According to latest reports, the new guidance from the U.S. Securities and Exchange Commission has cleared the final hurdle for staking in spot crypto ETFs. The SEC’s Division of Corporation Finance issued a staff statement saying that liquid staking activities, under certain conditions, do not constitute securities offerings.

- What the SEC Statement Means for Liquid Staking ETFs

- Why Industry Sees This as the Last Hurdle

- Benefits and Remaining Open Questions

- Conclusion

- FAQs

- What are liquid staking tokens (LSTs)?

- How does SEC staff view liquid staking for ETFs?

- Are spot staking ETFs already approved?

- What risks remain?

- Glossary

- Sources

According to the SEC, staking receipt tokens like those representing liquid staking positions; are ownership receipts not investment contracts themselves, which puts them outside the definition of securities.

What the SEC Statement Means for Liquid Staking ETFs

The SEC’s statement says that protocol staking activities including self-staking, self-custodial staking and custodial staking; do not involve the offer or sale of securities under federal law as long as they are administrative or ministerial rather than entrepreneurial or discretionary.

Hence, funds using LSTs like JitoSOL or similar instruments can operate staking strategies without triggering registration rules.

Importantly, this is non-binding staff guidance, representing staff views not formal Commission positions. Commissioner Caroline Crenshaw expressed concern that the assumptions surrounding the LST framework are legally fragile, warning that deviations may fall outside the safe harbor.

Why Industry Sees This as the Last Hurdle

Over the past months, Jito Labs, Multicoin Capital and other stakeholders presented two models to the SEC. These include partial staking through validators or holding LSTs to maintain liquidity and address redemption concerns inside ETF structures.

The new staff guidance says that under specific fact patterns, LST-based approaches no longer raise securities issues, removing a previously big barrier.

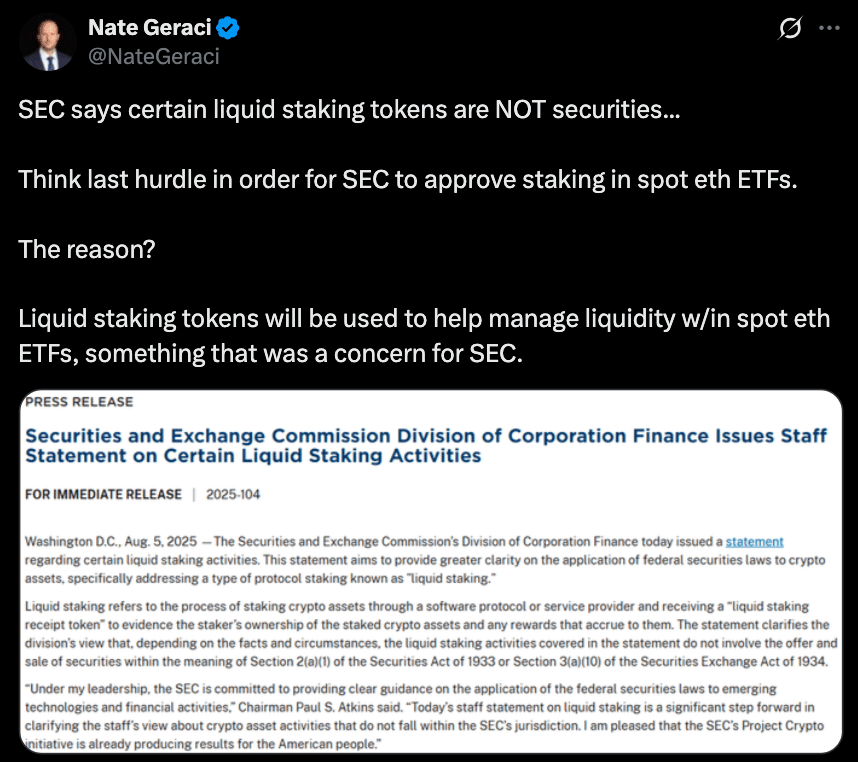

ETF analyst Nate Geraci of ETF Store called this the “last hurdle” for spot Ethereum ETFs, noting that liquid staking tokens (LSTs) can manage liquidity inside funds while keeping staking rewards.

Nate Geraci said that liquidity management via LSTs inside funds addresses the SEC’s main operational concern. As long as the structure stays within the scope of the staff statement, liquid staking ETFs are now legally possible in the US for the first time.

Benefits and Remaining Open Questions

Staking in spot Ethereum or Solana ETFs will make them more attractive to yield-seeking investors. Spot ETH ETFs got approved in mid-2024 but staking had to be removed from the initial filings due to regulatory uncertainty. If approved, staking ETFs can offer both price exposure and rewards income without user management.

But there are still questions. The SEC and some analysts want clarity on whether staking rewards can fit in grantor trust ETF structures and how the IRS will tax staking yields.

Additionally, Commissioner Crenshaw said staff statements are not enough, citing that only formal Commission action or legislation can provide legal protection.

Conclusion

Based on the latest research, liquid staking ETFs can now go from concept to possibility. Issuers can consider deploying staking strategies inside regulated spot crypto funds, and get yield and liquidity for investors.

But until formal SEC approvals, IRS rulings, and potential rule-making happens, these structures are contingent on precise alignment with the staff statement.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

The SEC’s new staff guidance removes regulatory uncertainty around liquid staking ETFs. By saying that certain staking arrangements involving LSTs under specified conditions do not constitute securities offerings, taking away what industry insiders call the last hurdle before spot ETH and similar staking-enabled ETFs can launch.

FAQs

What are liquid staking tokens (LSTs)?

They are derivative tokens representing staked crypto, so holders can earn staking rewards while remaining liquid and transferable.

How does SEC staff view liquid staking for ETFs?

The Division of Corporation Finance said that under certain fact patterns, liquid staking activities do not constitute securities offerings. Liquid staking tokens can be redeemable instruments within ETF structures.

Are spot staking ETFs already approved?

Not yet. This guidance enables the legal pathway, but formal approvals must still go through the ETF filing, SEC review and potential launch process.

What risks remain?

IRS treatment of staking rewards within ETF grantor trust structures is still unsettled, and the staff statement could be challenged or limited by future Commission decisions or litigation.

Glossary

LST – Liquid Staking Token, a tradable receipt token representing ownership of staked crypto, so holders can be liquid while rewards accrue.

Protocol Staking – Staking activities within proof-of-stake protocols such as self-staking, delegated staking or custodial staking.

Grantor Trust Structure – The traditional ETF structure where investors own the underlying assets indirectly and receive pass-through benefits like rewards and tax treatment.

Staff Statement – Non-binding guidance from the SEC staff, not Commission policy or rule.