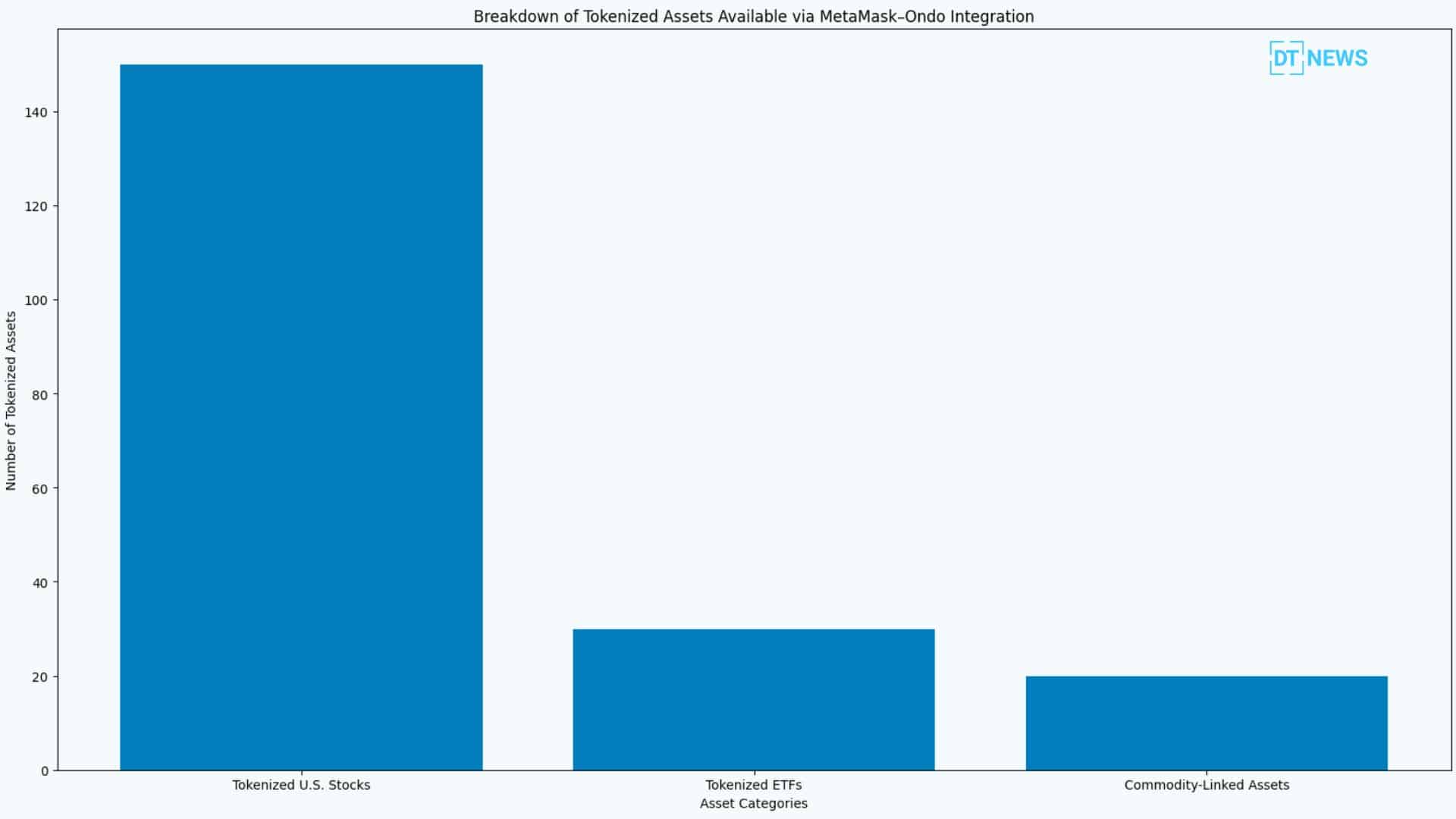

MetaMask is quietly crossing a line that once separated Wall Street from blockchain. The wallet, best known for holding crypto assets, now offers access to more than 200 U.S. equities and exchange-traded funds in tokenized form. The shift signals a bigger change in how investors may access traditional markets in the years ahead.

According to the source, the expansion comes through a new integration with Ondo Finance, whose Global Markets platform is now supported inside MetaMask. Rather than turning users into day traders overnight, the move reframes the wallet as a broader financial gateway where digital and traditional assets can coexist.

The integration allows eligible mobile users in supported regions to access tokenized U.S. stocks, ETFs, and commodity-linked products directly from the app. No external brokerage account is required. Ownership remains self-custodial, meaning users hold and transfer these assets alongside cryptocurrencies.

Why MetaMask’s Move Changes the Access Equation

By embedding tokenized securities inside a familiar wallet, MetaMask lowers a major barrier to entry. Many retail investors already understand wallets, keys, and onchain transfers. Bringing traditional assets into that environment reduces friction while preserving user control.

Tokenized stocks offered through the platform mirror real shares and funds, including exposure to major U.S. companies such as Tesla, Apple, Microsoft, NVIDIA, and Amazon. Popular ETFs like IWM and QQQ are also included, along with funds tied to gold, silver, copper, and rare earth metals.

A recent industry overview explains how this structure allows traditional assets to benefit from blockchain settlement while remaining compliant.

How Tokenized Stocks Actually Work

Although the assets live on public blockchains, they still respect market structure. Minting and redemption follow standard U.S. trading hours. Once issued, however, the tokens can move around the clock across Ethereum, Solana, and BNB Chain.

This hybrid model matters. Analysts note that tokenized stocks reduce settlement delays and improve transparency, while still anchoring value to regulated markets. Academic research on financial tokenization has shown that programmable assets can cut operational costs and reduce reconciliation errors when properly structured.

Ondo’s Growing Role in Institutional Tokenization

Since launching in September 2025, Ondo Global Markets has grown rapidly. Its total value locked has climbed beyond $500 million, reflecting demand from both retail and institutional participants. Ondo says the MetaMask integration removes the need for multiple platforms while reducing reliance on centralized intermediaries.

Leadership commentary framed the partnership as a bridge rather than a disruption. A senior executive stated that placing regulated assets inside a wallet people already trust introduces a new asset class without sacrificing control.

Consensys founder and Ethereum co-founder Joe Lubin echoed that view, saying crypto wallets now serve as meeting points for traditional and onchain finance.

Institutional Signals from the Ondo Summit

The announcement surfaced during the 2026 Ondo Summit in New York. The event brought together banks, regulators, and financial firms, highlighting growing openness to blockchain-based infrastructure. Speakers emphasized faster settlement, extended trading windows, and lower costs as practical benefits.

Ondo also outlined plans to expand its platform to thousands of tokenized securities, including mutual funds. Discussion around Ondo Chain focused on regulatory alignment, signaling that tokenization is moving beyond experiments into scalable financial systems.

Conclusion

The arrival of tokenized stocks inside MetaMask reflects a broader shift in market structure. Wallets are no longer just storage tools. They are becoming access points. For investors, students, and analysts, the message is clear. As traditional assets move onchain, control, transparency, and accessibility may define the next phase of global finance.

Glossary

Tokenization: Turning real assets into blockchain-based tokens.

Self-custody: Holding assets without a third-party custodian.

ETF: A fund that tracks a group of assets.

Onchain: Activity recorded directly on a blockchain.

FAQs About MetaMask

What are tokenized stocks?

They are blockchain-based representations of real shares or funds.

Who can access them in MetaMask?

Eligibility depends on region and regulatory requirements.

Do these assets trade all day?

Transfers run 24/7, while issuance follows market hours.

Why does self-custody matter?

It allows users to control assets without intermediaries.