According to Kraken’s official status page, the Kraken Monero deposit suspension was put in place after the exchange found that one mining pool, Qubic, had taken control of more than half of the network’s hashrate.

- Why Did Kraken Pause Monero Deposits?

- What Does Qubic Claim to Have Achieved?

- How Did the Market React to the News?

- How Serious Is the Security Threat?

- Conclusion

- FAQs

- 1. Why did Kraken stop Monero deposits?

- 2. Can users still withdraw Monero on Kraken?

- 3. Who runs the Qubic mining pool?

- 4. How did Monero’s price react?

- 5. When will Kraken allow Monero deposits again?

- Glossary

- Sources

Kraken stated that this step was taken to protect users and maintain network security. Trading and withdrawals for Monero ($XMR) are still working as usual.

Why Did Kraken Pause Monero Deposits?

The Kraken Monero deposit suspension happened soon after Qubic, a mining pool started by IOTA’s co-founder Sergey Ivancheglo, said it had taken more than 51% control of the network’s hashrate.

People worry that if one mining pool controls most of the power, it could change blocks or stop some payments. In the worst case, the same coins could be used twice. That would break the trust in a system that’s meant to stay private and safe.

Kraken said: “For safety reasons, Monero deposits are paused while we review the situation. We are watching it closely and will allow deposits again once it is safe”.

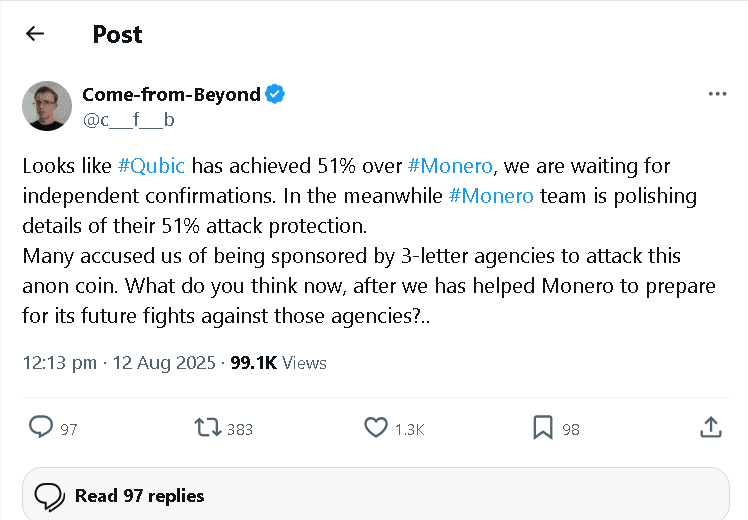

What Does Qubic Claim to Have Achieved?

Qubic openly admitted its actions. The mining pool said it had reorganized six blocks on Monero’s blockchain. Sergey Ivancheglo explained that this was done to show possible weaknesses and to prepare the community for future risks.

In a post on X (formerly Twitter), he said Qubic’s team was waiting for independent checks of its 51% control. The statement faced sharp criticism, with some accusing the group of trying to weaken a network known for its strength and privacy.

How Did the Market React to the News?

After news of the 51% control and the Kraken Monero deposit suspension, Monero’s price dropped. It was seen trading around $257, down about 6% for the week. By Friday, it had slipped further to about $241.69, based on exchange data.

Analysts say the wider crypto market has been volatile, but the Monero news made investors even more uneasy. Privacy coins already face pressure from regulators, and any sign of weakness in security could hurt their adoption.

| Metrics | Details |

| Exchange | Kraken |

| Cryptocurrency | Monero (XMR) |

| Mining Pool | Qubic |

| Reason for Suspension | Single mining pool gained >50% of the hashrate |

| Claimed Network Control | Approximately 51% hashrate |

| Block Reorganization Reported | 6 blocks reorganized |

| Monero Market Cap | $5.02B |

| Monero Price | $272.40 |

| Kraken Deposit Status | Deposits paused |

How Serious Is the Security Threat?

Not everyone agrees on how serious Qubic’s claim is. Some Monero developers pointed out that the pool’s claimed hashrate doesn’t completely line up with the number of blocks it has actually mined. Qubic maintains its reorganised blocks, but so far, no double-spending attack has been confirmed.

Experts warn that even the idea of a weakness can damage a network’s image. A blockchain researcher told Cointelegraph: “It’s worrying that one pool could reach this level of control.

Monero’s trust depends on decentralization, and even the hint of a weakness could push away big investors and long-term holders.”

Conclusion

Based on the latest research, the Kraken Monero deposit suspension shows how careful one of the biggest exchanges is trying to be.

Even though no double-spend attack has been proven, the event highlights the dangers that come with too much power in one mining pool.

For Monero backers, it’s both a warning sign and a reminder that the network needs stronger decentralization. The Monero community is now closely watching how Qubic and the project’s developers respond.

What happens next could shape whether the network builds stronger defences or continues to face questions about its long-term security.

Summary

The Kraken Monero deposit suspension happened after Qubic, a mining pool led by IOTA’s co-founder, claimed it had taken control of more than half of Monero’s hashrate.

Kraken stopped deposits to protect users, but trading and withdrawals are still working. Qubic said it had to redo some blocks, which made people worry about safety and how decentralized the network really is.

No double-spending has been proven, yet experts warn that even the fear of weakness can hurt Monero’s image. The community now waits for the next steps.

Stay updated on Kraken’s Monero suspension, latest crypto news, and key price predictions on our platform

FAQs

1. Why did Kraken stop Monero deposits?

The Kraken Monero Deposit Suspension happened after Qubic claimed 51% control.

2. Can users still withdraw Monero on Kraken?

Yes, withdrawals and trading are working.

3. Who runs the Qubic mining pool?

It was started by IOTA co-founder Sergey Ivancheglo.

4. How did Monero’s price react?

It dropped about 6% for the week, trading near $241.

5. When will Kraken allow Monero deposits again?

The Kraken Monero Deposit Suspension will end once it is safe.

Glossary

Block Reorganization – Changing recent blocks to alter transactions.

Double-Spending – Using the same coin twice by tricking the network.

Mining Pool – A group of miners combining power to earn rewards.

Privacy Coin – A cryptocurrency that hides user and transaction details.

Qubic – A mining pool created by IOTA’s co-founder Sergey Ivancheglo.