According to MANTRA Chain’s official announcement, the MANTRA OM token buyback worth $25 million has been launched, setting a major milestone for the project’s recovery efforts. This has triggered a mainnet staking surge, boosting network security, institutional confidence, and ecosystem growth.

The initiative, carried out by MANTRA AG, a subsidiary of the MANTRA Chain Association, signals strong backing from institutional investors and aims to reinforce OM’s long-term position in the real-world asset (RWA) sector.

The buyback follows Inveniam’s $20 million investment, raising total commitments to $45 million. Experts say this step is not only about adding funds but also about restoring trust in MANTRA’s plans after months of market ups and downs.

Why did MANTRA initiate the $25M buyback?

The MANTRA OM token buyback aims to bring back investor confidence after April’s sharp crash that wiped out most of OM’s value due to forced liquidations by centralized exchanges during low liquidity periods.

With $25 million set aside for buy orders on centralized exchanges, MANTRA will lower the number of tokens in circulation and stake the bought tokens with its validator network.

This two-way plan of cutting down the number of tokens in the market and adding more security through validators could give $OM stronger and steadier support in the coming months.

Also read: OM Token’s 88% Crash — How Mantra CEO Tries to Rebuild from the Ashes

How will the buyback impact OM’s circulating supply?

The $25 million buyback could acquire roughly 110 million $OM tokens, representing nearly 10% of all tokens in circulation. A supply cut of this size could tighten liquidity and may gradually support upward price movement.

Analysts say big buybacks in crypto often work like stock buybacks, as they show confidence and help steady the mood among investors, while also signaling a project’s commitment to long-term value and reducing token supply to create upward price pressure.

| Metrics | Value/Details |

| Buyback Amount | $25 million |

| Total Institutional Commitments | $45 million (including $20 million from Inveniam) |

| Percentage of Circulating Supply | ~10% |

| Token Migration | From Ethereum ERC-20 to MANTRA Chain mainnet |

| Market Reaction | Small price gains |

| Ecosystem Focus | Real World Asset (RWA) tokenization |

| Migration Deadline | January 15, 2026 for ERC-20 OM tokens |

| Inflation Rate Post-Migration | 8%, targeting approx. 18% staking APR |

| Supply Cap Proposed | 2.5 billion OM tokens |

What role does migration play in MANTRA’s strategy?

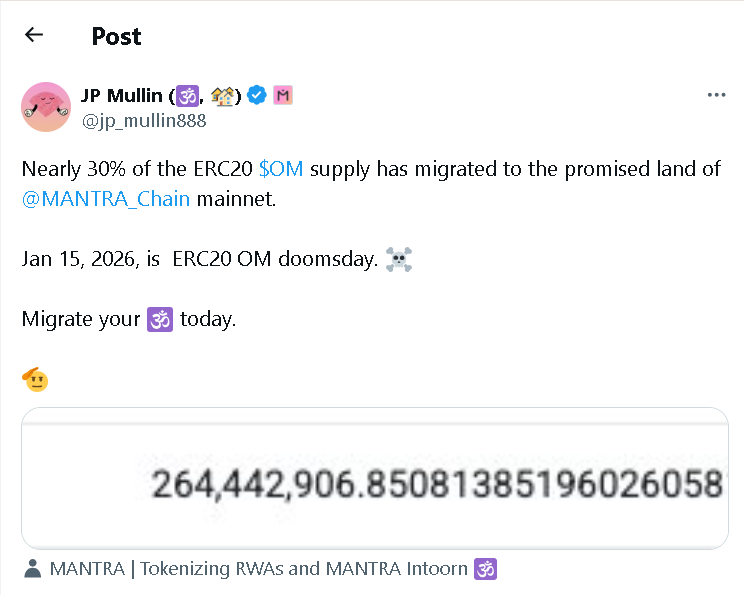

Along with the MANTRA OM token buyback, the project is moving $OM from Ethereum’s ERC-20 version to its own MANTRA Chain.

Around 30% of the tokens have already been shifted. CEO John Patrick Mullin has urged token holders to complete the migration before January 15, 2026, calling it the deadline for ERC-20 $OM tokens.

The migration is meant to bring liquidity together on MANTRA’s chain, make trading easier, and encourage developers to create an EVM-compatible network linked to Ethereum’s wider DeFi ecosystem.

How is the RWA sector shaping MANTRA’s future?

The MANTRA OM token buyback also supports the project’s bigger goal of growing in the fast-expanding RWA market. Binance research suggests that tokenized real-world assets may grow into a market worth a trillion dollars in the future.

The RWA sector has already passed $26 billion this year, and MANTRA plans to become a focused and compliant platform for asset tokenization. The buyback and growth of the ecosystem could be early signs of this long-term plan.

Also read: Mantra Signals Long Term Vision with 150M OM Burn

What does this mean for OM investors now?

Market data shows $OM with small daily gains of 2%. Although the buyback news has not caused a big price change, trading volume increased noticeably, reflecting more activity from both retail and institutional investors.

An independent analyst explained that the MANTRA OM token buyback is not just about price changes. It is focused on restoring trust and showing investors that the team is committed to fixing past issues.

Conclusion

Based on the latest research, the MANTRA OM token buyback is more than just a financial move. It shows strong support from institutions and marks a step toward rebuilding the ecosystem. With $45 million in total commitments, a new EVM-compatible chain, and plans for RWA growth, MANTRA is aiming to regain its place in a competitive market. For long-term holders, the buyback might not raise prices right away, but it could signal the start of OM’s gradual recovery.

Summary

The MANTRA OM token buyback of $25 million is an important step to help the project recover. With the $20 million from Inveniam, the project’s total funding has grown to $45 million. The buyback reduces $OM tokens in circulation and stakes them with MANTRA’s validators to bring back investor confidence after April’s crash.

Moving tokens to MANTRA Chain also improves liquidity and supports developers. The buyback highlights solid support and may gradually help the ecosystem get back on track.

Stay informed on MANTRA’s $25M buyback and OM price trends only on our platform.

Glossary

Buyback – Repurchasing tokens from the market to reduce supply and boost confidence.

Circulating Supply – The total number of tokens currently available for trading.

Mainnet Staking – Securing MANTRA Chain with locked OM.

Migration – Moving OM from Ethereum to MANTRA Chain.

Validators – Network participants who secure MANTRA Chain by verifying transactions.

FAQs for MANTRA OM token buyback 2025

1. How much is MANTRA spending on the OM token buyback?

$25 million has been allocated for the repurchase.

2. How does migration support the ecosystem?

It unifies liquidity, boosts trading, and supports developers on MANTRA Chain.

3. How many OM tokens could be bought back?

Around 110 million tokens, about 10% of circulating supply.

4. What role does the RWA sector play in MANTRA’s plan?

MANTRA aims to be a leading platform for tokenized real-world assets.

5. Has OM’s price reacted to the buyback news?

Price saw modest 2% gains, but trading volume and activity increased.