This article was first published on Deythere.

A Cardano whale has just suffered a massive loss after a long inactive wallet executed a huge ADA-to-USDA swap. The wallet reportedly moved 14.45 million ADA (worth around $7.08 million) into USDA but reports claim that because the chosen liquidity pool was super shallow, they only got 847,694 USDA in return.

This has raised concerns about liquidity in Cardano’s DeFi infrastructure.

What Caused the Cardano Whale Loss?

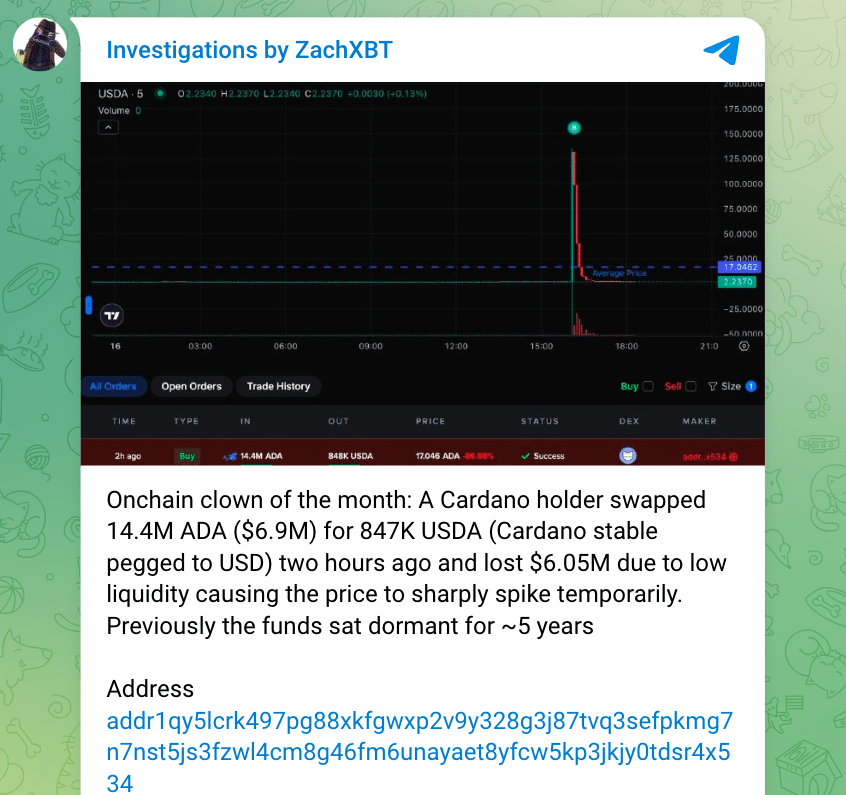

According to on-chain analytics from Lookonchain and ZachXBT, a wallet that had been inactive for 5 years initiated the trade. The wallet sold 14.45 million ADA (worth around $7.08 million) into USDA tokens.

However, the swap didn’t go as planned. Because the USDA pool used for the swap had very low liquidity, the large sell order caused price slippage, as a result, the price impact of the trade pushed the effective exchange rate against the seller.

So, instead of getting a proportional amount of USDA, the wallet ended up with just 847,694 USDA, losing around $6.2 million.

This is a classic example of how big trades in shallow DeFi pools can go horribly wrong when liquidity is low; big orders distort prices.

Why This Whale Loss Matters

Around the same time as the swap, as previously reported, on-chain data shows Cardano whales have been getting more active. Notably, over 4 million ADA were sold by large holders in the last week, suggesting a possible caution or redistributing.

Also, some whales reportedly sold more than 270 million ADA in previously recorded periods.

This is a bigger issue; liquidity in Cardano’s DeFi around native stablecoins like USDA appears to be fragile. Despite Cardano’s DeFi ambitions, TVL in the ecosystem is under pressure. Some say the DeFi market has shrunk and liquidity on DEXs is declining.

The timing also coincides with technical weakness in $ADA’s price. Large whale sell-offs and low volume have put pressure on the price and support levels are at risk and on-chain indicators are flashing further downside.

Market analysts are saying this is a visible and painful symptom of the deeper problems in Cardano’s DeFi infrastructure.

Reactions From the Crypto Community

The Cardano community is speaking out. On-chain analysts and DeFi users are calling this a wake-up call.

Many are pointing to UI issues on Cardano DEXs, saying swap tools should warn users of high slippage or shallow liquidity when large orders are placed.

Others are saying there needs to be a liquidity injection, referencing previous proposals. There’s a $100 million treasury proposal floating around the community to add stablecoin liquidity to Cardano.

Some are saying multi-route or multi-hop swap mechanisms should be the norm, so large trades can route through more liquid pairs instead of a single pool.

The episode has also reopened the debate on how the treasury should be used to support DeFi or other ecosystem priorities.

Implications for Cardano’s DeFi Future

The Cardano whale loss is a wake-up call for Cardano’s DeFi ambitions:

As Cardano scales with Hydra, the lack of liquidity in DEX pools is a bottleneck for real-world use, especially for large holders.

How the Community Treasury is used will determine if future traders avoid similar losses. Injecting capital into stablecoin pools could be a game-changer.

Better tooling, price impact estimates, multi-path swaps, slippage warnings may be needed to protect users from themselves.

For whales, or anyone holding a lot of $ADA, this may change how they exit or reallocate, maybe OTC trades or more cautious on-chain strategies.

If Cardano’s DeFi is to grow safely, these infrastructure and governance issues need to be fixed now.

Conclusion

The recent Cardano whale loss is an eye opener for the blockchain’s DeFi. A long-held ADA position was swapped out in one go only to get decimated by slippage in a low-liquidity USDA pool.

The aftermath begs a question that even in a mature project like Cardano, could it be that DeFi infrastructure isn’t ready for big trades?

As the community debates how to make the system more resilient, hope is that this will spur stronger safeguards, better tooling and more liquidity across Cardano’s DeFi.

Glossary

ADA: Cardano’s native cryptocurrency.

USDA: Anzen’s Cardano-native stablecoin for stable-value transactions.

Whale: In crypto, a person or entity holding a large amount of a token.

Liquidity Pool: A pool of two (or more) tokens on a DEX to facilitate swaps.

Slippage: The difference between expected price and actual price of a trade.

Treasury: On-chain funds controlled by the Cardano community to support ecosystem development.

Frequently Asked Questions About Recent Cardano Whale Loss

How did the whale lose so much money?

The whale did a huge swap into a USDA pool with very low liquidity. Since the pool couldn’t absorb the order, the price dropped while executing (slippage) and the whale lost a ton of value.

What is USDA on Cardano?

USDA is a fully-reserved stablecoin native to Cardano, created by Anzens. It’s meant for stable-value transactions but currently has low liquidity in many pools.

Could this happen to regular Cardano users?

While regular users are less likely to trade millions of $ADA at once, anyone making a large trade on a shallow pool will get significant slippage and value loss.

What’s being done to prevent future Cardano whale losses?

The community is calling for better user interfaces that warn of slippage, multi-route swaps and potentially using the Cardano treasury to inject liquidity into stablecoin pools.

Should big ADA holders avoid DeFi swaps entirely now?

Not necessarily, but big holders might want to use safer strategies, split trades, OTC desks, or make sure they use well-funded pools with deep liquidity.

References