Kaspa (KAS) is a fast, proof-of-work cryptocurrency using a blockDAG consensus (GhostDAG/PHANTOM) to enable parallel blocks and near-instant confirmations. Launched on Nov 7, 2021 by DAGLabs led by Yonatan Sompolinsky with backing from Polychain Capital, Kaspa was fair-launched with no premine or ICO.

- Kaspa Coin Overview

- KAS Price History

- KAS Recent Developments

- KAS Price Prediction 2025–2026

- Expert Forecasts for Kaspa

- Our Analysis

- Kaspa Price Drivers 2025–2026

- Conclusion

- FAQ

- Can Kaspa reach $1 by 2026?

- What are the main drivers for Kaspa’s price?

- How is Kaspa different from Bitcoin or Ethereum?

- Glossary

- Sources

Its goal is simple peer-to-peer payments at high speed: by rewriting the Bitcoin model into a Directed Acyclic Graph, Kaspa can process many blocks simultaneously for higher throughput. Kaspa’s native token supply is capped at around 28.7B KAS, with ~26.2B currently circulating.

Kaspa’s price had a wild 2024, by mid-2024 it was one of the few top-25 crypto assets in positive territory. Marathon Digital’s announcement in June 2024 that it was mining KAS ignited a rally, pushing KAS up 17% in a week and 750% year-over-year. By July 31, 2024 Kaspa hit an all-time high around $0.2078. Since then the price has consolidated.

As of mid-May 2025 Kaspa trades near $0.12, about 45% below the July 2024 peak. We look at Kaspa price predictions for 2025 and 2026, checking out what the future holds for the crypto.

Kaspa Coin Overview

Kaspa is a decentralized, open-source payment network built on proof-of-work (PoW) mining. It inherits Bitcoin-like fundamentals (UTXO model, deflationary issuance, no premine or ICO) but replaces a single blockchain with a multi-block blockDAG. In Kaspa’s GhostDAG/PHANTOM protocol, many blocks can be created and ordered in parallel, rather than orphaning them as Bitcoin does.

This yields much faster block confirmation and high transaction throughput: block time is now just 0.1 second after the “Crescendo” upgrade (10 blocks per second). Kaspa’s use cases today are similar to other Layer‑1s: a fast settlement layer for digital payments and potentially decentralized apps once smart contracts roll out. The community is now also building Layer‑2 and EVM compatibility (see below) to expand Kaspa beyond payments.

Kaspa was created in late 2021 by the DAGLabs team (Yonatan Sompolinsky et al.). It is financed by its community (with early funding from Polychain Capital). Key milestones so far include: the mainnet launch on November 7, 2021; a critical protocol bug fix with a reset genesis on November 22, 2021; a hard fork in April 2022 to optimize block handling; and performance upgrades in 2023.

Notably, Kaspa’s latest upgrades (the “Crescendo” hard fork in May 2025) have rewritten Kaspa’s code from Go to Rust and boosted block production to 10 BPS.

The result is that Kaspa is now touted as “the fastest pure Proof-of-Work coin in history,” confirming transactions in milliseconds. A mobile wallet (Kaspium v1.0) was also launched in late 2023, and new funding rails have been added (e.g. integration with the Topper/Uphold fiat on-ramp). .

KAS Price History

Kaspa traded low through 2022–2023 but exploded in 2024. By 2024 KAS was surging. Marathon Digital’s mining of Kaspa in June 2024 caused a breakout and Kaspa went up ~17% in a week. By late July 2024 it was ~$0.2078. That was ~+750% year-over-year gain.

In 2025, the price dropped back to the mid $0.10s as the overall crypto market did. In early 2025, Kaspa was trading ~$0.11–0.15 as the development news (Crescendo announcements) and ancillary interest supported it.

As of May 16, 2025 KAS is ~$0.12. Volume and momentum are low and the technicals are neutral. Over the last year, Kaspa is up big but the recent consolidation has seen 10s of percent swings rather than continuous runs.

KAS Recent Developments

Kaspa’s network and ecosystem have seen some big developments recently:

Code Upgrades: On May 5, 2025 the Kaspa team deployed the “Crescendo” upgrade on mainnet. This hard fork switched Kaspa’s engine to Rust and increased block production from 1 BPS to 10 BPS (block time 100 ms). The result is about an 8x increase in throughput and near-instant confirmations. Earlier on Jan 5, 2024 the team released a testnet (TN-11) for the full architecture rewrite to Rust and future smart contracts. This makes Kaspa an ultra-fast PoW network.

Wallets & Fiat Onramps: Kaspa launched its native Kaspium mobile wallet (iOS/Android) in Sept 2023. In early 2025 it also added the Topper/Uphold fiat gateway on Kaspa.org so users can buy KAS with cash directly. That reduces friction for new investors.

Mining Economics: Kaspa’s emission is inflationary but decaying: block rewards halve geometrically over time (currently ~130.8 KAS/block). Over the next few years, supply inflation will decline and converge to a ~28.7B max supply around 2057. That means KAS has a mild deflationary bias built in that can support price if demand grows.

Ecosystem Growth: Along with technical upgrades, Kaspa’s network is growing. Hash rate has increased (Marathon plus community miners), and new wallets/exchanges are listing KAS. On-chain adoption metrics are still small compared to giants, but dev activity (Github commits, forum discussions) is active.

Sentiment is cautiously bullish: CoinCodex has a Greed Index of ~71 (in Greed territory) and expects KAS to reach ~$0.40 by mid-2025. This means the community is optimistic, but high sentiment also means risk of pullbacks.

Overall, recent news improves Kaspa’s fundamentals as throughput is much higher, smart contract infrastructure is being built, and big players are interested. But Kaspa is still a niche altcoin with competition from PoW (Bitcoin, Bitcoin Cash) and upcoming DAG platforms. Each upgrade is priced in quickly, so the market’s reaction will depend on broader crypto trends.

KAS Price Prediction 2025–2026

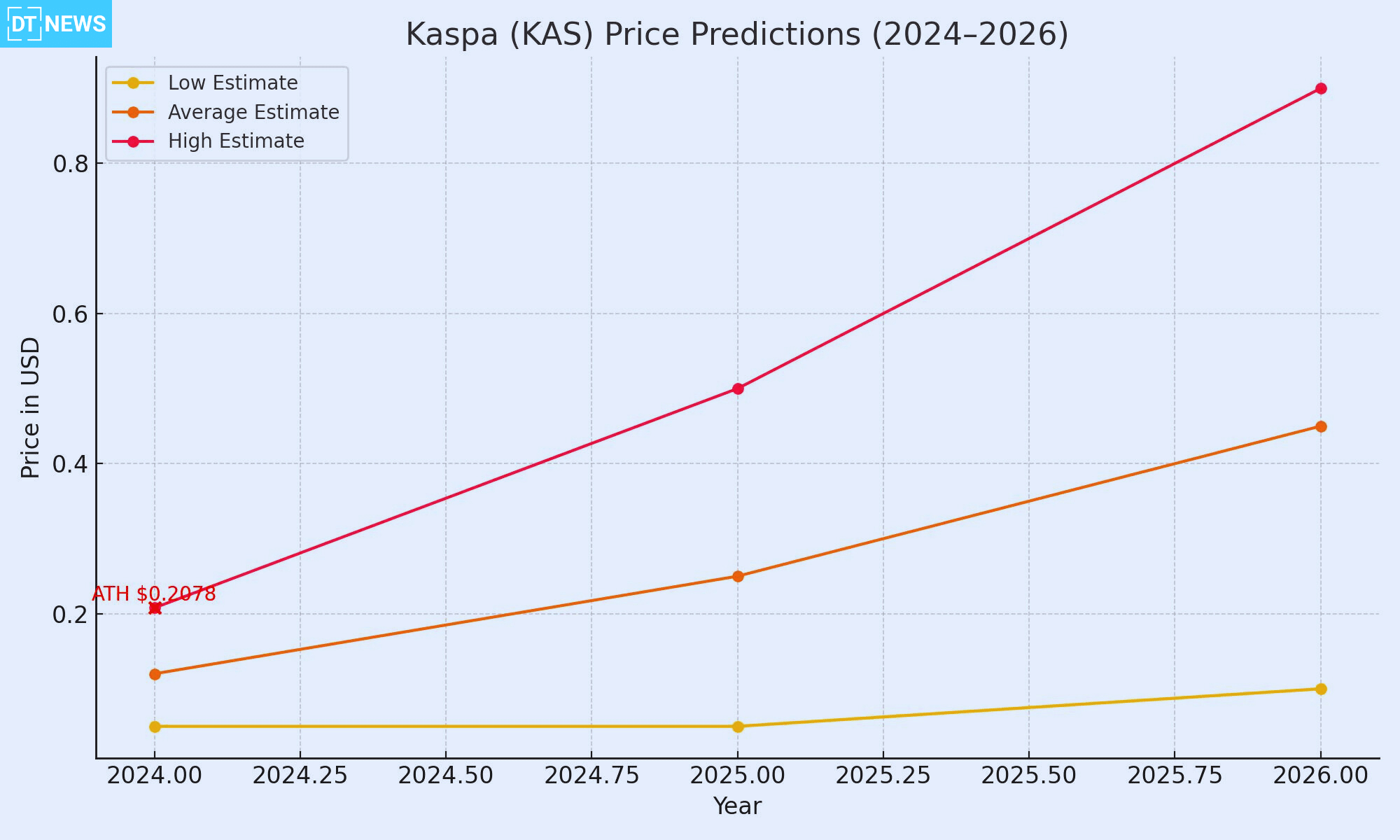

Our analysis suggests moderate growth under base case, with upside if bull markets come fully. The table below shows low/average/high estimates.

| Year | Low (USD) | Average (USD) | High (USD) |

| 2025 | $0.05 | $0.25 | $0.50 |

| 2026 | $0.10 | $0.45 | $0.90 |

For 2025, our base case is a slow rise to mid-$0.20s by year-end. The low is $0.05 (bearish crypto market or technical failure, e.g. upgrade delays) and the high is $0.50 (bull cycle and adoption catalysts, e.g. Igra rollout, high miner demand).

For 2026, the midpoint is $0.45 (moderate growth), the low is $0.10 (deeper correction) and the high is $0.90 (Kaspa benefits from Layer-2 adoption and crypto rally).

We’ve combined market sentiment and technicals into our view. For example, Kaspa’s RSI (~70) is overbought and its MACD is neutral, so upward momentum but caution. Sentiment is bullish (CoinCodex’s Fear & Greed is 71) which may mean a near-term flatline. But Kaspa’s network fundamentals (very high throughput, rich ecosystem) could drive demand if crypto markets turn up.

Expert Forecasts for Kaspa

Changelly (CryptoAnalyst blog): “min $0.0519, max $0.218, average ~$0.384” May 2025: average ~$0.158 (range $0.113–$0.202), June 2025: avg ~$0.247 (range $0.109–$0.384). Changelly is bullish, expects Kaspa to almost triple by summer 2025 .

CoinCodex: uses algorithmic models and sees big growth: $0.4019 by June 15, 2025 (a ~228% rise). June 2025: mid-$0.30–0.40s (e.g. avg ~$0.4879). 2026: average $0.249 (range $0.164–$0.339), March 2026: $0.3393. CoinCodex is very bullish: 2027: bullish channel (average ~$0.133).

DigitalCoinPrice (DCP): expects moderate growth. The expect KAS will clear $0.27 by year-end, breaking the old ATH first. Short-term chart shows rise from ~$0.12 to ~$0.19 by mid-June 2025. DCP is positive but not as extreme as other analysts prediction.

WalletInvestor is bearish. Its automated AI forecast sees KAS in a long-term downtrend. WalletInvestor’s narrative says “negative trend” and even predicts KAS could get to $0.017 by mid-2025 (an 85% drop from $0.121).

Other analysts: TradingView community scripts and YouTube pundits have varying opinions, some call for a $2 spike in a bull cycle, others see return to $0.07 support).

In summary, experts are divided. The average of bullish models (Changelly, CoinCodex, DCP) is $0.20–0.40 by end-2025, while pessimistic models (WalletInvestor) see $0.02–0.05. We lean towards the former, given Kaspa’s recent momentum and upgrade tailwinds. The table above is a compromise across these views.

Our Analysis

Combining market trends, technicals and adoption signals, Kaspa’s RSI has been above 60–70, indicating short-term overbought. Its MACD is neutral and volumes have been low recently. Historically, extended rallies pause after such runs. If Kaspa retraces, it could test $0.08–$0.10 (previous consolidation zone). Above $0.15, it could break the post-all-time-high range and open up $0.20–$0.30.

Kaspa’s ecosystem is small but growing. On-chain transaction counts and active addresses are low compared to giants, but dev activity is picking up. Network hashrate is increasing (Marathon and others), which helps security, but also means miners will sell KAS for profit. The new EVM/L2 integration will be a key adoption catalyst if devs start building on Kaspa in 2025, which will justify higher prices. Until then, adoption is investor-driven.

Kaspa competes with other Layer-1s (Bitcoin, Ethereum, Solana, etc.) and emerging DAG chains (IOTA, etc.). Its unique features (pure PoW + DAG) make it an outlier. Regulatory moves such as China’s crypto stance, US SEC actions will indirectly impact Kaspa by shaking crypto markets.

The market is waiting for macro signals. If stocks/crypto go up, Kaspa will catch the exuberance (like 2024). If fear returns, Kaspa will fall sharply. We assume a mix: some up, some down.

In a moderate bull market, our base case is KAS to $0.20–$0.30 in 2025 and $0.40–$0.50 by end-2026. This is based on development progress and moderate investor interest. In a bear market, it could go back to $0.05–$0.10 if euphoria fades. In a strong bull market (with mass investor inflows into crypto), KAS could go to our high estimates ($0.50+ in 2025, $1 by 2026).

Kaspa Price Drivers 2025–2026

Several factors will move Kaspa’s price:

| Driver Category | Impact Description |

| Regulation | PoW regulations or ETF approvals could affect prices dramatically |

| Tech Upgrades | DAGKnight, EVM compatibility, smart contracts can expand use cases |

| Ecosystem Growth | Listings, L2s, mobile wallet growth and dev activity could support adoption |

| Market Sentiment | Greed index (~71 in May 2025) indicates optimism, but risk of corrections |

| Mining Economics | Emission halving creates mild deflation; high hash rate = strong security |

| Competition | Other DAGs or Layer-1 chains may dilute Kaspa’s uniqueness |

| Macroeconomics | Fed policy, inflation, Bitcoin price trends will steer altcoin movements |

Conclusion

Kaspa entered 2025 with solid tech and a fired-up community, but also with crypto volatility. We think 2025–26 will see moderate gains for KAS. Under the base case (steady development and modest growth), KAS could get to $0.20–$0.50 by the end of 2026.

However, extreme scenarios are possible. Some analysts warn of big drops to $0.02 if markets turn. If crypto booms and Kaspa’s new tech is adopted widely, we could see prices near our high-end forecasts $0.50 in 2025, $1 in 2026.

FAQ

Can Kaspa reach $1 by 2026?

In our bull case ($0.90 high), KAS nearly doubles from our 2026 base-case, but $1 would need extreme market conditions and adoption. Conversely, bears say much lower prices. We view $1 in 2026 as an extreme bull scenario rather than base case.

What are the main drivers for Kaspa’s price?

Price will depend on general crypto market (Bitcoin’s moves, investor appetite), Kaspa specific news (upgrade releases, partnerships), adoption (usage, listings). Technicals like network hash rate, supply emission (halving schedule), sentiment indicators (RSI, Fear & Greed) will influence short term moves.

How is Kaspa different from Bitcoin or Ethereum?

Kaspa is PoW like Bitcoin, but uses a blockDAG instead of a linear chain. This allows block confirmations in ~100 ms, much faster than Bitcoin’s 10 min. Unlike Ethereum (PoS smart contracts), Kaspa is focusing first on raw speed and then on adding smart contracts later via Layer-2 solutions.

Glossary

BlockDAG: A graph of blocks; unlike a single chain, blocks can form a web. Kaspa’s GhostDAG protocol orders these parallel blocks into a consensus.

GhostDAG/PHANTOM: Kaspa’s consensus mechanisms. GhostDAG allows blocks to be accepted simultaneously, and PHANTOM orders them to prevent double-spends.

Proof-of-Work (PoW): A consensus model where miners solve cryptographic puzzles to create blocks. Kaspa is PoW (like Bitcoin) but faster.

Halving: A scheduled reduction in block reward. In Kaspa, the reward per block decreases geometrically each month (halving rate).

Smart Contracts / EVM: Programmable contracts. Kaspa will have full Ethereum-compatible smart contracts via its upcoming Layer-2 (with Igra Labs).

RSI (Relative Strength Index): A technical indicator (0–100). Above 70 is “overbought”, below 30 is “oversold”.

MACD (Moving Average Convergence Divergence): A momentum indicator. MACD line above signal is bullish; near zero is neutral.

Sentiment (Fear & Greed): A measure of market mood. High “Greed” values mean exuberance (possibly a top), “Fear” means caution. CoinCodex reported Kaspa sentiment as “Greed” (~71) in mid-2025.

Market Cap: Total value of all coins (price × circulating supply). Kaspa’s market cap was around $3.2B at $0.12/KAS.

Layer-2 / Rollup: A secondary protocol built on Kaspa for added scalability. Igra Labs zk-rollup is an example, moving most transactions off-chain then batching them on Kaspa.

Sources

Dislaimer: Price predictions are always uncertain. Investors should be aware that all crypto is high risk. Kaspa’s price can swing big on market tides or news. Always do your own research, diversify, and only invest what you can afford to lose. Past performance (Kaspa’s 2024 rally) is no guarantee of future results. The above is not investment advice, just analysis based on current data.