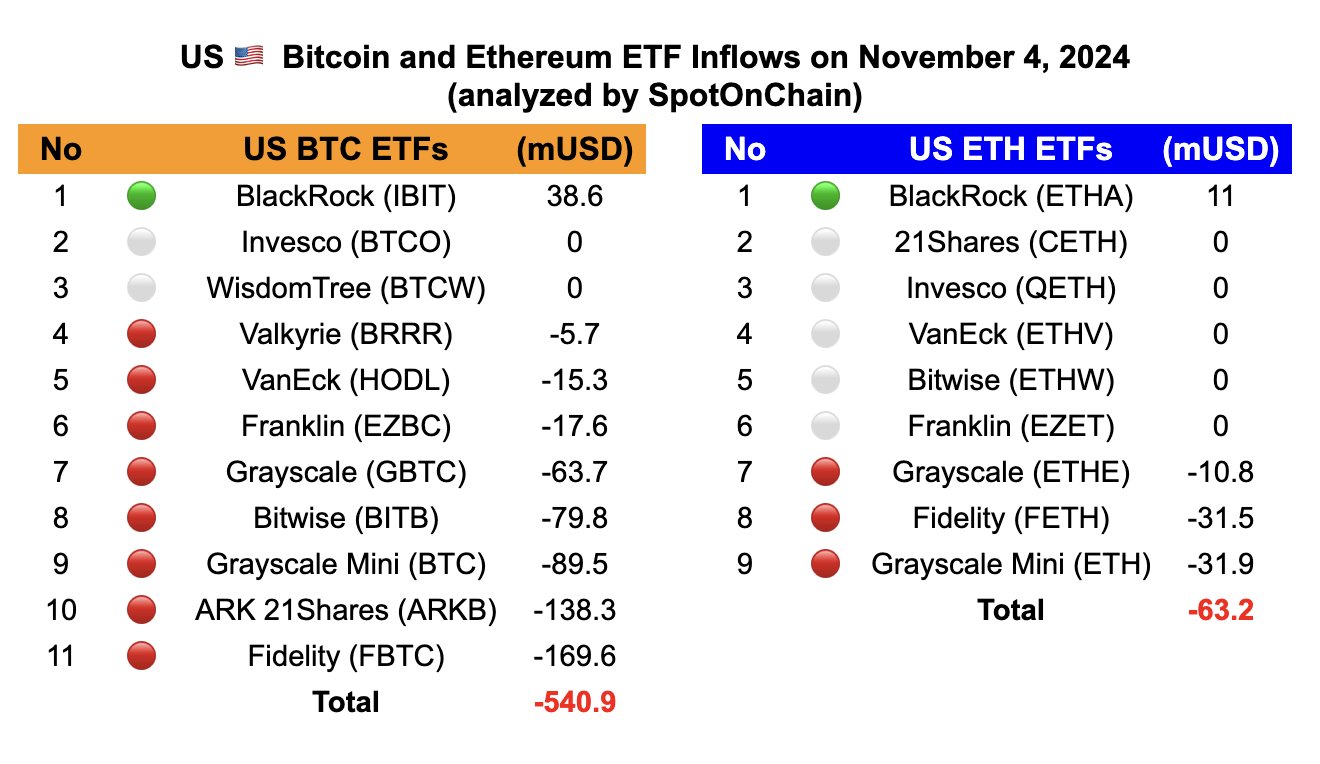

On November 4, 2024, spot Bitcoin and Ethereum ETFs in the U.S. faced significant outflows, attributed to the ongoing uncertainty surrounding the U.S. presidential election. According to Spot On Chain, net outflows from spot Bitcoin ETFs totaled $540.9 million, while Ethereum ETFs saw $63.2 million in net withdrawals.

BlackRock’s Spot Bitcoin ETF Stands Out

Among U.S. Bitcoin ETFs, only BlackRock’s IBIT ETF recorded a positive inflow, attracting $38.6 million. In contrast, other spot Bitcoin ETFs suffered substantial outflows. Fidelity’s FBTC ETF, for example, saw a withdrawal of $169.6 million, and ARK 21Shares’ ARKB ETF lost $138.3 million. Leading providers like Grayscale, Bitwise, and VanEck also recorded negative flows, reflecting the market’s cautious stance amid election-related uncertainty.

Ethereum ETFs Also Experience Outflows

Spot Ethereum ETFs mirrored this trend. Only BlackRock’s ETHA ETF attracted a positive inflow of $11 million, while other providers like Grayscale and Fidelity experienced significant outflows of $10.8 million, $31.5 million, and $31.9 million, respectively. This indicates a decline in investor interest in spot Ethereum ETFs.

These outflows from both Bitcoin and Ethereum ETFs are closely tied to the broader crypto market volatility and the uncertainties triggered by the presidential election. Analysts suggest that outflows from U.S.-based ETFs may be a reflection of shifting investor sentiment and market instability.

With the presidential race nearing its conclusion, Republican candidate Donald Trump appears to have secured a win. Experts believe that as election uncertainties subside and Trump, known for his pro-crypto stance, officially assumes office, the crypto market could see renewed inflows into ETFs.

Bitcoin ETF, Ethereum ETF, BlackRock, crypto market, election uncertainty

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)